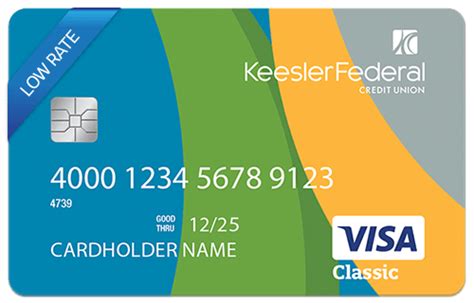

Discover Keesler Credit Unions credit card options, offering low rates, rewards, and cashback benefits, with flexible terms and convenient management, ideal for building credit, everyday purchases, and financial freedom.

The world of credit cards can be overwhelming, with numerous options available to consumers. However, for members of the Keesler Credit Union, the decision-making process is simplified. Keesler Credit Union offers a range of credit card options that cater to different needs and preferences. In this article, we will delve into the various credit card options available from Keesler Credit Union, highlighting their features, benefits, and advantages.

Keesler Credit Union is a not-for-profit financial cooperative that provides its members with a wide range of financial products and services. As a member-owned institution, Keesler Credit Union is committed to serving the financial needs of its members, including providing access to competitive credit card options. With a strong focus on community and member satisfaction, Keesler Credit Union has established itself as a trusted financial partner for its members.

The credit card options offered by Keesler Credit Union are designed to meet the diverse needs of its members. From rewards credit cards to low-interest credit cards, Keesler Credit Union has a credit card that suits every lifestyle and financial goal. Whether you're looking to earn rewards, build credit, or simply enjoy the convenience of a credit card, Keesler Credit Union has a credit card option that's right for you.

Types of Credit Cards Offered by Keesler Credit Union

Keesler Credit Union offers a variety of credit card options, each with its unique features and benefits. Some of the most popular credit card options include:

- Rewards credit cards: Earn rewards points or cashback on every purchase, redeemable for travel, merchandise, or statement credits.

- Low-interest credit cards: Enjoy low introductory APRs and ongoing low interest rates, perfect for balance transfers or everyday purchases.

- Secured credit cards: Build or rebuild credit with a secured credit card, requiring a security deposit to establish credit limits.

- Student credit cards: Designed for students, these credit cards offer low credit limits, flexible payment terms, and educational resources to help manage credit.

Benefits of Keesler Credit Union Credit Cards

The credit cards offered by Keesler Credit Union come with a range of benefits, including: * Competitive interest rates and fees * Generous rewards programs * Flexible payment terms and due dates * Access to online account management and mobile banking * Dedicated customer service and supportHow to Apply for a Keesler Credit Union Credit Card

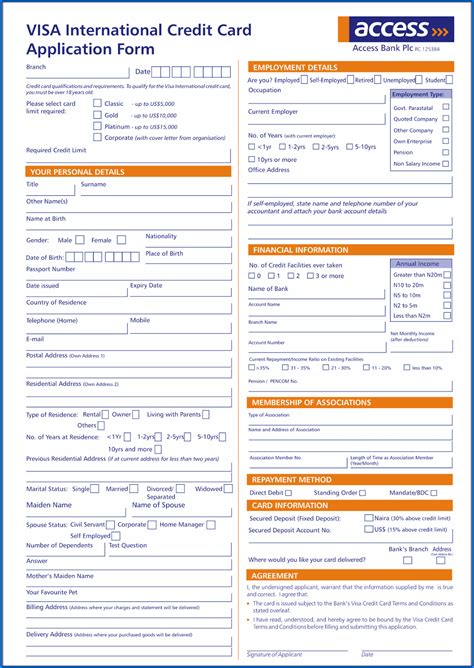

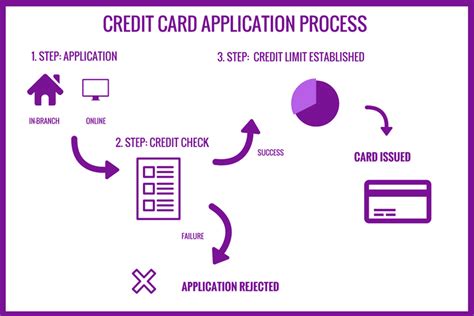

Applying for a Keesler Credit Union credit card is a straightforward process. Members can apply online, by phone, or in-person at a Keesler Credit Union branch. To apply, you'll need to provide personal and financial information, including:

- Identification and proof of address

- Income and employment information

- Credit history and credit score

- Security deposit (for secured credit cards)

