As the IRS continues to update and refine its reporting requirements, it's essential for businesses and organizations to stay compliant with the latest regulations. One critical aspect of this compliance is the IRS-mandated WISP (Written Information Security Policy) template. In this article, we will delve into the world of WISP, exploring its importance, benefits, and step-by-step guide to creating a compliant template.

The Importance of WISP Template

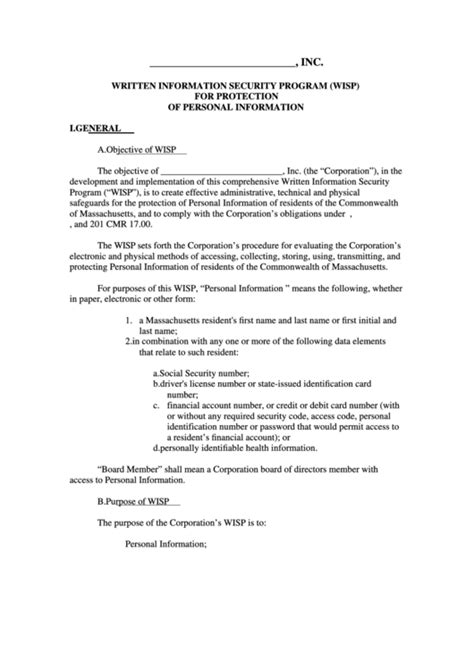

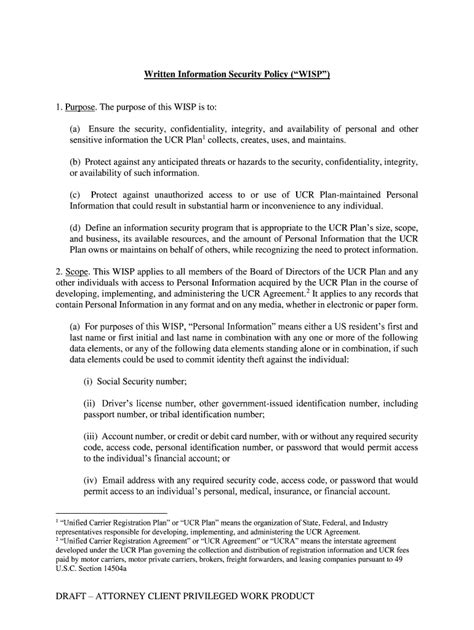

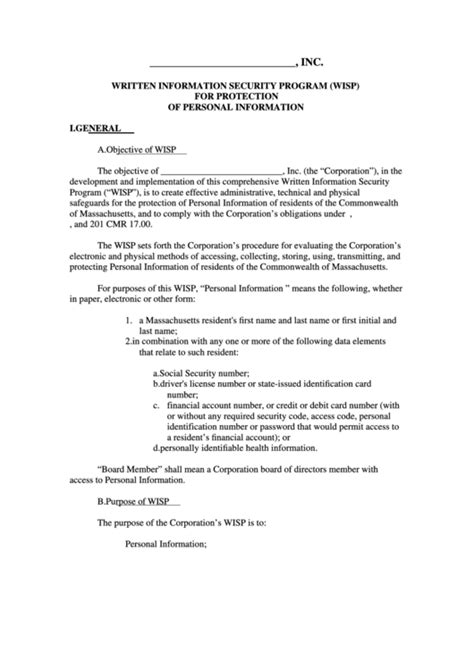

A Written Information Security Policy (WISP) is a comprehensive document that outlines an organization's procedures for protecting sensitive information, including personally identifiable information (PII) and protected health information (PHI). The IRS mandates that certain organizations, such as those handling tax-related data, implement a WISP to ensure the confidentiality, integrity, and availability of sensitive information.

Organizations that fail to implement a WISP may face severe penalties, including fines and reputational damage. Moreover, a WISP is not only a regulatory requirement but also a crucial tool for protecting sensitive information from cyber threats and data breaches.

Benefits of a WISP Template

A well-crafted WISP template offers numerous benefits to organizations, including:

- Compliance: A WISP template ensures that an organization meets the IRS's reporting requirements, reducing the risk of non-compliance and associated penalties.

- Data Protection: A WISP template helps organizations protect sensitive information from cyber threats and data breaches, reducing the risk of reputational damage and financial loss.

- Risk Management: A WISP template enables organizations to identify and mitigate potential risks, ensuring the confidentiality, integrity, and availability of sensitive information.

Creating a WISP Template: A Step-by-Step Guide

Creating a WISP template requires careful consideration of an organization's specific needs and requirements. Here's a step-by-step guide to creating a compliant WISP template:

Step 1: Identify Sensitive Information

Identify the types of sensitive information handled by the organization, including PII and PHI. This information may include:

- Employee data (e.g., Social Security numbers, addresses)

- Customer data (e.g., credit card numbers, medical records)

- Financial data (e.g., tax returns, bank statements)

Step 2: Assess Risks

Assess the potential risks associated with handling sensitive information. This may include:

- Cyber threats (e.g., hacking, phishing)

- Physical threats (e.g., theft, loss)

- Insider threats (e.g., employee negligence, malicious activity)

Step 3: Develop Policies and Procedures

Develop policies and procedures for protecting sensitive information, including:

- Data encryption and access controls

- Incident response and breach notification

- Employee training and awareness programs

Step 4: Assign Roles and Responsibilities

Assign roles and responsibilities for implementing and maintaining the WISP, including:

- Information security officer

- Data protection officer

- Compliance officer

Step 5: Review and Update

Regularly review and update the WISP to ensure it remains effective and compliant with changing regulations.

Implementing a WISP Template: Best Practices

Implementing a WISP template requires careful consideration of best practices, including:

- Conduct regular risk assessments to identify potential vulnerabilities and update the WISP accordingly.

- Provide employee training and awareness programs to ensure employees understand their roles and responsibilities in protecting sensitive information.

- Regularly review and update the WISP to ensure it remains effective and compliant with changing regulations.

Conclusion: A Call to Action

Creating a compliant WISP template is a critical step in protecting sensitive information and ensuring regulatory compliance. By following the step-by-step guide and implementing best practices, organizations can ensure the confidentiality, integrity, and availability of sensitive information.

We encourage you to take action today and create a WISP template that meets the IRS's reporting requirements. Share your experiences and tips in the comments below, and don't forget to share this article with your colleagues and peers.

Gallery of WISP Templates

WISP Template Image Gallery

Frequently Asked Questions

Q: What is a WISP template? A: A WISP template is a comprehensive document that outlines an organization's procedures for protecting sensitive information.

Q: Why is a WISP template required? A: A WISP template is required by the IRS to ensure that organizations handling sensitive information implement adequate security measures to protect that information.

Q: How do I create a WISP template? A: To create a WISP template, identify sensitive information, assess risks, develop policies and procedures, assign roles and responsibilities, and regularly review and update the WISP.

Q: What are the benefits of a WISP template? A: The benefits of a WISP template include compliance, data protection, and risk management.