Determining the right amount of life insurance coverage is crucial to ensure that your loved ones are financially protected in the event of your passing. However, calculating the ideal coverage amount can be a daunting task, especially for those without a financial background. This is where a life insurance needs calculator in Excel can come in handy.

In this article, we will guide you through the process of creating a simple yet effective life insurance needs calculator in Excel. We will also provide an overview of the importance of life insurance, the factors that affect coverage needs, and the benefits of using a calculator to determine the ideal coverage amount.

Understanding Life Insurance Needs

Before we dive into the world of Excel calculators, it's essential to understand the concept of life insurance needs. Life insurance provides a financial safety net for your dependents in the event of your passing. The primary purpose of life insurance is to ensure that your loved ones can maintain their standard of living, even if you're no longer around to provide for them.

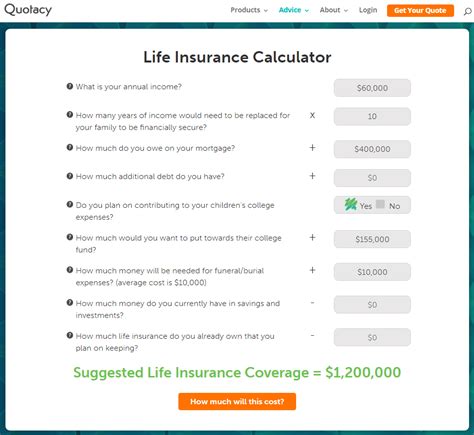

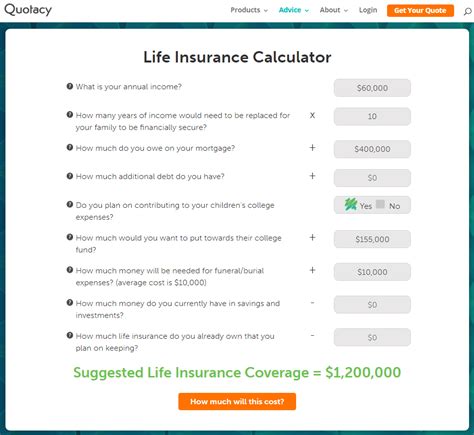

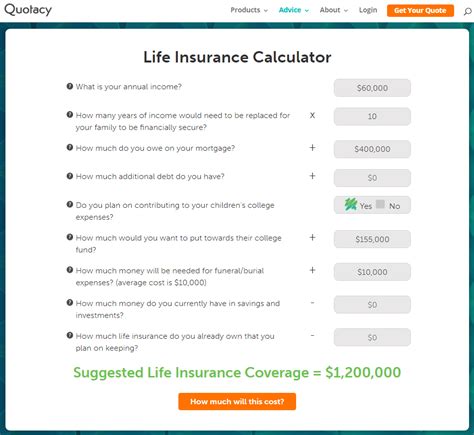

The amount of life insurance coverage you need depends on various factors, including:

- Income: Your annual income plays a significant role in determining your life insurance needs. A general rule of thumb is to have a coverage amount that's 5-10 times your annual income.

- Debt: Outstanding debts, such as mortgages, car loans, and credit card balances, can impact your life insurance needs. You'll want to ensure that your coverage amount can pay off these debts in the event of your passing.

- Dependents: The number of dependents you have, including children and spouses, can also affect your life insurance needs. You'll want to ensure that your coverage amount can provide for their financial well-being.

- Funeral expenses: Funeral expenses can be significant, and you'll want to ensure that your coverage amount can cover these costs.

Factors That Affect Life Insurance Needs

Several factors can impact your life insurance needs, including:

- Age: Your age can affect your life insurance needs, as you may have fewer financial obligations as you get older.

- Health: Your health can also impact your life insurance needs, as certain medical conditions may require more extensive coverage.

- Occupation: Your occupation can affect your life insurance needs, as certain jobs may be more hazardous than others.

- Location: Your location can also impact your life insurance needs, as the cost of living varies significantly depending on where you live.

Creating a Life Insurance Needs Calculator in Excel

Now that we've covered the basics of life insurance needs, let's create a simple calculator in Excel to determine the ideal coverage amount.

Step 1: Determine the Input Variables

- Income: Enter your annual income in cell A1.

- Debt: Enter your outstanding debt balance in cell A2.

- Dependents: Enter the number of dependents you have in cell A3.

- Funeral expenses: Enter the estimated cost of funeral expenses in cell A4.

Step 2: Calculate the Coverage Amount

- Multiply your income by 5-10 to determine the coverage amount based on income. Enter this formula in cell B1:

=A1*5 - Add your debt balance to the coverage amount. Enter this formula in cell B2:

=B1+A2 - Multiply the number of dependents by $10,000 to determine the coverage amount based on dependents. Enter this formula in cell B3:

=A3*10000 - Add the funeral expenses to the coverage amount. Enter this formula in cell B4:

=B2+B3+A4

Step 3: Determine the Ideal Coverage Amount

- Enter the following formula in cell C1:

=MAX(B1,B2,B3,B4) - This formula will determine the highest coverage amount based on the input variables.