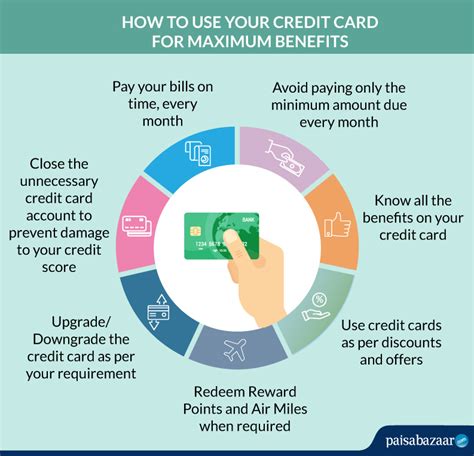

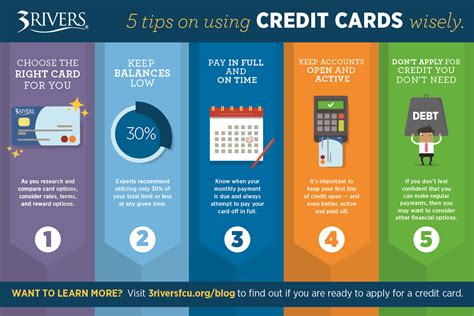

Tips for Choosing the Right Keesler Credit Union Credit Card

With so many credit card options available, it can be challenging to choose the right one. Here are some tips to consider:- Assess your financial goals and needs

- Compare interest rates, fees, and rewards programs

- Consider your credit score and history

- Read reviews and ask for recommendations

- Evaluate the credit limit and payment terms

Keesler Credit Union Credit Card Rewards and Benefits

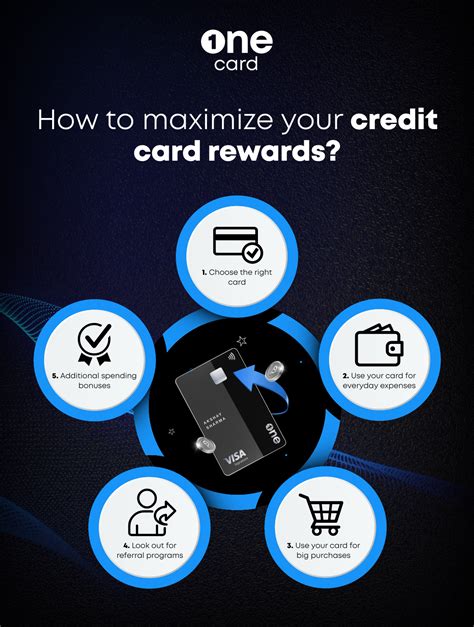

The rewards and benefits offered by Keesler Credit Union credit cards are designed to enhance your overall credit card experience. Some of the most notable rewards and benefits include:

- Earn rewards points or cashback on every purchase

- Redeem rewards for travel, merchandise, or statement credits

- Enjoy exclusive discounts and promotions

- Access to premium customer service and support

- Travel insurance and purchase protection

Managing Your Keesler Credit Union Credit Card Account

Managing your Keesler Credit Union credit card account is easy and convenient. Members can access their account information online or through the mobile banking app, allowing them to:- View account balances and transaction history

- Make payments and schedule transfers

- Set up account alerts and notifications

- Monitor credit score and report

- Access educational resources and financial tools

Keesler Credit Union Credit Card Security and Protection

The security and protection of your Keesler Credit Union credit card account are top priorities. Keesler Credit Union employs advanced security measures to prevent unauthorized access and protect your personal and financial information. Some of the security features include:

- Encryption and secure socket layer (SSL) technology

- Two-factor authentication and password protection

- Real-time account monitoring and alerts

- Zero-liability protection for unauthorized transactions

- Identity theft protection and credit monitoring

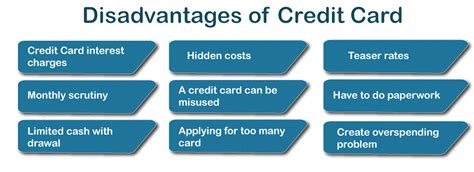

Common Mistakes to Avoid with Keesler Credit Union Credit Cards

While Keesler Credit Union credit cards offer many benefits, there are common mistakes to avoid:- Making late payments or missing payments

- Exceeding credit limits or accumulating high balances

- Not monitoring account activity or reporting errors

- Not taking advantage of rewards programs or benefits

- Not reviewing and understanding credit card terms and conditions

Keesler Credit Union Credit Card FAQs

Here are some frequently asked questions about Keesler Credit Union credit cards:

- What is the minimum credit score required for a Keesler Credit Union credit card?

- How do I apply for a Keesler Credit Union credit card?

- What are the interest rates and fees associated with Keesler Credit Union credit cards?

- Can I use my Keesler Credit Union credit card for international transactions?

- How do I report a lost or stolen Keesler Credit Union credit card?

Keesler Credit Union Image Gallery

Final Thoughts on Keesler Credit Union Credit Cards

In conclusion, Keesler Credit Union credit cards offer a range of benefits and advantages for members. With competitive interest rates, generous rewards programs, and flexible payment terms, Keesler Credit Union credit cards are an excellent choice for anyone looking to establish or rebuild credit. By understanding the different types of credit cards available, managing your account effectively, and avoiding common mistakes, you can make the most of your Keesler Credit Union credit card and achieve your financial goals.

We invite you to share your thoughts and experiences with Keesler Credit Union credit cards in the comments below. Whether you're a current member or considering joining, we'd love to hear your feedback and insights. Don't forget to share this article with friends and family who may be interested in learning more about Keesler Credit Union credit cards. Together, we can help each other make informed decisions and achieve financial success.