Intro

Planning for the future is a responsible and caring act that ensures your wishes are respected and your loved ones are protected. One of the most important documents you can create is a last will and testament, which outlines how you want your assets to be distributed after your passing. For residents of North Carolina, using a North Carolina last will template can help simplify the process. Here's a step-by-step guide to creating a valid and effective will in North Carolina.

Understanding the Importance of a Last Will and Testament in North Carolina

A last will and testament is a legal document that allows you to decide how your assets will be distributed after your death. Without a will, the state of North Carolina will determine how your assets are distributed, which may not align with your wishes. By creating a will, you can ensure that your loved ones are taken care of and your assets are distributed according to your desires.

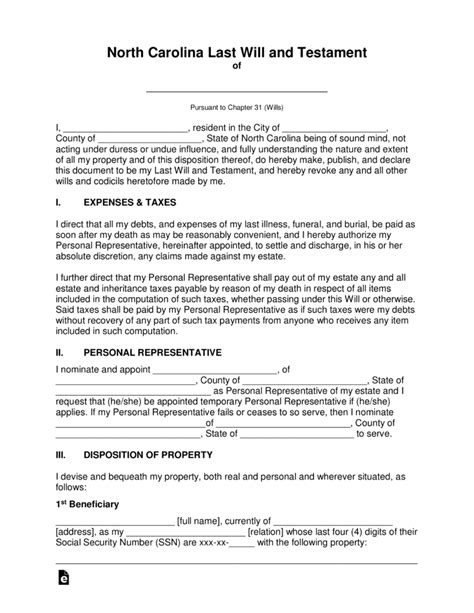

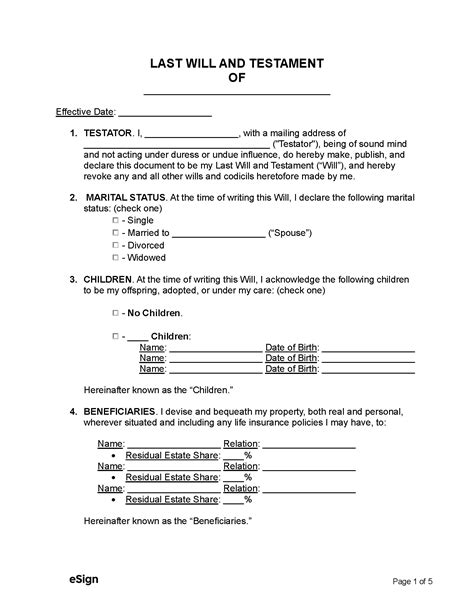

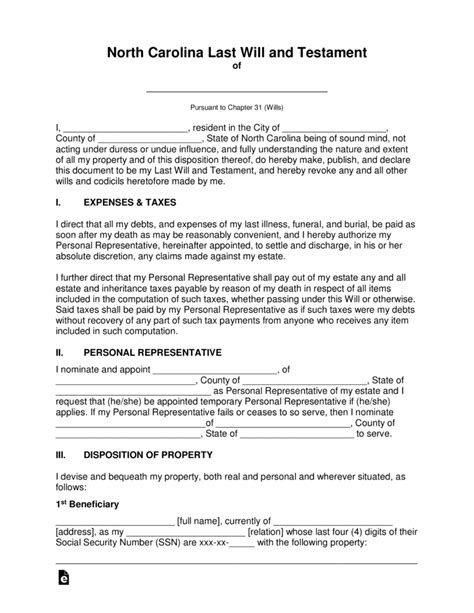

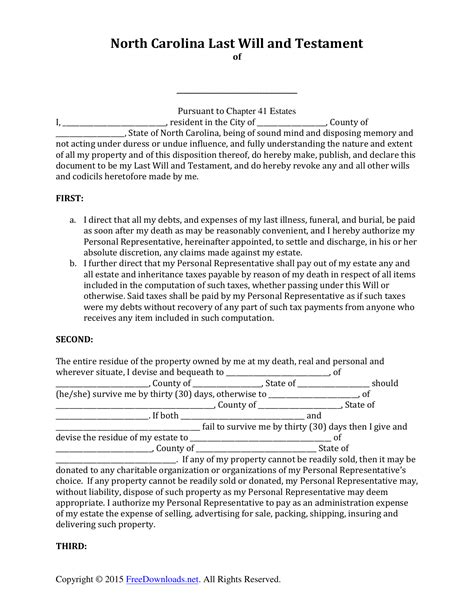

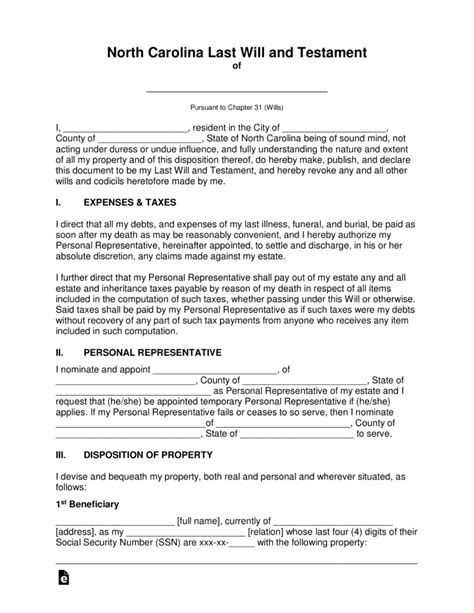

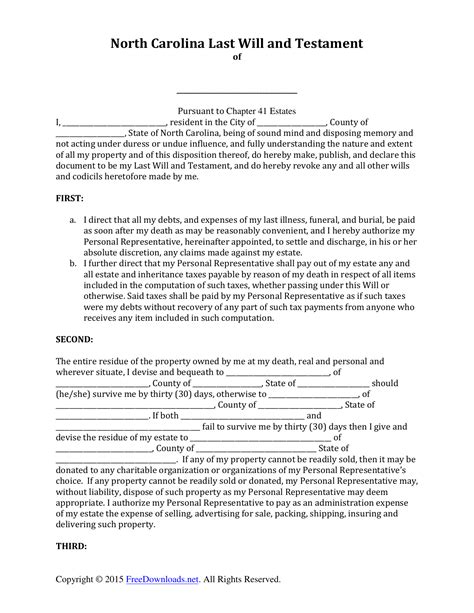

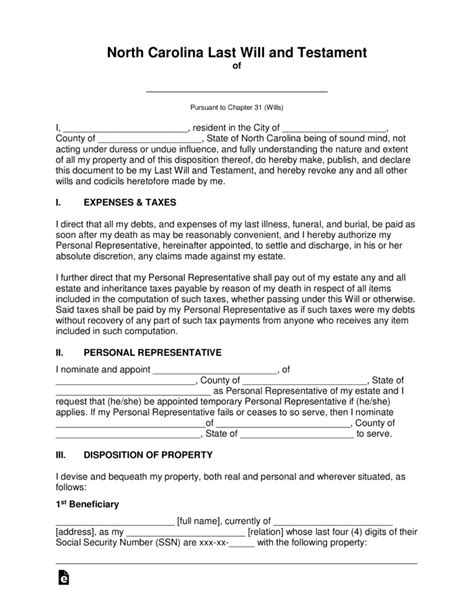

