Intro

Understand your take-home pay with our guide to base pay before taxes. Learn if base pay is deducted before taxes, how gross income differs from net income, and how to calculate your base pay after taxes. Plus, get answers to FAQs on tax deductions, gross income, and net pay to maximize your earnings.

Understanding the intricacies of one's salary and the various components that affect the final take-home pay can be quite perplexing. Base pay, before taxes are deducted, is a fundamental aspect of an individual's compensation package. In this article, we will delve into the concept of base pay, its importance, and address some frequently asked questions related to the topic.

What is Base Pay?

Base pay, also known as basic salary, is the amount of money an employee receives before any deductions, bonuses, or benefits are added or subtracted. It is the core component of an individual's salary and serves as the foundation for calculating various benefits, such as overtime pay, bonuses, and social security benefits.

Why is Base Pay Important?

Base pay is crucial because it determines an individual's overall compensation package. It affects not only the take-home pay but also the benefits, such as health insurance, retirement plans, and other perks. A higher base pay can lead to increased benefits, which can significantly impact an individual's quality of life.

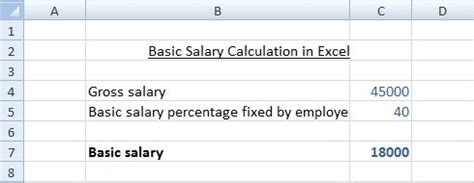

How is Base Pay Calculated?

