Intro

Veterans who receive VA disability compensation may wonder how it affects their eligibility for other government benefits, such as food stamps. The relationship between VA disability and food stamps is complex, and it's essential to understand how they interact.

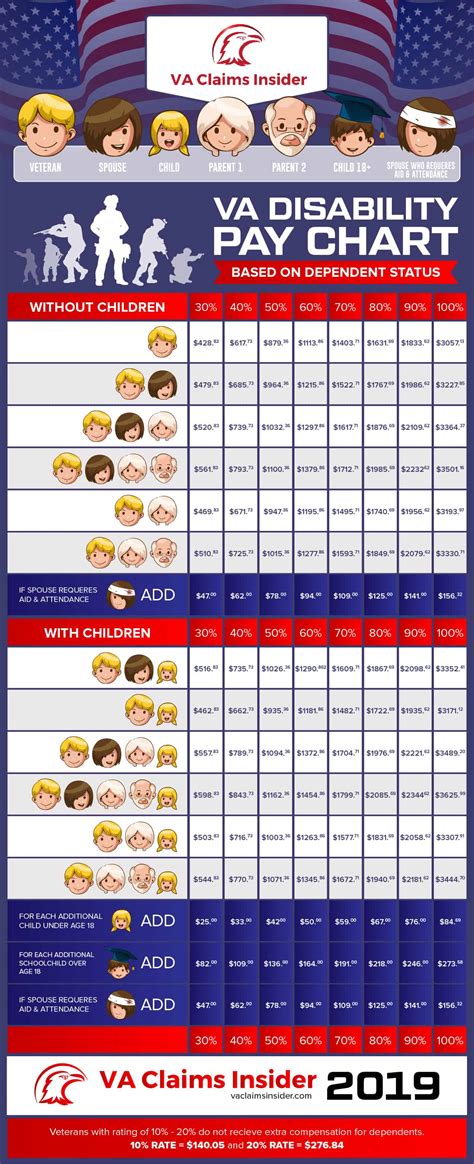

Understanding VA Disability Compensation

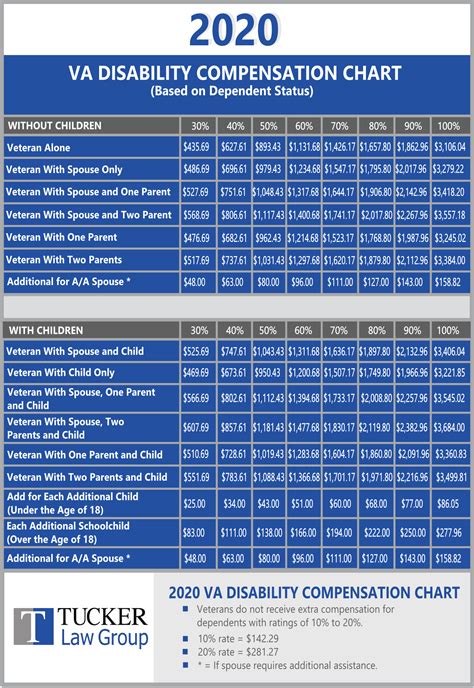

VA disability compensation is a tax-free benefit paid to veterans who have suffered an injury or illness during their military service. The amount of compensation varies depending on the severity of the disability, with more severe disabilities receiving higher compensation.

Is VA Disability Considered Income?

VA disability compensation is not considered income for tax purposes, but it can be considered income for other government benefits. The rules surrounding VA disability and food stamps can be confusing, but we'll break it down for you.

Food Stamps and VA Disability

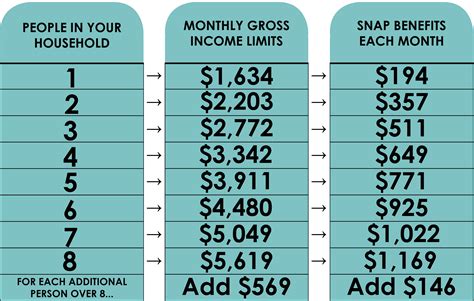

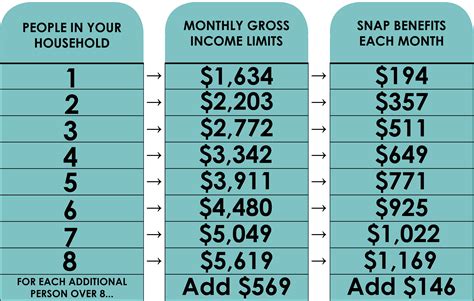

Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to purchase food. When applying for food stamps, the applicant's income is evaluated to determine eligibility.

Does VA Disability Affect Food Stamp Eligibility?

VA disability compensation is not considered income when determining food stamp eligibility. However, some states may count VA disability compensation as income when calculating the applicant's overall income.

How to Apply for Food Stamps with VA Disability

To apply for food stamps with VA disability, follow these steps:

- Gather required documents, including proof of income, identification, and residency.

- Apply online or in-person through your local social services department.

- Report your VA disability compensation as non-taxable income on your application.

- Provide documentation supporting your VA disability compensation, such as a VA award letter.

Additional Benefits for Veterans

Veterans receiving VA disability compensation may be eligible for other benefits, such as:

- Medicaid

- Housing assistance

- Employment assistance

- Education benefits

State-Specific Rules

Some states have specific rules regarding VA disability and food stamps. For example:

- California: VA disability compensation is not considered income when determining food stamp eligibility.

- Texas: VA disability compensation is counted as income when calculating the applicant's overall income.

- New York: VA disability compensation is not considered income, but applicants must report it on their application.

FAQs

Q: Is VA disability compensation considered income for tax purposes? A: No, VA disability compensation is not considered income for tax purposes.

Q: Can I receive food stamps if I'm receiving VA disability compensation? A: Yes, VA disability compensation is not considered income when determining food stamp eligibility, but some states may count it as income.

Q: How do I report VA disability compensation on my food stamp application? A: Report VA disability compensation as non-taxable income on your application and provide documentation supporting your VA disability compensation.

Gallery of VA Disability and Food Stamps

Final Thoughts

Understanding the relationship between VA disability and food stamps can be complex. While VA disability compensation is not considered income for tax purposes, it may be considered income when determining food stamp eligibility in some states. Veterans receiving VA disability compensation should report it as non-taxable income on their food stamp application and provide supporting documentation.