Navy Federal is a good bank offering reliable banking services, competitive rates, and secure online banking, making it a top choice for military personnel and civilians seeking trusted financial management and credit union benefits.

The world of banking can be overwhelming, with numerous options available to consumers. However, some banks stand out from the rest due to their exceptional services, benefits, and commitment to their customers. Navy Federal Credit Union is one such institution that has garnered a reputation for being a top-notch banking option. With its rich history, extensive range of services, and dedication to its members, Navy Federal has become a go-to choice for many individuals and families.

Navy Federal's origins date back to 1933, when a group of seven Navy Department employees came together to form a credit union. Since then, the institution has grown exponentially, now serving over 10 million members worldwide. This remarkable growth is a testament to Navy Federal's ability to adapt to the changing needs of its members while maintaining its core values of service, integrity, and community. As a credit union, Navy Federal is member-owned, which means that its primary focus is on providing benefits and services to its members, rather than maximizing profits for shareholders.

The benefits of banking with Navy Federal are numerous. For starters, the credit union offers a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investment options. Navy Federal's rates and terms are often more competitive than those offered by traditional banks, making it an attractive option for individuals and families looking to save money or finance large purchases. Additionally, Navy Federal's online banking platform and mobile app provide members with convenient access to their accounts, allowing them to manage their finances from anywhere, at any time.

Benefits of Navy Federal

Services Offered by Navy Federal

Navy Federal's services are designed to meet the diverse needs of its members. From basic checking and savings accounts to more complex financial products, such as mortgages and investment portfolios, Navy Federal has something for everyone. The credit union's services include: * Checking and savings accounts with competitive rates and low fees * Credit cards with rewards programs and introductory APR offers * Loans for cars, homes, and personal expenses * Investment options, including brokerage accounts and retirement plans * Insurance products, such as auto, home, and life insurance * Financial planning and advisory servicesWorking Mechanisms of Navy Federal

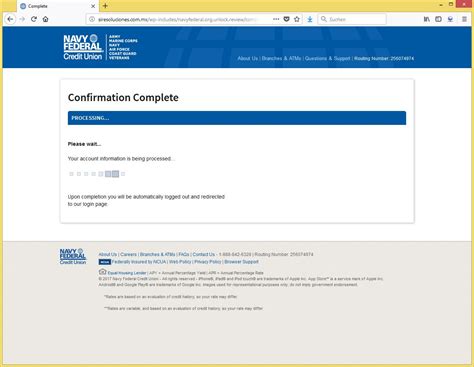

Steps to Join Navy Federal

Joining Navy Federal is a straightforward process that can be completed online or in person. To become a member, individuals must meet certain eligibility requirements, such as being a member of the military, a veteran, or a family member of a military personnel. The steps to join Navy Federal include: 1. Checking eligibility: Visit Navy Federal's website to determine if you are eligible for membership. 2. Gathering required documents: You will need to provide identification, such as a driver's license or passport, and proof of eligibility, such as a military ID or DD Form 214. 3. Filling out the application: Complete the online application or visit a Navy Federal branch to apply in person. 4. Funding your account: Once your application is approved, you will need to fund your account with a minimum deposit of $5.Advantages of Navy Federal Over Traditional Banks

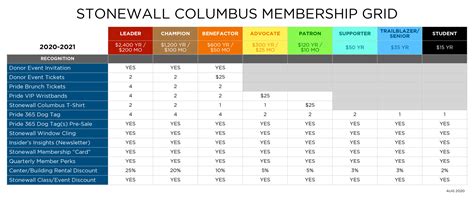

Statistics and Data

Navy Federal's statistics and data are impressive, with the credit union serving over 10 million members worldwide. According to a recent survey, 95% of Navy Federal members reported being satisfied with the credit union's services, while 90% reported being likely to recommend Navy Federal to friends and family. Navy Federal's financial performance is also strong, with the credit union reporting assets of over $100 billion.Practical Examples of Navy Federal's Benefits

Conclusion and Final Thoughts

In conclusion, Navy Federal is a good bank that offers a wide range of benefits and services to its members. With its competitive rates and terms, low fees, and exceptional customer service, Navy Federal is an attractive option for individuals and families looking for a reliable and trustworthy banking partner. Whether you are looking to save money, finance a large purchase, or simply manage your daily finances, Navy Federal has something for everyone.Final Thoughts on Navy Federal

Gallery of Navy Federal Images

Navy Federal Image Gallery

We encourage you to share your thoughts and experiences with Navy Federal in the comments below. If you have any questions or need further information, please do not hesitate to ask. Additionally, if you found this article informative and helpful, please share it with your friends and family who may be looking for a reliable and trustworthy banking partner. By working together, we can help each other achieve our financial goals and make informed decisions about our banking needs.