Labor costs are a significant expense for businesses, and accurately calculating them is crucial for making informed decisions about resource allocation, budgeting, and project management. A labor cost calculator in Excel can help you streamline this process and ensure that your calculations are accurate and up-to-date. In this article, we'll explore five ways to create a labor cost calculator in Excel, including different formulas, templates, and techniques to help you get started.

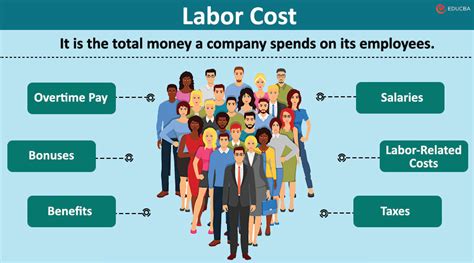

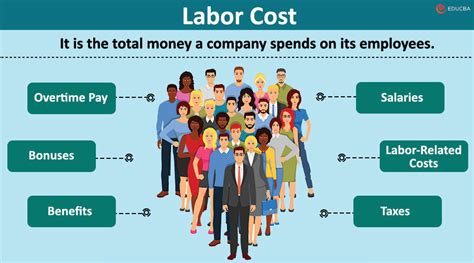

Understanding Labor Costs

Before we dive into the different methods for creating a labor cost calculator, it's essential to understand what labor costs entail. Labor costs include not only the hourly wages of employees but also benefits, taxes, and other expenses associated with hiring and maintaining a workforce. These costs can be categorized into direct labor costs, indirect labor costs, and overhead costs.

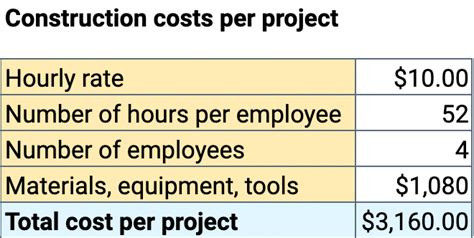

Method 1: Basic Labor Cost Calculator

A basic labor cost calculator can be created using a simple Excel formula that multiplies the number of hours worked by the hourly wage rate. Here's an example:

- Create a table with the following columns: Employee Name, Hours Worked, Hourly Wage Rate, and Labor Cost.

- Enter the employee data, including hours worked and hourly wage rate.

- In the Labor Cost column, use the formula:

=B2*C2, where B2 is the hours worked and C2 is the hourly wage rate. - Drag the formula down to calculate the labor cost for each employee.

Method 2: Labor Cost Calculator with Benefits and Taxes

To create a more comprehensive labor cost calculator, you can include benefits and taxes in your calculations. Here's an example:

- Create a table with the following columns: Employee Name, Hours Worked, Hourly Wage Rate, Benefits Rate, Tax Rate, and Labor Cost.

- Enter the employee data, including hours worked, hourly wage rate, benefits rate, and tax rate.

- In the Labor Cost column, use the formula:

=B2*C2*(1+D2)*(1+E2), where B2 is the hours worked, C2 is the hourly wage rate, D2 is the benefits rate, and E2 is the tax rate. - Drag the formula down to calculate the labor cost for each employee.

Method 3: Labor Cost Calculator with Overhead Costs

To create a labor cost calculator that includes overhead costs, you can use a formula that multiplies the labor cost by an overhead factor. Here's an example:

- Create a table with the following columns: Employee Name, Hours Worked, Hourly Wage Rate, Overhead Factor, and Labor Cost.

- Enter the employee data, including hours worked, hourly wage rate, and overhead factor.

- In the Labor Cost column, use the formula:

=B2*C2*(1+F2), where B2 is the hours worked, C2 is the hourly wage rate, and F2 is the overhead factor. - Drag the formula down to calculate the labor cost for each employee.

