Intro

Debt can be overwhelming, and for Oklahoma residents, finding a reliable debt relief solution can be a daunting task. With the rise of debt relief companies, it's essential to understand what they offer and whether they are legitimate. In this article, we'll delve into the world of Oklahoma debt relief, exploring the options available, how they work, and what to expect.

Understanding Debt Relief

Debt relief, also known as debt settlement or debt negotiation, is the process of negotiating with creditors to reduce the amount owed. This can be a viable option for individuals struggling to pay their debts, especially those facing financial hardship. Oklahoma debt relief companies act as intermediaries between the debtor and the creditor, working to reach a mutually acceptable agreement.

How Oklahoma Debt Relief Works

The debt relief process typically involves the following steps:

- Initial Consultation: A debt relief company assesses the individual's financial situation, including their income, expenses, debts, and credit score.

- Debt Assessment: The company evaluates the debts, identifying opportunities for negotiation and determining the best course of action.

- Negotiation: The debt relief company contacts the creditors, negotiating a reduced settlement amount or a payment plan that works for both parties.

- Agreement: Once an agreement is reached, the individual pays the negotiated amount, and the creditor accepts the settlement.

Oklahoma Debt Relief Options

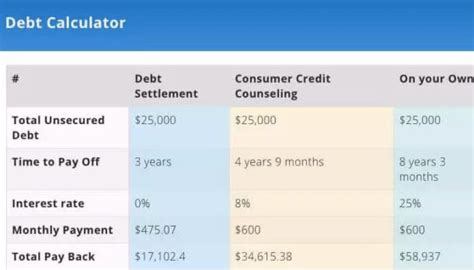

There are several Oklahoma debt relief options available, including:

- Debt Management Plans (DMPs): Non-profit credit counseling agencies create a plan to repay debts in full, often with reduced interest rates and fees.

- Debt Settlement: For-profit companies negotiate settlements with creditors, typically for a fee.

- Credit Counseling: Non-profit agencies provide financial education and assistance, helping individuals create a budget and manage their debt.

- Bankruptcy: A legal process that can discharge or restructure debts, but often carries significant consequences.

Oklahoma Debt Relief Laws and Regulations

Oklahoma has specific laws and regulations governing debt relief companies. For example:

- Oklahoma Debt Management Services Act: Regulates debt management companies, requiring them to register with the state and adhere to specific guidelines.

- Oklahoma Consumer Credit Code: Protects consumers from unfair debt collection practices and ensures transparency in debt relief agreements.

Is Oklahoma Debt Relief Legit?

While there are legitimate Oklahoma debt relief companies, it's essential to be cautious and do your research. Some companies may engage in deceptive practices, such as:

- False advertising: Misrepresenting their services or success rates.

- Hidden fees: Charging excessive or unexpected fees.

- Unqualified representatives: Lacking the necessary expertise or experience.

To ensure you're working with a legitimate Oklahoma debt relief company:

- Check for accreditation: Look for companies accredited by reputable organizations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Verify registration: Confirm the company is registered with the state of Oklahoma and the Federal Trade Commission (FTC).

- Research online reviews: Read reviews from multiple sources to gauge the company's reputation and customer satisfaction.

Alternatives to Oklahoma Debt Relief

Before pursuing debt relief, consider the following alternatives:

- Credit counseling: Non-profit credit counseling agencies can provide guidance and assistance.

- Debt consolidation: Combine multiple debts into a single loan with a lower interest rate and a single monthly payment.

- Budgeting and financial planning: Create a budget and develop a plan to manage your finances and pay off debts on your own.

Conclusion

Oklahoma debt relief can be a viable option for individuals struggling with debt. However, it's crucial to understand the process, options, and potential risks. By doing your research, verifying a company's legitimacy, and exploring alternative solutions, you can make an informed decision and take the first step towards financial freedom.Oklahoma Debt Relief Image Gallery