Intro

Unlock the power of small-cap investing with the Russell 2000 Companies List in Excel. Download the comprehensive list of 2000 US-based small-cap stocks, perfect for portfolio optimization, research, and analysis. Get instant access to the list in Excel format, featuring key company data, market insights, and investment opportunities in the small-cap sector.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000 Index, which is a broader index of the largest 3,000 publicly traded companies in the US. The Russell 2000 is widely considered to be a benchmark for small-cap stocks and is often used as a proxy for the overall performance of the US small-cap market.

The Russell 2000 is maintained by FTSE Russell, a leading global index provider, and is updated annually to ensure that it remains representative of the US small-cap market. The index is market-capitalization weighted, meaning that the companies with the largest market capitalization have a greater influence on the index's performance.

Why is the Russell 2000 Companies List important?

The Russell 2000 Companies List is important for a number of reasons:

- Investment research: The list provides a comprehensive dataset of small-cap companies that can be used for investment research and analysis.

- Portfolio construction: The list can be used to construct a portfolio of small-cap stocks that are representative of the broader US small-cap market.

- Benchmarking: The Russell 2000 Index is widely used as a benchmark for small-cap stocks, allowing investors to compare the performance of their portfolios to the broader market.

How to download the Russell 2000 Companies List in Excel

The Russell 2000 Companies List is publicly available on the FTSE Russell website. Here's how to download it in Excel:

- Visit the FTSE Russell website at www.ftserussell.com.

- Click on the "Data" tab at the top of the page.

- Select "Index Data" from the drop-down menu.

- Click on "Russell 2000 Index" from the list of available indices.

- Click on the " Constituents" tab.

- Click on the "Download" button to download the list of constituents in CSV format.

- Open the CSV file in Excel to view the list of companies.

Alternatively, you can also use a third-party data provider such as Quandl or Alpha Vantage to download the Russell 2000 Companies List in Excel.

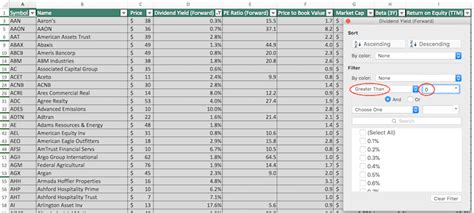

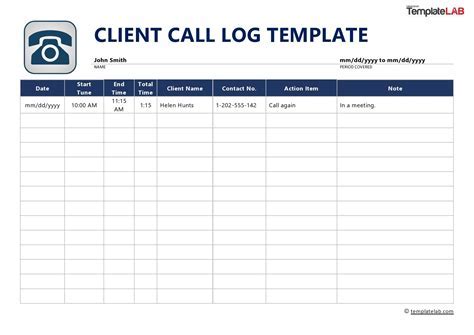

What information is included in the Russell 2000 Companies List?

The Russell 2000 Companies List includes the following information:

- Company name: The name of each company in the index.

- Ticker symbol: The ticker symbol for each company.

- Market capitalization: The market capitalization of each company.

- Index weight: The weight of each company in the index.

- Industry classification: The industry classification for each company.

- Sector classification: The sector classification for each company.

Using the Russell 2000 Companies List in Excel

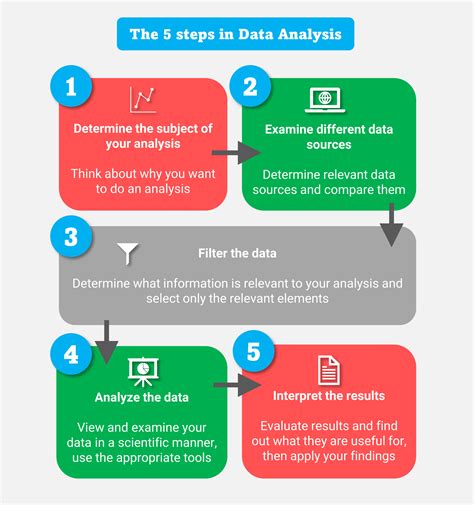

Once you have downloaded the Russell 2000 Companies List in Excel, you can use it to analyze the small-cap market and make investment decisions. Here are some ways to use the list:

- Filter and sort: Use Excel's filtering and sorting functions to analyze the list by company name, ticker symbol, market capitalization, and industry classification.

- Create charts and graphs: Use Excel's charting and graphing functions to visualize the data and gain insights into the small-cap market.

- Perform statistical analysis: Use Excel's statistical functions to perform regression analysis, correlation analysis, and other statistical tests on the data.

Benefits of using the Russell 2000 Companies List in Excel

Using the Russell 2000 Companies List in Excel provides a number of benefits, including:

- Easy data analysis: Excel's data analysis functions make it easy to analyze the list and gain insights into the small-cap market.

- Flexibility: The list can be easily sorted, filtered, and manipulated to meet your specific needs.

- Customization: You can use the list to create custom charts, graphs, and reports to suit your investment goals and objectives.

Common applications of the Russell 2000 Companies List

The Russell 2000 Companies List has a number of common applications, including:

- Investment research: The list is widely used by investment researchers and analysts to analyze the small-cap market and make investment decisions.

- Portfolio construction: The list is used by portfolio managers to construct portfolios of small-cap stocks that are representative of the broader US small-cap market.

- Benchmarking: The Russell 2000 Index is widely used as a benchmark for small-cap stocks, allowing investors to compare the performance of their portfolios to the broader market.

Conclusion

The Russell 2000 Companies List is a valuable resource for investment researchers, portfolio managers, and anyone interested in analyzing the small-cap market. By downloading the list in Excel, you can easily analyze the data and gain insights into the small-cap market. Whether you're looking to construct a portfolio of small-cap stocks or simply want to stay up-to-date on the latest market trends, the Russell 2000 Companies List is an essential tool to have in your investment toolkit.

Gallery of Russell 2000 Companies List

Russell 2000 Companies List Image Gallery

FAQs

Q: What is the Russell 2000 Index? A: The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000 Index.

Q: How do I download the Russell 2000 Companies List in Excel? A: You can download the list from the FTSE Russell website or use a third-party data provider such as Quandl or Alpha Vantage.

Q: What information is included in the Russell 2000 Companies List? A: The list includes company name, ticker symbol, market capitalization, index weight, industry classification, and sector classification.

Q: How can I use the Russell 2000 Companies List in Excel? A: You can use the list to analyze the small-cap market, construct portfolios of small-cap stocks, and benchmark the performance of your portfolio against the broader market.

Q: What are the benefits of using the Russell 2000 Companies List in Excel? A: The benefits include easy data analysis, flexibility, and customization.

Q: What are the common applications of the Russell 2000 Companies List? A: The list is commonly used for investment research, portfolio construction, and benchmarking.

Q: How can I stay up-to-date on the latest market trends using the Russell 2000 Companies List? A: You can use the list to analyze the small-cap market and stay informed about the latest market trends.

Q: What is the difference between the Russell 2000 Index and the Russell 3000 Index? A: The Russell 2000 Index represents the bottom 2,000 stocks in the Russell 3000 Index, which is a broader index of the largest 3,000 publicly traded companies in the US.