Intro

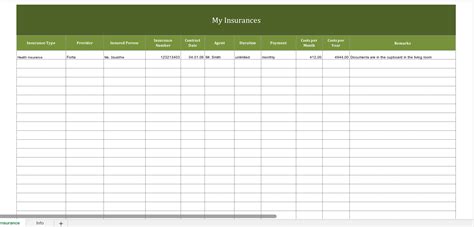

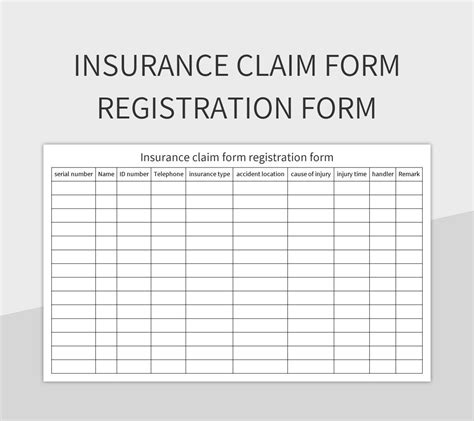

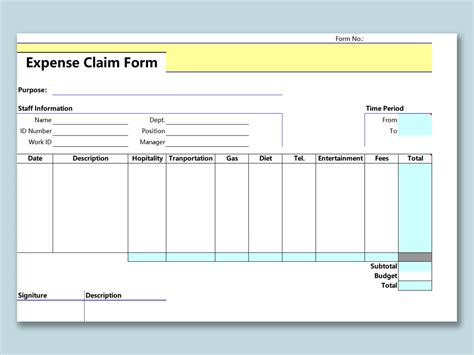

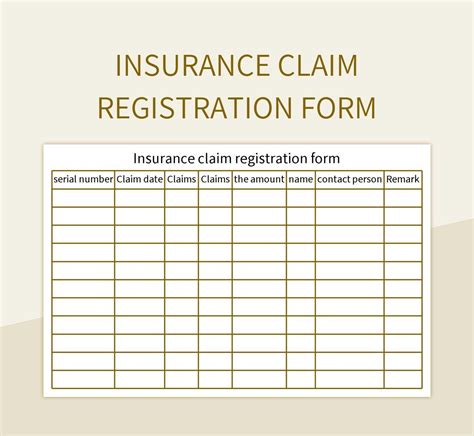

Streamline your insurance claims process with our free Excel template. Easily itemize damages with our downloadable template, featuring a detailed list to ensure accurate reporting. Simplify your claims submission and maximize your reimbursement. Get instant access to our insurance claim template Excel itemized list download and take control of your claims process today.

When dealing with insurance claims, having a clear and organized itemized list is crucial to ensure that you receive fair compensation for your losses. An insurance claim template in Excel can be a valuable tool in streamlining this process. In this article, we will explore the benefits of using an insurance claim template in Excel, provide a comprehensive guide on how to create an itemized list, and discuss the importance of downloading a reliable template.

The Importance of Insurance Claim Templates

Insurance claim templates are designed to help individuals and businesses navigate the often complex process of filing an insurance claim. These templates provide a structured format for documenting losses, tracking expenses, and submitting claims to insurance providers. By using an insurance claim template, you can ensure that you have a comprehensive and accurate record of your losses, which can help to expedite the claims process and reduce the risk of errors or omissions.

Benefits of Using an Insurance Claim Template in Excel

Excel is a popular choice for creating insurance claim templates due to its flexibility, functionality, and ease of use. Here are some benefits of using an insurance claim template in Excel:

- Easy to customize: Excel templates can be easily customized to suit your specific needs and requirements.

- Automated calculations: Excel formulas can be used to automatically calculate totals, percentages, and other relevant calculations.

- Data analysis: Excel's data analysis tools can be used to identify trends, patterns, and discrepancies in your claim data.

- Collaboration: Excel templates can be shared and collaborated on by multiple parties, including insurance adjusters, accountants, and other stakeholders.

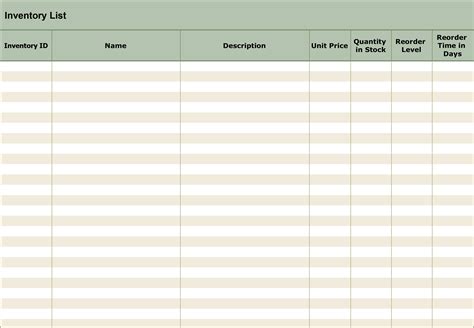

Creating an Itemized List for Your Insurance Claim

An itemized list is a critical component of any insurance claim. This list should include a detailed description of each item, its value, and any relevant documentation or evidence. Here are some steps to follow when creating an itemized list for your insurance claim:

- Categorize your losses: Start by categorizing your losses into different categories, such as property damage, personal injury, or business interruption.

- Document each item: Create a detailed description of each item, including its make, model, serial number, and any relevant documentation or evidence.

- Assign a value: Assign a value to each item, based on its original purchase price, replacement cost, or other relevant factors.

- Include supporting documentation: Include any supporting documentation or evidence, such as receipts, invoices, or photographs.

Downloading a Reliable Insurance Claim Template

There are many insurance claim templates available for download online. However, it's essential to choose a reliable template that meets your specific needs and requirements. Here are some factors to consider when downloading an insurance claim template:

- Reputation: Choose a template from a reputable source, such as a insurance company or a financial institution.

- Customization: Select a template that can be easily customized to suit your specific needs and requirements.

- Compliance: Ensure that the template complies with relevant laws and regulations, such as HIPAA or GDPR.

Best Practices for Using an Insurance Claim Template

Here are some best practices to follow when using an insurance claim template:

- Keep it organized: Keep your template organized and easy to navigate, with clear headings and categories.

- Be detailed: Be detailed and thorough in your documentation, including descriptions, values, and supporting documentation.

- Review and revise: Review and revise your template regularly, to ensure that it remains accurate and up-to-date.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using an insurance claim template:

- Inaccurate documentation: Inaccurate or incomplete documentation can lead to delays or disputes in the claims process.

- Insufficient evidence: Insufficient evidence or supporting documentation can weaken your claim and reduce your chances of receiving fair compensation.

- Poor organization: Poor organization and formatting can make it difficult to navigate and understand your template.

Conclusion

An insurance claim template in Excel can be a valuable tool in streamlining the claims process and ensuring that you receive fair compensation for your losses. By following the best practices outlined in this article, you can create a comprehensive and accurate itemized list that will help to expedite your claim and reduce the risk of errors or omissions. Remember to choose a reliable template, keep it organized, and be detailed in your documentation.

Insurance Claim Template Excel Itemized List Download Gallery

We hope this article has provided you with a comprehensive guide on how to use an insurance claim template in Excel. Remember to choose a reliable template, keep it organized, and be detailed in your documentation. By following these best practices, you can ensure that you receive fair compensation for your losses and streamline the claims process.