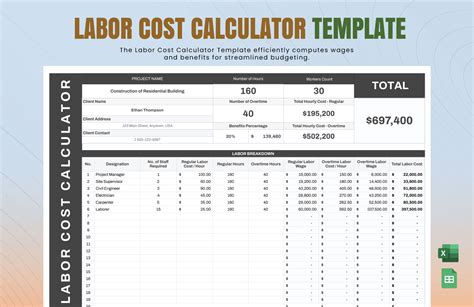

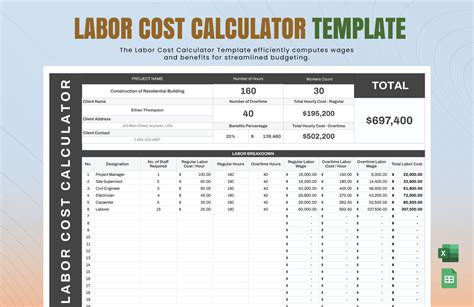

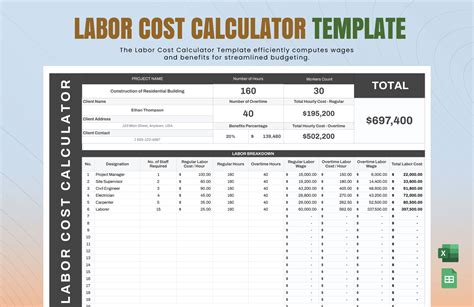

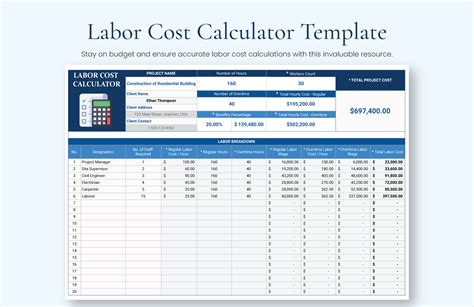

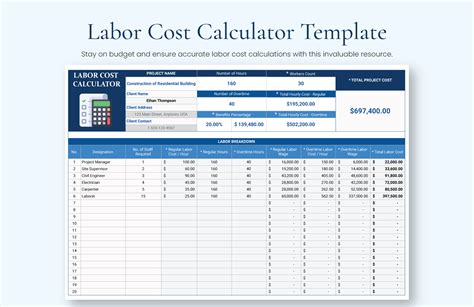

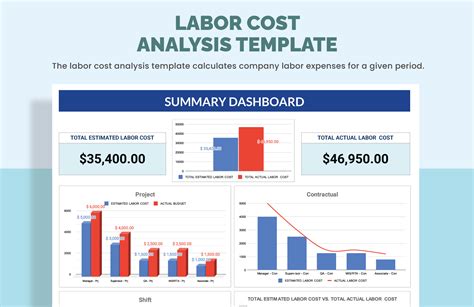

Method 4: Using Excel Templates

Microsoft Excel offers a range of templates that can help you create a labor cost calculator quickly and easily. Here's an example:

- Go to the Excel template gallery and search for "labor cost calculator."

- Select a template that meets your needs and download it to your computer.

- Enter your employee data into the template, including hours worked, hourly wage rate, benefits rate, and tax rate.

- The template will automatically calculate the labor cost for each employee.

Method 5: Using Excel Add-ins

Excel add-ins can also help you create a labor cost calculator quickly and easily. Here's an example:

- Go to the Excel add-in store and search for "labor cost calculator."

- Select an add-in that meets your needs and download it to your computer.

- Enter your employee data into the add-in, including hours worked, hourly wage rate, benefits rate, and tax rate.

- The add-in will automatically calculate the labor cost for each employee.

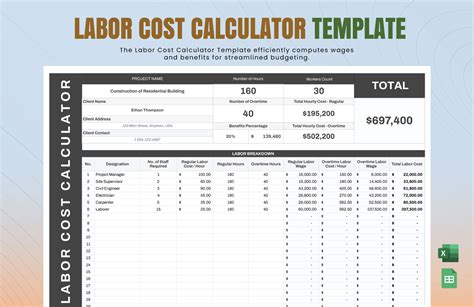

Gallery of Labor Cost Calculator Examples

Labor Cost Calculator Image Gallery

Conclusion

Creating a labor cost calculator in Excel can help you streamline your calculations and ensure that your labor costs are accurate and up-to-date. By using one of the five methods outlined in this article, you can create a comprehensive labor cost calculator that meets your business needs. Whether you're a small business owner or a large corporation, a labor cost calculator can help you make informed decisions about resource allocation, budgeting, and project management.