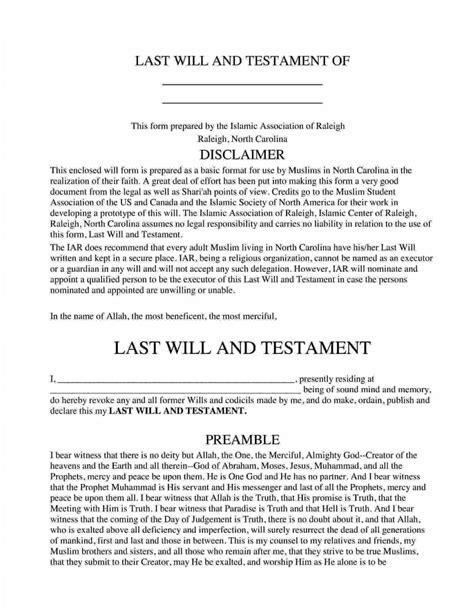

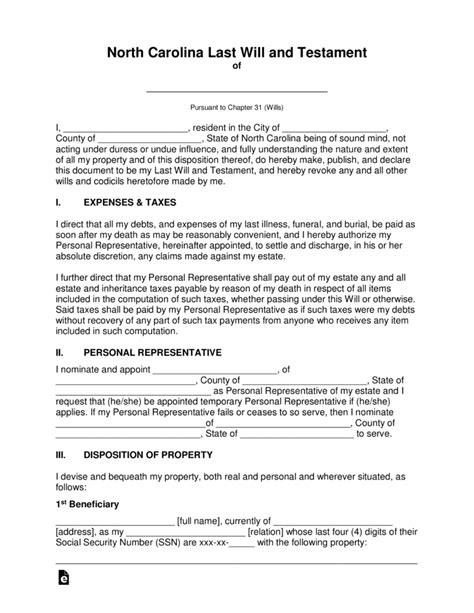

Why You Need a North Carolina Last Will Template

Using a North Carolina last will template can help you create a valid and effective will. A will template provides a general outline of the information you need to include in your will, such as your personal details, assets, beneficiaries, and executor. By using a template, you can ensure that you don't forget any important details and that your will meets the legal requirements of the state of North Carolina.

Step 1: Choose Your Executor

The executor is the person responsible for carrying out the instructions in your will. This person will be in charge of managing your estate, paying off debts, and distributing your assets to your beneficiaries. When choosing an executor, consider someone who is trustworthy, responsible, and familiar with your financial situation.

What to Consider When Choosing an Executor

- Age: Your executor should be at least 18 years old and of sound mind.

- Relationship: Your executor should be someone you trust, such as a family member or close friend.

- Financial knowledge: Your executor should have a basic understanding of financial matters, such as managing bank accounts and paying bills.

