Child support is a crucial aspect of ensuring that children receive the financial support they need from both parents, even if they are no longer together. However, when it comes to determining eligibility for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), the treatment of child support as income can be complex. In this article, we will delve into the details of how child support is considered in the context of food stamp eligibility.

Understanding Food Stamp Eligibility

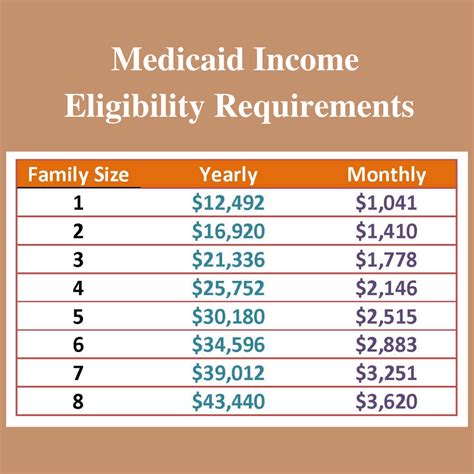

To be eligible for food stamps, households must meet certain income and resource requirements. The income limits vary by state and are typically based on the federal poverty guidelines. Gross income, which includes income from all sources, is used to determine eligibility. However, not all income is treated equally, and some types of income, such as child support, are subject to specific rules.

How Child Support Affects Food Stamp Eligibility

Child support is considered unearned income for food stamp eligibility purposes. Unearned income includes income that is not earned through employment, such as social security benefits, unemployment benefits, and child support. When determining eligibility, the gross amount of child support received is counted as income.

However, there are some important exceptions and considerations:

- Only the amount actually received is counted: If a household is entitled to receive child support but does not actually receive it, the amount is not counted as income.

- Court-ordered child support is counted: If a court has ordered child support, the amount is counted as income, even if the household does not actually receive it.

- Voluntary child support is not counted: If a parent provides voluntary child support, such as through a private agreement, the amount is not counted as income.

Calculating Income for Food Stamp Eligibility

When calculating income for food stamp eligibility, the following steps are taken:

- Gross income is determined: The total amount of income from all sources is calculated.

- Deductions are applied: Certain deductions, such as housing costs and child care expenses, are subtracted from gross income.

- Net income is calculated: The resulting amount after deductions is the net income.

- Income limits are applied: The net income is compared to the income limits for food stamp eligibility.

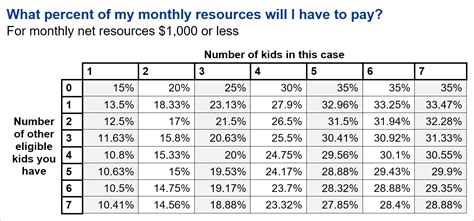

Impact of Child Support on Food Stamp Benefits

Child support can have a significant impact on food stamp benefits. If a household receives child support, the amount may affect their eligibility for benefits or the amount of benefits they receive. In some cases, child support may reduce the amount of benefits a household is eligible for.

- Reduced benefits: If a household's income, including child support, exceeds the income limits, they may not be eligible for benefits or may receive reduced benefits.

- Increased benefits: In some cases, child support may not affect benefits, or may even increase benefits if the household's income is below the poverty level.

Gallery of Child Support and Food Stamps

Child Support and Food Stamps Image Gallery

Conclusion: Navigating Child Support and Food Stamp Eligibility

Navigating the complexities of child support and food stamp eligibility can be challenging. Understanding how child support is considered income and how it affects eligibility is crucial for households seeking benefits. By knowing the rules and guidelines, households can make informed decisions about their financial situation and take steps to ensure they receive the benefits they need.

We invite you to share your thoughts and experiences with child support and food stamp eligibility in the comments below. How has child support affected your eligibility for benefits? What challenges have you faced, and how have you overcome them? Your insights can help others navigate this complex issue.