Intro

Receiving food stamps can be a crucial support for individuals and families struggling to make ends meet. However, the rules surrounding food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), can be complex and confusing. One common question that arises is whether food stamps count as income. In this article, we will delve into the details and explore five key facts about food stamps and their relationship to income.

What Are Food Stamps?

Before we dive into the details, it's essential to understand what food stamps are and how they work. Food stamps, or SNAP, is a program funded by the US Department of Agriculture (USDA) that provides eligible individuals and families with a monthly benefit to purchase food. The program aims to alleviate hunger and food insecurity by providing a safety net for those struggling to afford basic necessities.

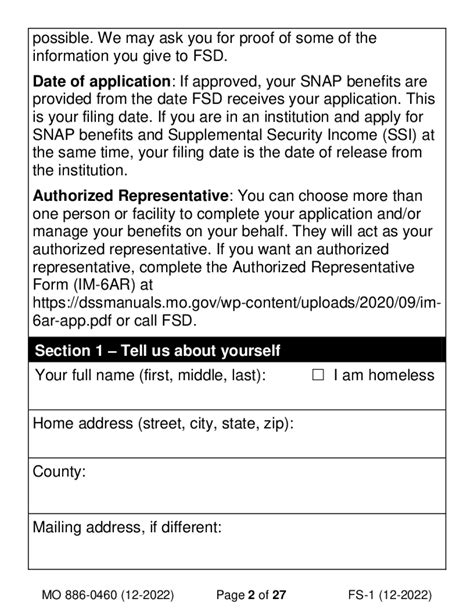

Eligibility and Application Process

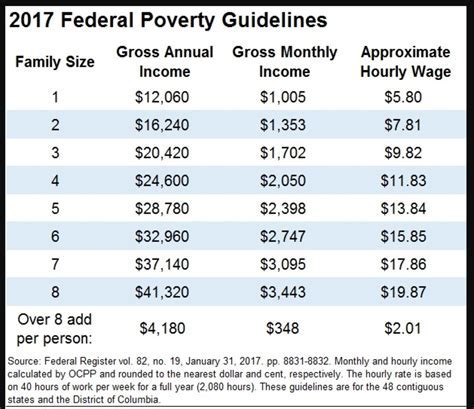

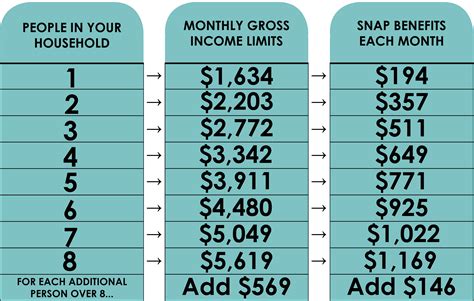

To be eligible for food stamps, applicants must meet specific income and resource requirements. The application process typically involves providing documentation, such as proof of income, expenses, and identity. Once approved, recipients receive a monthly benefit, which is loaded onto an Electronic Benefits Transfer (EBT) card.

Fact #1: Food Stamps Are Not Considered Income

One of the most critical facts about food stamps is that they are not considered income. According to the USDA, SNAP benefits are not subject to federal income tax and are not considered when determining eligibility for other government programs, such as Medicaid or the Children's Health Insurance Program (CHIP).

Why Are Food Stamps Not Considered Income?

Food stamps are not considered income because they are a form of in-kind assistance, meaning they provide a specific benefit (food) rather than cash. This distinction is essential, as it allows recipients to use their benefits without worrying about the impact on their tax liability or eligibility for other programs.

Fact #2: Food Stamps Can Affect Other Benefits

While food stamps are not considered income, they can affect other benefits in certain situations. For example, if a recipient receives SNAP benefits and also receives cash assistance, such as Temporary Assistance for Needy Families (TANF), the SNAP benefits may be counted as income when determining eligibility for TANF.

Understanding the Interplay Between Benefits

It's essential to understand how different benefits interact with each other. Recipients should consult with a social services representative or a benefits counselor to ensure they understand how their SNAP benefits may impact other benefits they receive.

Fact #3: Food Stamps Are Subject to Reporting Requirements

Food stamps are subject to reporting requirements, which means recipients must report changes in their income, expenses, or household composition to their local SNAP office. Failure to report these changes can result in benefit reductions or even termination.

Understanding Reporting Requirements

Recipients should carefully review their reporting requirements and ensure they understand what changes must be reported and when. This can help prevent unnecessary benefit reductions or termination.

Fact #4: Food Stamps Can Be Used to Purchase Certain Non-Food Items

While food stamps are primarily intended for food purchases, they can also be used to buy certain non-food items, such as seeds and plants for home gardens. Additionally, some states allow recipients to use their SNAP benefits to purchase prepared meals at participating restaurants.

Exploring Non-Food Purchases with SNAP

Recipients should consult with their local SNAP office to learn more about the specific non-food items they can purchase with their benefits.

Fact #5: Food Stamps Have a Positive Impact on Local Economies

Food stamps have a positive impact on local economies, as they help inject funds into local businesses and support economic growth. According to the USDA, every dollar in SNAP benefits generates approximately $1.79 in economic activity.

The Economic Benefits of SNAP

The economic benefits of SNAP are a crucial aspect of the program. By supporting local businesses and promoting economic growth, SNAP benefits not only help recipients but also contribute to the overall well-being of the community.

Food Stamps Image Gallery

We hope this article has provided valuable insights into the world of food stamps and their relationship to income. By understanding the facts and nuances of the SNAP program, recipients can make informed decisions and maximize their benefits. Share your thoughts and experiences with food stamps in the comments below!