Intro

Create a valid Florida last will with our expert guide. Discover the 5 essential tips for a Florida last will template, including requirements for witnesses, executors, and beneficiaries. Ensure your assets are distributed according to your wishes. Learn how to avoid probate, minimize taxes, and safeguard your estate with a comprehensive Florida will template.

Creating a last will and testament is a crucial step in estate planning, ensuring that your assets are distributed according to your wishes after you pass away. In Florida, having a valid will can help avoid disputes and ensure that your loved ones are taken care of. If you're looking to create a Florida last will template, here are five essential tips to keep in mind.

Understanding Florida's Last Will Requirements

Before creating a Florida last will template, it's essential to understand the state's requirements for a valid will. In Florida, a will must be in writing, signed by the testator (the person creating the will), and witnessed by two individuals who are not beneficiaries of the will. The witnesses must sign the will in the presence of the testator and each other.

1. Choose the Right Template

There are many Florida last will templates available online, but not all of them are created equal. When selecting a template, make sure it meets Florida's specific requirements and is tailored to your individual needs. Consider the following factors:

- Is the template specifically designed for Florida residents?

- Does the template cover all the necessary elements, such as appointing an executor, naming beneficiaries, and distributing assets?

- Is the template easy to understand and fill out?

2. Appoint an Executor

The executor, also known as the personal representative, is responsible for carrying out the instructions in your will. When choosing an executor, consider the following factors:

- Trustworthiness: Can you trust the person to carry out your wishes?

- Organizational skills: Is the person organized and able to manage the estate?

- Time commitment: Does the person have the time to devote to settling the estate?

Executor Responsibilities

- Gathering and inventorying assets

- Paying debts and taxes

- Distributing assets to beneficiaries

- Managing the estate until it's settled

3. Name Beneficiaries

Beneficiaries are the individuals or organizations that will inherit your assets. When naming beneficiaries, consider the following factors:

- Who do you want to inherit your assets?

- Are there any specific gifts or bequests you want to make?

- Are there any charities or organizations you want to support?

Types of Beneficiaries

- Primary beneficiaries: The individuals or organizations that will inherit your assets

- Secondary beneficiaries: The individuals or organizations that will inherit your assets if the primary beneficiaries predecease you

- Residual beneficiaries: The individuals or organizations that will inherit any remaining assets after specific gifts or bequests are made

4. Distribute Assets

When distributing assets, consider the following factors:

- What assets do you want to distribute?

- Who do you want to inherit each asset?

- Are there any specific instructions for the distribution of assets?

Types of Asset Distribution

- Specific gifts: Leaving specific assets to specific beneficiaries

- Residuary clause: Leaving any remaining assets to a beneficiary or group of beneficiaries

- Per stirpes: Leaving assets to beneficiaries in a specific order, such as children, grandchildren, etc.

5. Review and Update Your Will

Once you've created your Florida last will template, it's essential to review and update it regularly. Consider the following factors:

- Have there been any changes in your life, such as marriage, divorce, or the birth of a child?

- Have there been any changes in your assets or estate?

- Are there any changes in your wishes or intentions?

