Intro

Create a legally binding Illinois will with our expert guide. Discover 7 essential tips for a valid Illinois will template, including requirements for witnesses, signatures, and testamentary intent. Ensure your estate plan is secure and compliant with Illinois state laws, and avoid costly mistakes with our comprehensive guide.

Creating a valid Illinois will template can be a daunting task, especially for those who are not familiar with the state's specific laws and regulations. However, with the right guidance, you can ensure that your will is properly drafted and executed, providing peace of mind for you and your loved ones. In this article, we will provide 7 essential tips to help you create a valid Illinois will template.

Understanding the Importance of a Will

Before we dive into the tips, it's essential to understand the importance of having a will in Illinois. A will allows you to control how your assets are distributed after your passing, ensuring that your wishes are respected. Without a will, the state will determine how your assets are distributed, which may not align with your intentions.

Tip 1: Meet the Age and Capacity Requirements

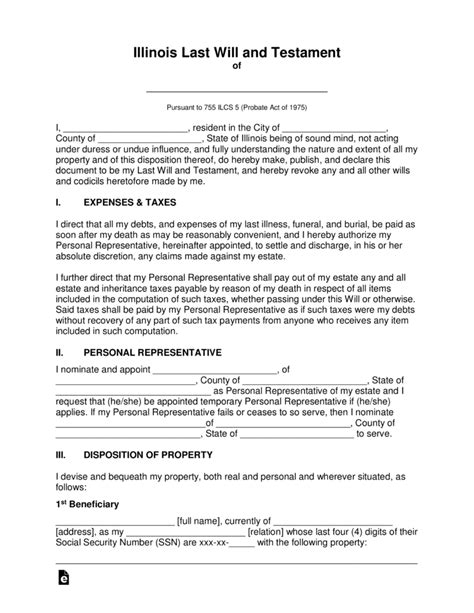

In Illinois, you must be at least 18 years old and of sound mind to create a valid will. Being of sound mind means that you must be able to understand the nature of your actions and the consequences of creating a will.