Step 2: Identify Your Beneficiaries

Your beneficiaries are the people or organizations that will receive your assets after your death. When identifying your beneficiaries, consider who you want to leave your assets to and what percentage of your estate you want to leave to each beneficiary.

Types of Beneficiaries

- Primary beneficiaries: These are the people or organizations that will receive your assets first.

- Secondary beneficiaries: These are the people or organizations that will receive your assets if your primary beneficiaries predecease you.

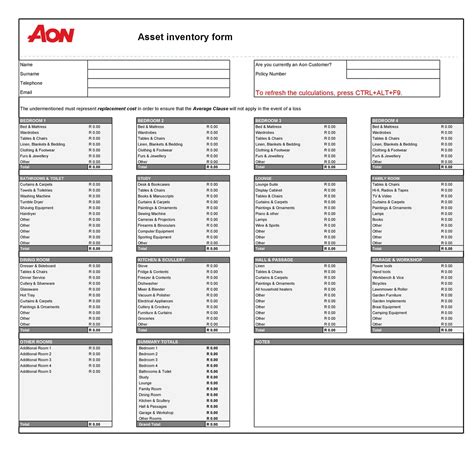

Step 3: List Your Assets

Your assets include all of your personal property, such as bank accounts, investments, real estate, and personal items. When listing your assets, be as specific as possible and include the following information:

- Asset name

- Asset value

- Location of asset

Types of Assets

- Real property: This includes your home, vacation home, and any other real estate you own.

- Personal property: This includes your bank accounts, investments, and personal items.

- Intellectual property: This includes any patents, trademarks, or copyrights you own.

Step 4: Determine How You Want to Distribute Your Assets

When determining how you want to distribute your assets, consider what percentage of your estate you want to leave to each beneficiary. You can also specify specific assets you want to leave to each beneficiary.

Types of Distribution

- Percentage distribution: This is when you leave a percentage of your estate to each beneficiary.

- Specific distribution: This is when you leave specific assets to each beneficiary.

Step 5: Consider Adding a Contingent Beneficiary

A contingent beneficiary is someone who will receive your assets if your primary beneficiaries predecease you. When considering adding a contingent beneficiary, think about who you want to receive your assets if your primary beneficiaries are no longer alive.

Why You Need a Contingent Beneficiary

- Ensures your assets are distributed according to your wishes

- Provides a backup plan in case your primary beneficiaries predecease you

Step 6: Sign and Date Your Will

Once you have completed your will, you need to sign and date it in the presence of two witnesses. Your witnesses should be at least 18 years old and of sound mind.

Why You Need to Sign and Date Your Will

- Makes your will legally binding

- Ensures your wishes are respected after your death

Step 7: Store Your Will Safely

Once you have signed and dated your will, you need to store it in a safe and secure location. This could be a fireproof safe, a safe deposit box at a bank, or with your attorney.

Why You Need to Store Your Will Safely

- Protects your will from damage or loss

- Ensures your will can be found after your death

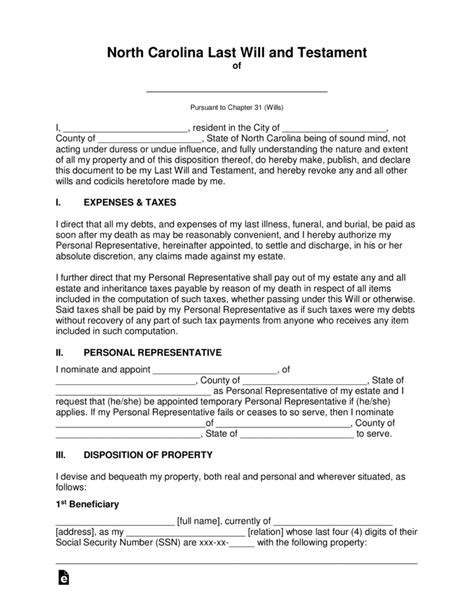

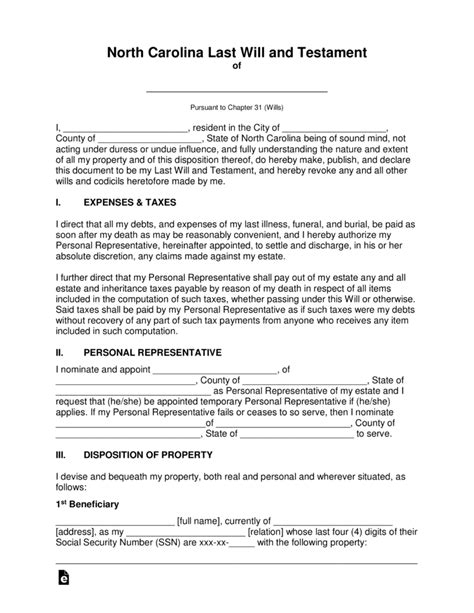

North Carolina Last Will Template Gallery

By following these 7 essential steps, you can create a valid and effective North Carolina last will template that ensures your wishes are respected and your loved ones are protected after your death.