When to Update Your Will

- Every 5-10 years

- After a major life event, such as marriage, divorce, or the birth of a child

- After a significant change in assets or estate

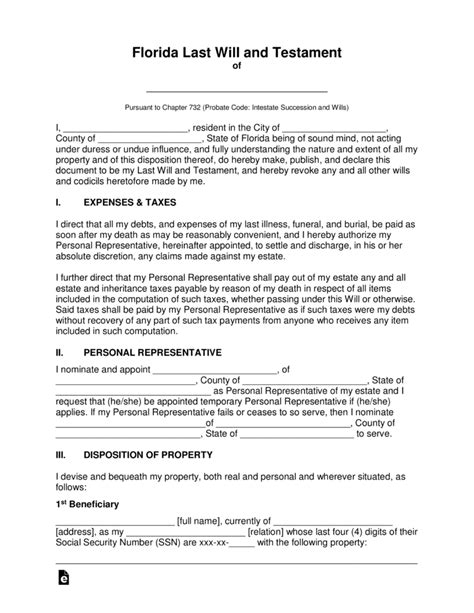

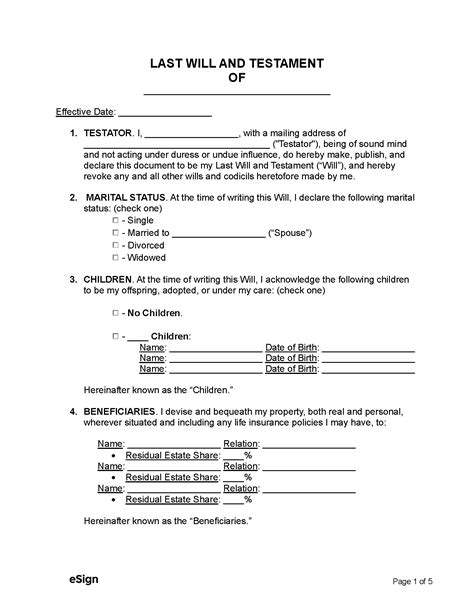

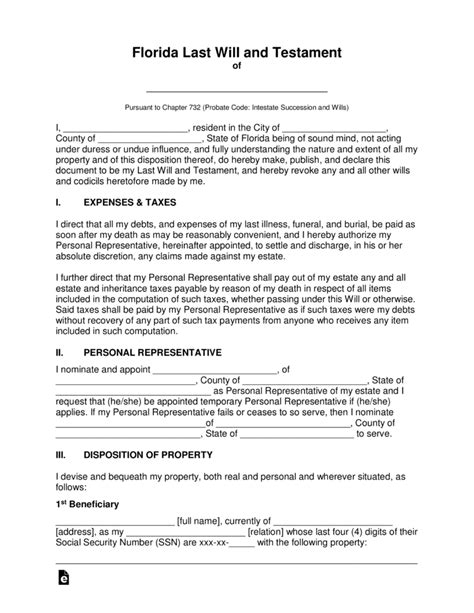

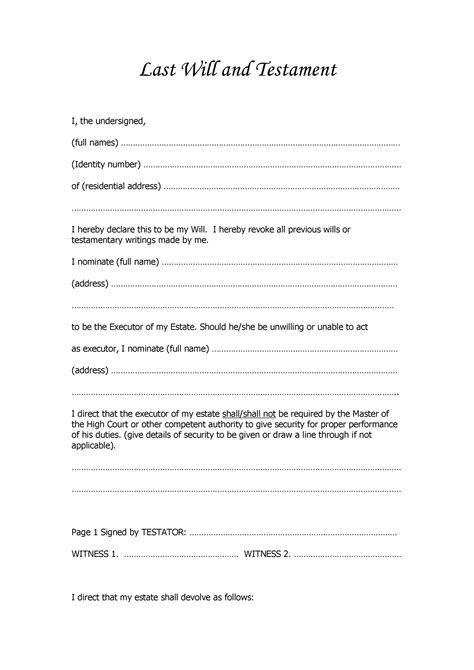

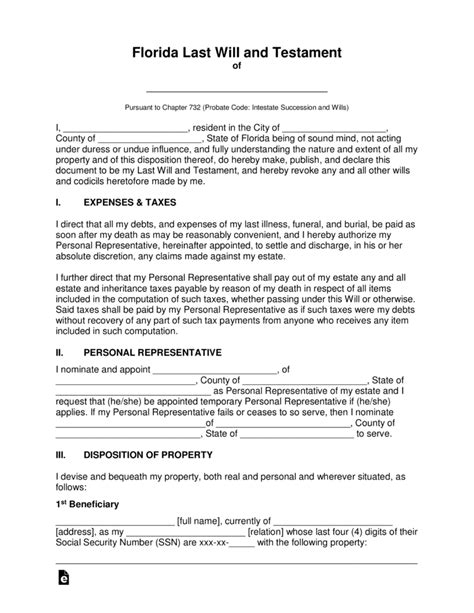

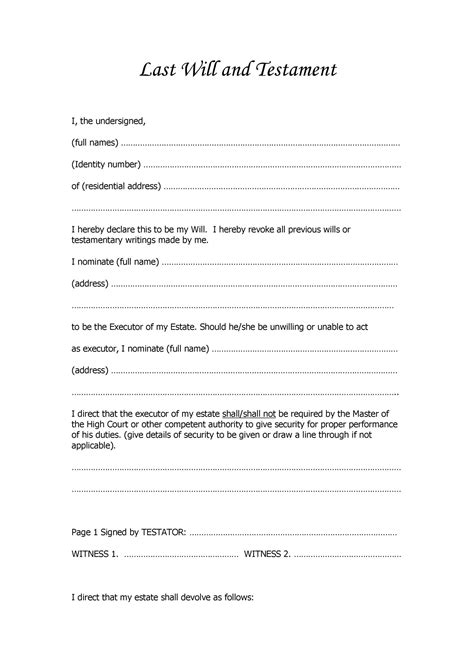

Florida Last Will Template Image Gallery

In conclusion, creating a Florida last will template requires careful consideration of several factors, including choosing the right template, appointing an executor, naming beneficiaries, distributing assets, and reviewing and updating your will. By following these essential tips, you can ensure that your wishes are carried out and your loved ones are taken care of after you pass away.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to reach out.