Benefits of Using a Life Insurance Needs Calculator

Using a life insurance needs calculator can provide several benefits, including:

- Accuracy: A calculator can help you determine the ideal coverage amount based on your individual circumstances.

- Efficiency: A calculator can save you time and effort in determining the right coverage amount.

- Objectivity: A calculator can provide an objective assessment of your life insurance needs, eliminating emotional bias.

Conclusion

In conclusion, determining the right amount of life insurance coverage is crucial to ensure that your loved ones are financially protected in the event of your passing. A life insurance needs calculator in Excel can help you determine the ideal coverage amount based on your individual circumstances. By following the steps outlined in this article, you can create a simple yet effective calculator to determine your life insurance needs.

We hope this article has provided you with valuable insights into the world of life insurance needs calculators. Remember to regularly review and update your coverage amount to ensure that it remains aligned with your changing circumstances.

Get Started Today!

Create your own life insurance needs calculator in Excel using the steps outlined in this article. Don't leave your loved ones' financial future to chance – determine the ideal coverage amount today.

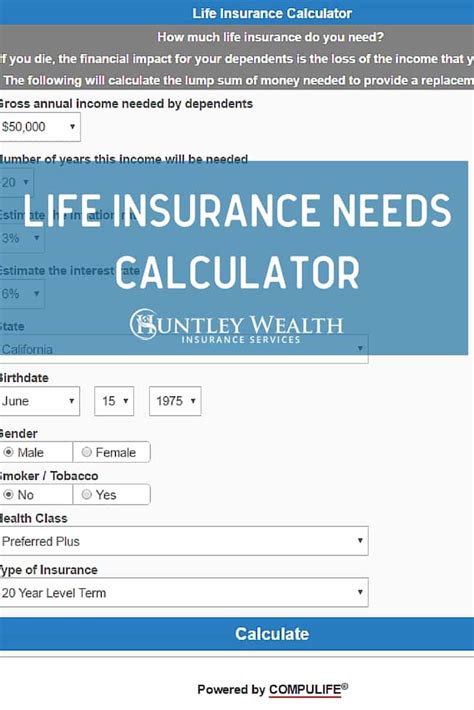

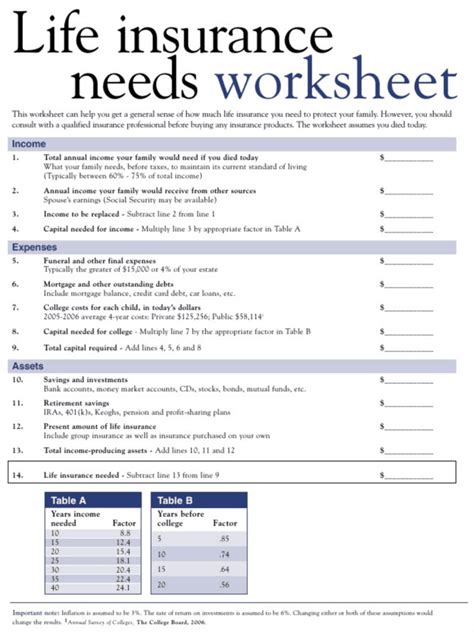

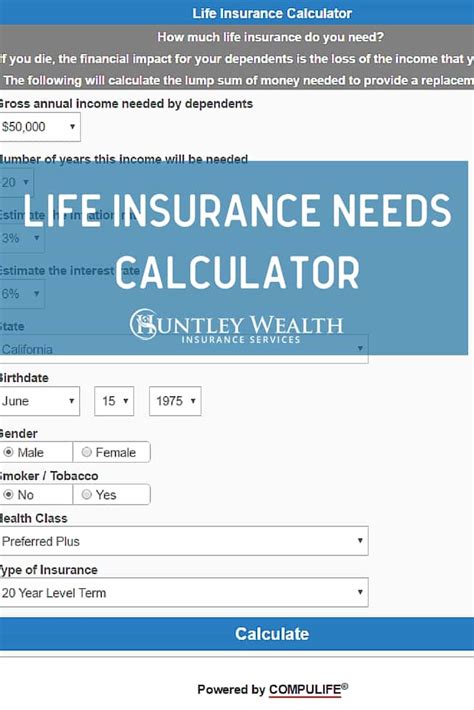

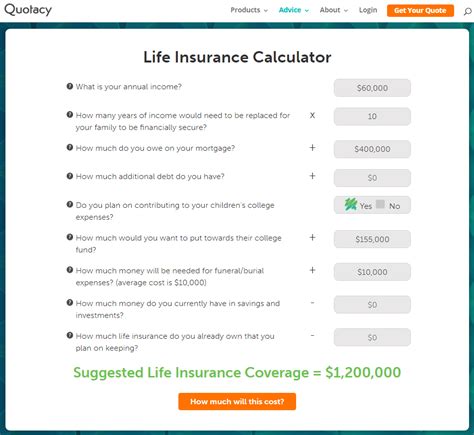

Gallery of Life Insurance Needs Calculators

Life Insurance Needs Calculator Gallery