Intro

Ensure your final wishes are respected with a valid Alabama Last Will and Testament. Learn the 5 essential tips to create a legally binding will in Alabama, including choosing an executor, listing assets, and understanding testamentary capacity. Discover how to avoid common mistakes and ensure a smooth probate process.

Creating a last will and testament is a crucial step in planning for the future, ensuring that your wishes are respected and your loved ones are taken care of after you pass away. In Alabama, having a valid will can help avoid unnecessary complications and costs for your heirs. Here are five essential tips to consider when creating your Alabama last will and testament.

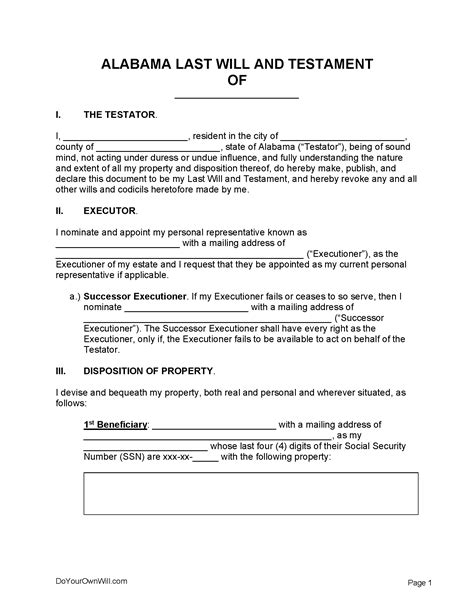

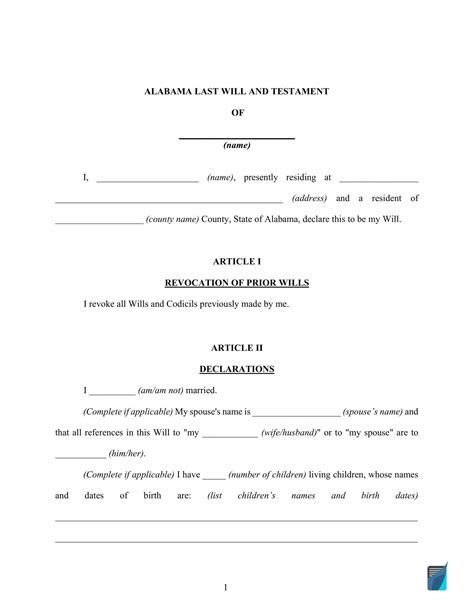

Understand the Requirements for a Valid Will in Alabama

In Alabama, a will must meet certain requirements to be considered valid. These requirements include:

- The testator (the person creating the will) must be at least 18 years old

- The testator must be of sound mind and disposing memory

- The will must be in writing

- The will must be signed by the testator in the presence of two witnesses

- The witnesses must also sign the will

It is essential to note that Alabama recognizes two types of wills: attested wills and holographic wills. Attested wills are the most common type and require the signature of two witnesses. Holographic wills, on the other hand, are entirely in the testator's handwriting and do not require witnesses.

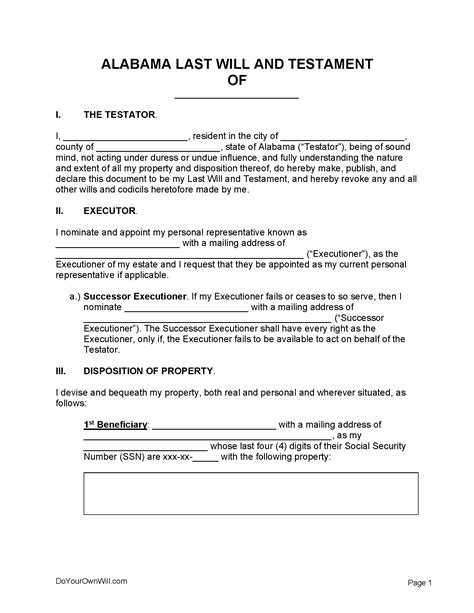

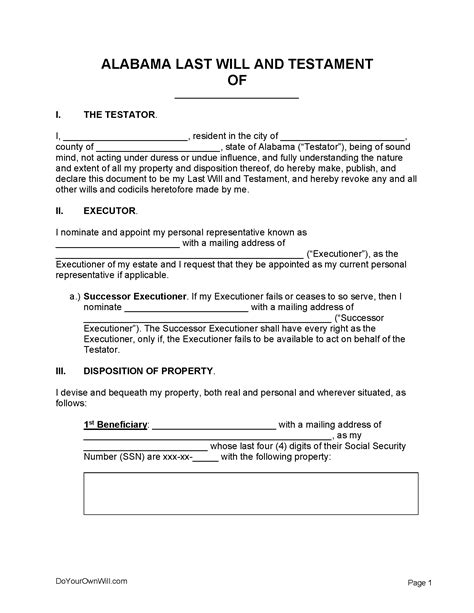

Choose the Right Executor for Your Estate

The executor of your estate plays a crucial role in carrying out the instructions outlined in your will. This person is responsible for managing your estate, paying off debts, and distributing your assets according to your wishes. When choosing an executor, consider the following factors:

- Trustworthiness: Your executor should be someone you trust to act in your best interests.

