Explore Keesler Federal Credit Unions credit card options, featuring low rates, rewards, and benefits, including cashback, travel, and purchase protection, with flexible terms and competitive APRs for members.

The world of credit cards can be overwhelming, with numerous options available to consumers. For those affiliated with Keesler Federal Credit Union, the choice of credit card can be particularly important. As a member of Keesler Federal Credit Union, individuals have access to a range of credit card options that cater to different needs and financial goals. In this article, we will delve into the various credit card options offered by Keesler Federal Credit Union, exploring their features, benefits, and advantages.

Keesler Federal Credit Union has been serving its members for over 70 years, providing a wide range of financial services and products. As a not-for-profit cooperative, the credit union is committed to helping its members achieve financial stability and success. One way it does this is by offering a variety of credit card options that are designed to meet the diverse needs of its members. Whether you're looking for a low-interest rate, cashback rewards, or travel benefits, Keesler Federal Credit Union has a credit card that can help you achieve your financial objectives.

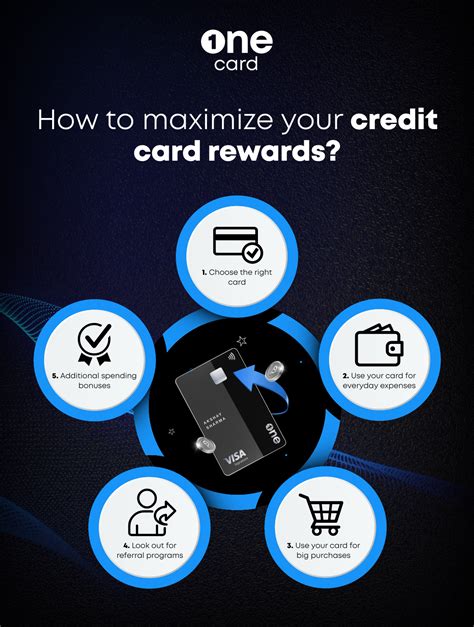

The importance of choosing the right credit card cannot be overstated. With so many options available, it's essential to consider your individual needs and financial goals before making a decision. A credit card can be a valuable tool for building credit, earning rewards, and managing expenses, but it can also lead to debt and financial difficulties if not used responsibly. By understanding the features and benefits of each credit card option, you can make an informed decision that aligns with your financial priorities.

Keesler Federal Credit Union Credit Card Options

Keesler Federal Credit Union offers several credit card options, each with its unique features and benefits. These options include the Visa Platinum Card, Visa Signature Card, and Visa Secured Card. The Visa Platinum Card is a popular choice among members, offering a low-interest rate and no annual fee. The Visa Signature Card, on the other hand, provides cashback rewards and travel benefits, making it an excellent option for those who want to earn rewards on their purchases. The Visa Secured Card is designed for members who are looking to establish or rebuild their credit, requiring a security deposit to open the account.

Visa Platinum Card

The Visa Platinum Card is a great option for members who want a low-interest rate and no annual fee. This card offers a competitive interest rate, making it an excellent choice for those who want to keep their interest payments low. Additionally, the Visa Platinum Card provides a range of benefits, including travel accident insurance, auto rental insurance, and purchase protection. With no annual fee and a low-interest rate, the Visa Platinum Card is an attractive option for members who want a hassle-free credit card experience.Visa Signature Card

The Visa Signature Card is a premium credit card option that offers a range of benefits and rewards. This card provides cashback rewards on all purchases, as well as travel benefits such as travel insurance and concierge service. The Visa Signature Card also offers a higher credit limit, making it an excellent option for members who want to make larger purchases. With its rewards program and travel benefits, the Visa Signature Card is a great choice for members who want to earn rewards and enjoy a more luxurious credit card experience.

Visa Secured Card

The Visa Secured Card is a great option for members who are looking to establish or rebuild their credit. This card requires a security deposit to open the account, which becomes the credit limit. The Visa Secured Card offers a range of benefits, including credit reporting to all three major credit bureaus, making it an excellent option for members who want to build or rebuild their credit. With its low fees and competitive interest rate, the Visa Secured Card is a great choice for members who want to take control of their credit.Benefits of Keesler Federal Credit Union Credit Cards

Keesler Federal Credit Union credit cards offer a range of benefits that make them an attractive option for members. These benefits include low-interest rates, no annual fees, and rewards programs. Additionally, Keesler Federal Credit Union credit cards provide a range of protections, including travel accident insurance, auto rental insurance, and purchase protection. With their competitive interest rates and rewards programs, Keesler Federal Credit Union credit cards are a great choice for members who want to manage their expenses and earn rewards.

Low-Interest Rates

Keesler Federal Credit Union credit cards offer competitive interest rates, making them an excellent option for members who want to keep their interest payments low. With a low-interest rate, members can save money on interest payments and pay off their balances more quickly. Whether you're looking to make a large purchase or simply want to manage your everyday expenses, a Keesler Federal Credit Union credit card with a low-interest rate can help you achieve your financial goals.How to Choose the Right Keesler Federal Credit Union Credit Card

Choosing the right Keesler Federal Credit Union credit card can be a daunting task, with so many options available. However, by considering your individual needs and financial goals, you can make an informed decision that aligns with your priorities. Here are some factors to consider when choosing a Keesler Federal Credit Union credit card:

- Interest rate: If you plan to carry a balance, look for a credit card with a low-interest rate.

- Fees: Consider the annual fee, late fee, and foreign transaction fee when choosing a credit card.

- Rewards: If you want to earn rewards, look for a credit card with a rewards program that aligns with your spending habits.

- Credit limit: Consider the credit limit and whether it meets your needs.

- Benefits: Look for credit cards that offer benefits such as travel insurance, auto rental insurance, and purchase protection.

Application Process

The application process for a Keesler Federal Credit Union credit card is straightforward and can be completed online or in-person at a branch. To apply, you will need to provide personal and financial information, including your income, employment history, and credit history. Once you have submitted your application, it will be reviewed, and you will be notified of the decision.Keesler Federal Credit Union Credit Card FAQs

Here are some frequently asked questions about Keesler Federal Credit Union credit cards:

- What is the interest rate on Keesler Federal Credit Union credit cards?

- How do I apply for a Keesler Federal Credit Union credit card?

- What are the benefits of a Keesler Federal Credit Union credit card?

- Can I use my Keesler Federal Credit Union credit card abroad?

- How do I make payments on my Keesler Federal Credit Union credit card?

Gallery of Keesler Federal Credit Union Credit Cards

Keesler Federal Credit Union Credit Card Image Gallery

In conclusion, Keesler Federal Credit Union credit cards offer a range of benefits and features that make them an attractive option for members. By considering your individual needs and financial goals, you can choose the right credit card that aligns with your priorities. Whether you're looking for a low-interest rate, cashback rewards, or travel benefits, Keesler Federal Credit Union has a credit card that can help you achieve your financial objectives. We invite you to share your thoughts and experiences with Keesler Federal Credit Union credit cards in the comments below. Additionally, if you found this article helpful, please share it with your friends and family who may be in the market for a new credit card.