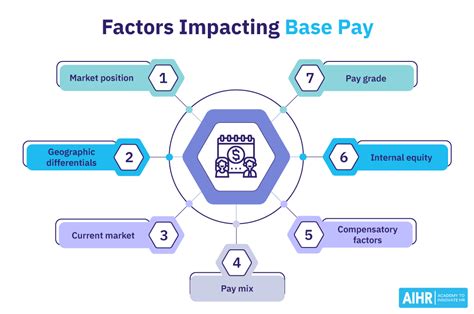

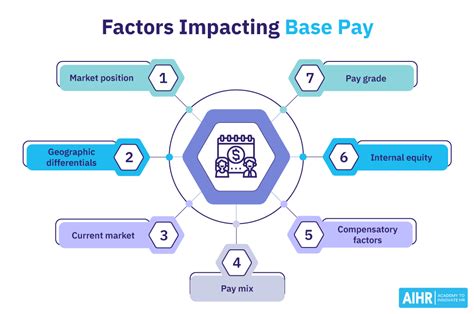

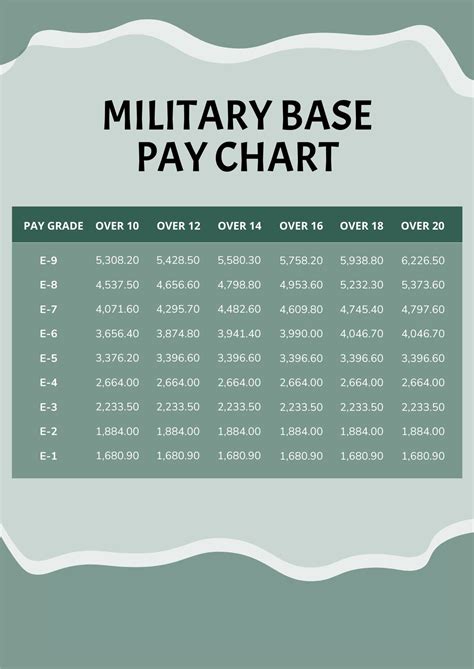

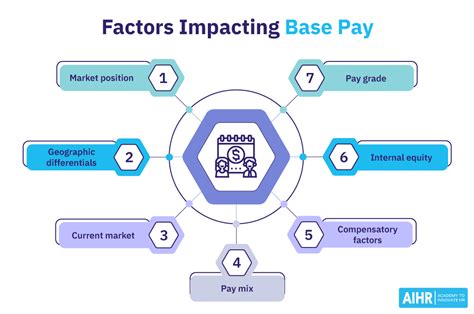

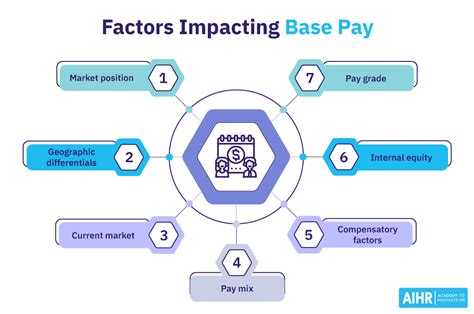

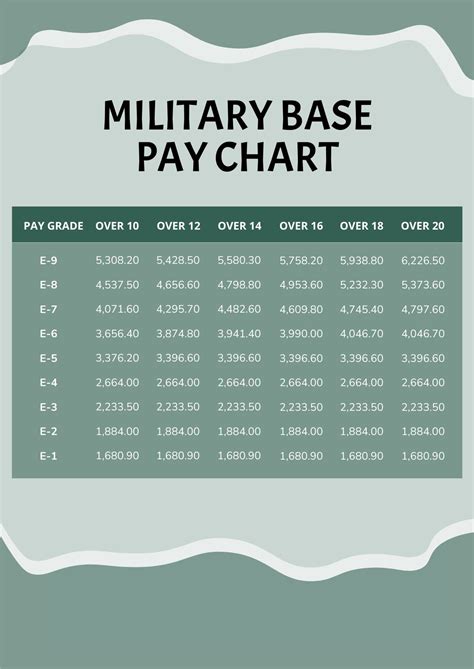

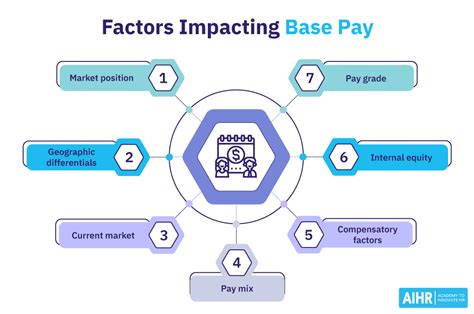

The calculation of base pay varies from organization to organization. However, it is typically determined by the employee's position, level of experience, education, and the industry standards. Some common factors that influence base pay include:

- Job requirements and responsibilities

- Level of experience and qualifications

- Industry standards and market rates

- Company budget and financial constraints

- Performance and productivity expectations

What are the Different Types of Base Pay?

There are various types of base pay, including:

- Hourly base pay: Paid for each hour worked

- Salary base pay: Paid a fixed amount per pay period

- Commission-based base pay: Paid a percentage of sales or revenue generated

- Piece-rate base pay: Paid for each unit produced or task completed

Faqs on Base Pay

Here are some frequently asked questions about base pay:

-

Q: Is base pay the same as gross pay?

A: No, base pay and gross pay are not the same. Base pay is the amount before any deductions, while gross pay includes all forms of income, including bonuses and overtime pay.

-

Q: Can base pay be negotiated?

A: Yes, base pay can be negotiated. Employees can discuss their salary expectations with their employer during the hiring process or during performance reviews.

-

Q: How often is base pay reviewed?

A: Base pay is typically reviewed annually or bi-annually, depending on the organization's policies and industry standards.

-

Q: Can base pay be reduced?

A: Yes, base pay can be reduced in certain circumstances, such as a company-wide salary reduction or a change in job responsibilities.

Understanding Taxes on Base Pay

Taxes on base pay can significantly impact an individual's take-home pay. Understanding how taxes are calculated and deducted can help employees better manage their finances.

-

Q: What taxes are deducted from base pay?

A: Federal income tax, state income tax, and social security tax are typically deducted from base pay.

-

Q: How are taxes calculated on base pay?

A: Taxes are calculated based on the employee's tax filing status, number of dependents, and tax deductions.

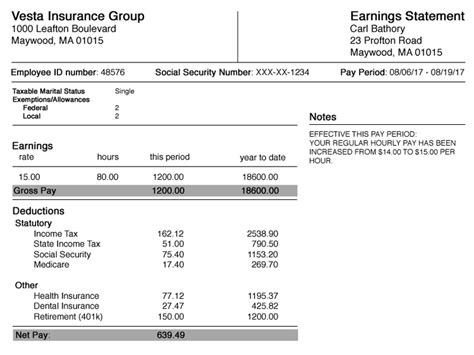

Benefits and Deductions on Base Pay

In addition to taxes, various benefits and deductions can be added or subtracted from base pay. These may include:

- Health insurance premiums

- Retirement plan contributions

- Life insurance premiums

- Disability insurance premiums

- Flexible spending account contributions

Understanding the Impact of Benefits and Deductions

It is essential to understand the impact of benefits and deductions on base pay. Employees should carefully review their pay stubs and ask questions if they are unsure about any deductions or benefits.

Conclusion

Base pay is a critical component of an individual's compensation package. Understanding how base pay is calculated, the different types of base pay, and the impact of taxes, benefits, and deductions can help employees better manage their finances and make informed decisions about their career.

Gallery of Base Pay Images

Base Pay Images

We hope this article has provided valuable insights into the concept of base pay and its significance in an individual's compensation package. If you have any further questions or concerns, please feel free to comment below.