- Organizational skills: Managing an estate can be complex, so your executor should be organized and able to handle multiple tasks.

- Communication skills: Your executor will need to communicate with your heirs, creditors, and other parties, so good communication skills are essential.

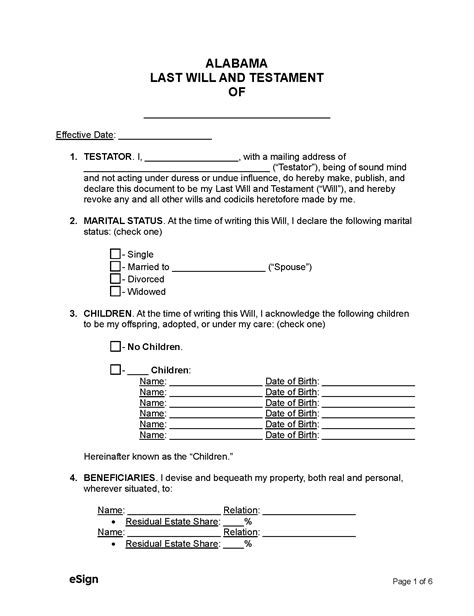

Be Specific and Clear in Your Wishes

Avoid Ambiguity in Your Will

To avoid disputes and ensure that your wishes are carried out, it is essential to be specific and clear in your will. Here are some tips to help you avoid ambiguity:

- Use specific language: Avoid using vague language or general terms that could be open to interpretation.

- Identify beneficiaries: Clearly identify your beneficiaries and their relationships to you.

- Describe assets: Provide a detailed description of your assets, including their location and any identifying features.

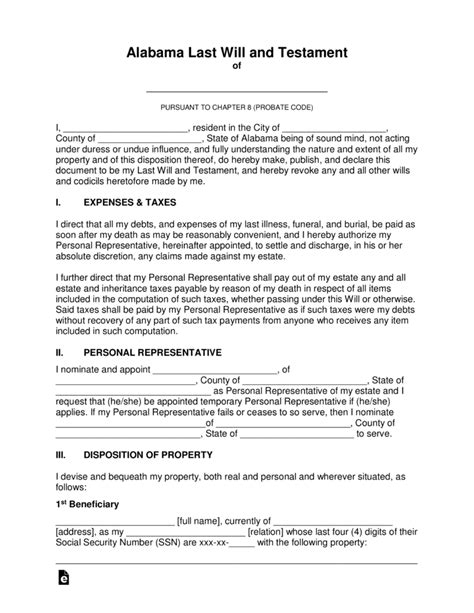

Consider the Tax Implications of Your Will

Minimizing Taxes in Your Estate

When creating your will, it is essential to consider the tax implications of your estate. Here are some tips to help minimize taxes:

- Take advantage of tax exemptions: Alabama exempts certain assets, such as the first $3.5 million of your estate, from state estate taxes.

- Use tax-deferred assets: Consider using tax-deferred assets, such as 401(k)s or IRAs, to minimize taxes.

- Consider charitable donations: Donating to charity can help reduce your taxable estate.

Review and Update Your Will Regularly

Keeping Your Will Up-to-Date

Your will should be a dynamic document that reflects changes in your life and circumstances. Here are some tips to help you keep your will up-to-date:

- Review your will every 5-10 years: Regularly review your will to ensure that it still reflects your wishes and circumstances.

- Update your will after major life events: If you get married, divorced, or have children, you should update your will to reflect these changes.

- Consider a living will: A living will outlines your wishes for medical treatment if you become incapacitated.

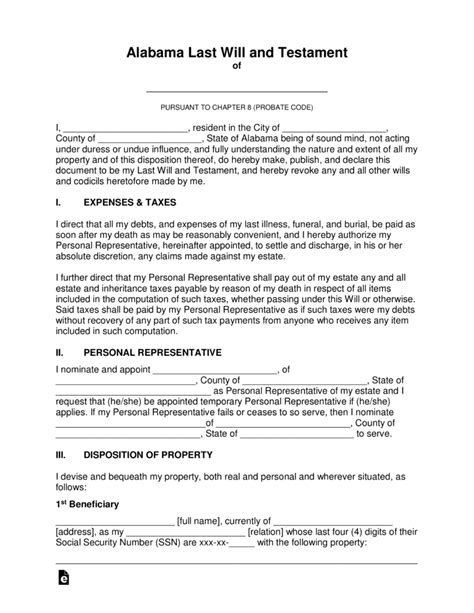

Alabama Last Will and Testament Image Gallery

We hope this article has provided you with valuable insights and tips for creating a comprehensive and valid last will and testament in Alabama. If you have any questions or concerns, please don't hesitate to reach out to us. We invite you to share your thoughts and experiences in the comments section below.