Predicting a US Dollar collapse ahead, experts warn of economic downturn, currency devaluation, and financial instability, sparking concerns over inflation, recession, and global market volatility.

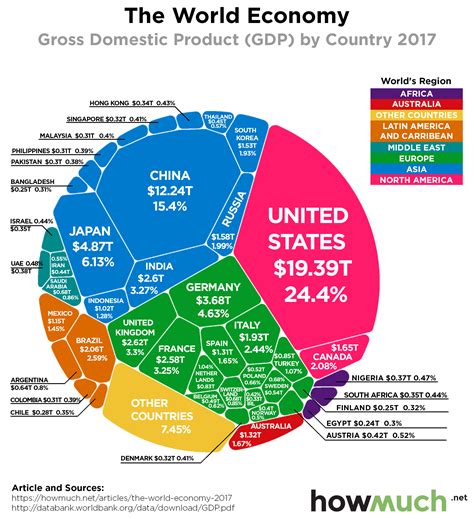

The possibility of a US dollar collapse has been a topic of discussion among economists and financial experts for several years. The US dollar has been the world's reserve currency since the end of World War II, and its stability is crucial for global trade and finance. However, there are several factors that could potentially lead to a collapse of the US dollar, including massive debt, trade deficits, and a decline in its global influence. In this article, we will explore the potential causes and consequences of a US dollar collapse and what it could mean for the global economy.

The US dollar has been facing significant challenges in recent years, including a massive national debt that has surpassed $28 trillion. This debt is unsustainable and could lead to a loss of confidence in the US dollar, causing its value to decline. Additionally, the US has been running large trade deficits, which means that it is importing more goods and services than it is exporting. This can lead to a decline in the value of the US dollar, making imports more expensive and potentially leading to higher inflation.

The US dollar's status as a reserve currency is also under threat. The International Monetary Fund (IMF) has been promoting the use of alternative currencies, such as the Chinese yuan, and some countries have begun to diversify their foreign exchange reserves away from the US dollar. This could lead to a decline in demand for the US dollar, causing its value to decline.

Causes of a US Dollar Collapse

Potential Consequences of a US Dollar Collapse

A US dollar collapse could have significant consequences for the global economy, including: * Higher inflation: A decline in the value of the US dollar could lead to higher inflation, as imports become more expensive. * Reduced purchasing power: A decline in the value of the US dollar could reduce the purchasing power of US consumers, making it more difficult for them to afford goods and services. * Global economic instability: A US dollar collapse could lead to global economic instability, as countries that hold large amounts of US dollar reserves could see their wealth decline.Signs of a US Dollar Collapse

How to Prepare for a US Dollar Collapse

If you are concerned about the potential for a US dollar collapse, there are several steps you can take to prepare, including: * Diversifying your assets: Consider diversifying your assets away from the US dollar, by investing in other currencies, gold, or other assets. * Building an emergency fund: Having an emergency fund in place can help you weather any economic storms that may arise. * Reducing debt: Reducing your debt can help you reduce your financial risk and make it easier to weather any economic downturns.Potential Alternatives to the US Dollar

Impact of a US Dollar Collapse on Global Trade

A US dollar collapse could have significant implications for global trade, including: * Higher prices: A decline in the value of the US dollar could lead to higher prices for imports, making it more difficult for countries to afford the goods and services they need. * Reduced trade: A US dollar collapse could lead to reduced trade, as countries may be less likely to trade with each other if the value of the US dollar is uncertain. * Increased protectionism: A US dollar collapse could lead to increased protectionism, as countries may seek to protect their domestic industries by imposing tariffs and other trade barriers.Potential Solutions to a US Dollar Collapse

Conclusion and Next Steps

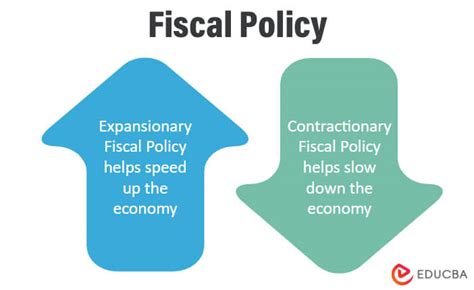

In conclusion, a US dollar collapse is a potential risk that could have significant implications for the global economy. While there are several potential causes and consequences of a US dollar collapse, there are also several steps that can be taken to prepare and mitigate its impact. By diversifying assets, building an emergency fund, and reducing debt, individuals can reduce their financial risk and make it easier to weather any economic downturns. Additionally, international cooperation and monetary and fiscal policy can help to stabilize the value of the US dollar and prevent a collapse.US Dollar Collapse Image Gallery

We hope this article has provided you with a comprehensive understanding of the potential causes and consequences of a US dollar collapse. We encourage you to share your thoughts and opinions on this topic in the comments section below. Additionally, if you have any questions or concerns about how to prepare for a potential US dollar collapse, please do not hesitate to reach out to us. We are always here to help.