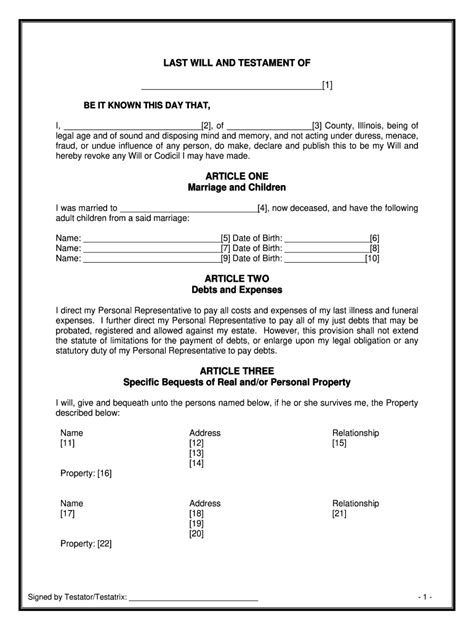

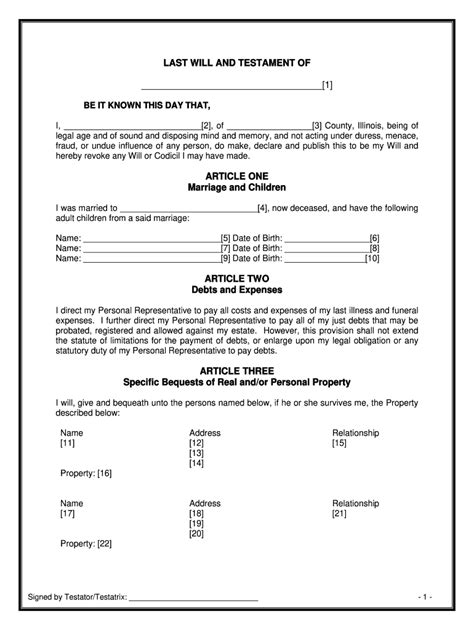

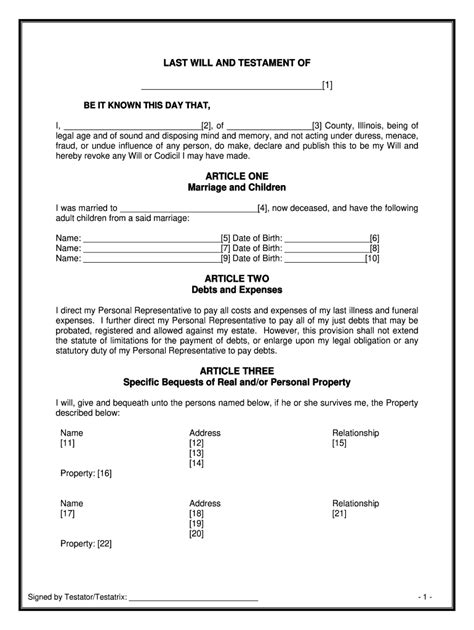

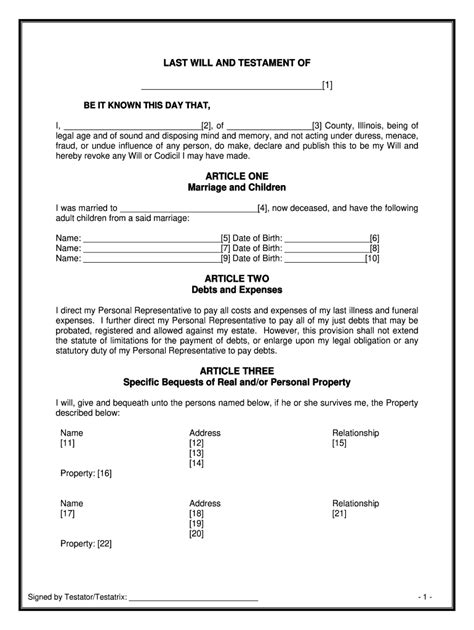

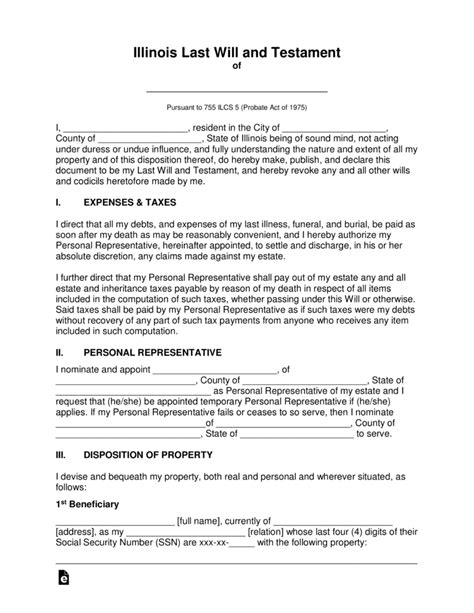

Tip 2: Choose the Right Type of Will

Illinois recognizes two types of wills: attested wills and holographic wills. Attested wills are the most common type and require two witnesses to sign the document. Holographic wills, on the other hand, are entirely handwritten and do not require witnesses. However, holographic wills are only valid if they meet specific requirements.

Tip 3: Identify Your Assets

Before creating your will, it's essential to identify your assets, including real estate, bank accounts, investments, and personal property. This will help you determine how you want to distribute your assets and ensure that your will is comprehensive.

Tip 4: Appoint a Personal Representative

Your personal representative, also known as the executor, will be responsible for carrying out the instructions in your will. This person should be trustworthy and able to manage your estate effectively.

Tip 5: Name Beneficiaries

Your beneficiaries will inherit your assets according to the instructions in your will. You can name specific individuals, charities, or organizations as beneficiaries.

Tip 6: Sign and Witness the Will

Your will must be signed in the presence of two witnesses, who must also sign the document. This is a critical step in creating a valid Illinois will template.

Tip 7: Review and Update Your Will

Your will is not a one-time document; it should be reviewed and updated regularly to reflect changes in your life and assets. This will ensure that your will remains valid and effective.

Conclusion: Creating a Valid Illinois Will Template

Creating a valid Illinois will template requires careful consideration and attention to detail. By following these 7 essential tips, you can ensure that your will is properly drafted and executed, providing peace of mind for you and your loved ones.

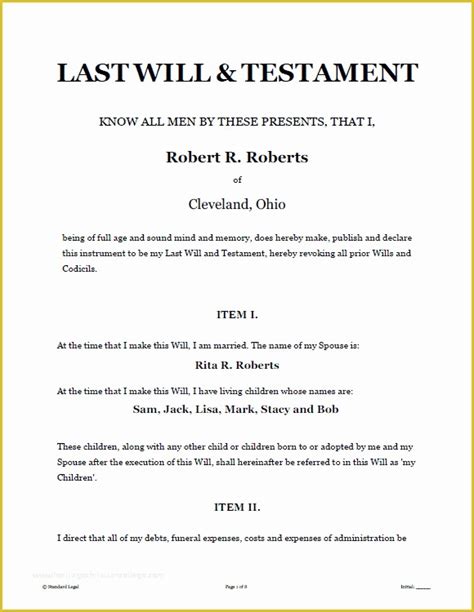

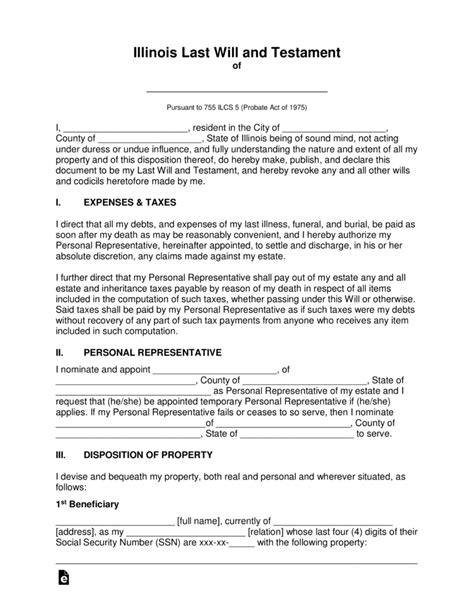

Illinois Will Template Image Gallery

We hope this article has provided you with valuable insights and tips for creating a valid Illinois will template. If you have any questions or concerns, please don't hesitate to reach out to a qualified attorney or estate planning professional.