Intro

Create a valid Minnesota will in just 5 easy steps. Learn how to make a will in MN, including choosing an executor, appointing guardians, distributing assets, and signing your document. Discover the importance of estate planning in Minnesota and how to avoid probate with a comprehensive will. Plan your legacy today!

Minnesota residents who want to ensure their wishes are respected after they pass away should consider creating a will. A will, also known as a last will and testament, is a legal document that outlines how you want your assets, property, and other belongings to be distributed among your loved ones. In this article, we will guide you through the process of creating a Minnesota will in 5 easy steps.

Understanding the Importance of Having a Will in Minnesota

Having a will in Minnesota is crucial for several reasons. Firstly, it allows you to control how your assets are distributed after your death. Without a will, the state of Minnesota will decide how your assets are distributed, which may not align with your wishes. Secondly, a will ensures that your loved ones are taken care of and that your wishes are respected. Finally, a will can also help to minimize conflicts and disputes among family members after your death.

Step 1: Determine Your Assets and Property

Before creating a will, it's essential to take stock of your assets and property. This includes:

- Real estate properties, such as your home or vacation home

- Bank accounts, including checking and savings accounts

- Investments, such as stocks and bonds

- Retirement accounts, such as 401(k) or IRA

- Personal property, such as jewelry, artwork, or collectibles

- Business interests, such as a partnership or corporation

Make a list of all your assets and property, including their estimated value. This will help you to decide how you want to distribute them among your loved ones.

Who Should You Include in Your Will?

When creating a will, you'll need to decide who you want to include as beneficiaries. This typically includes:

- Spouse or partner

- Children or grandchildren

- Parents or siblings

- Friends or charitable organizations

Consider who you want to inherit your assets and property, and make sure to include them in your will.

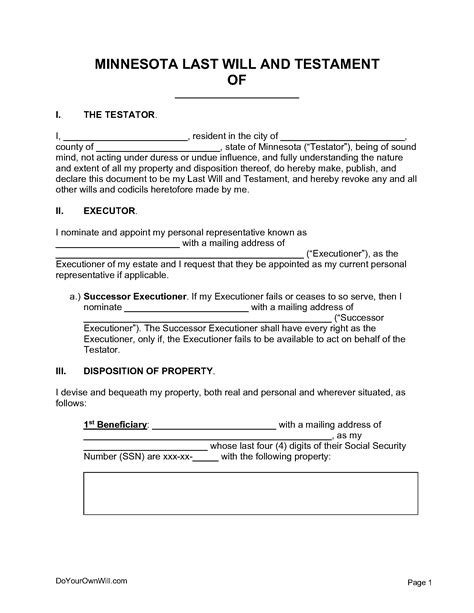

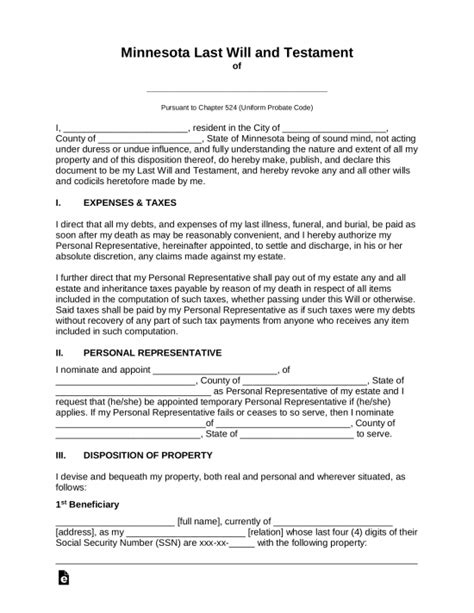

Step 2: Choose an Executor

An executor, also known as a personal representative, is responsible for carrying out the instructions in your will. This includes:

- Managing your assets and property

- Paying off debts and taxes

- Distributing your assets and property to your beneficiaries

Choose someone you trust to be your executor, such as a spouse, child, or close friend. Make sure to include their name and contact information in your will.

Step 3: Decide on Guardianship

If you have minor children, you'll need to decide on guardianship. This includes:

- Choosing a guardian to care for your children

- Naming an alternate guardian in case the first guardian is unable to serve

Consider who you want to care for your children and make sure to include their name and contact information in your will.

Step 4: Sign and Witness Your Will

Once you've completed your will, you'll need to sign and witness it. This includes:

- Signing your will in the presence of two witnesses

- Having your witnesses sign your will

Make sure to follow the witnessing requirements in Minnesota, which include:

- The witnesses must be at least 18 years old

- The witnesses must be mentally competent

- The witnesses must not be beneficiaries of your will

Step 5: Store Your Will Safely

Finally, make sure to store your will safely. This includes:

- Keeping your will in a secure location, such as a safe deposit box or a fireproof safe

- Making sure your executor knows where to find your will

Consider giving a copy of your will to your executor or a trusted friend or family member.

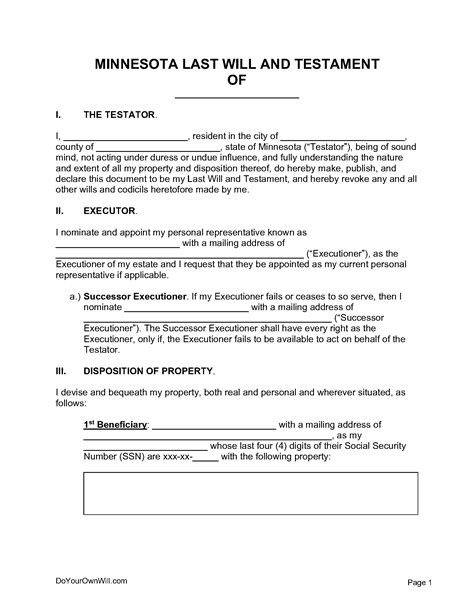

Minnesota Will Image Gallery

By following these 5 easy steps, you can create a Minnesota will that ensures your wishes are respected and your loved ones are taken care of. Remember to review and update your will regularly to reflect any changes in your life or assets.