Intro

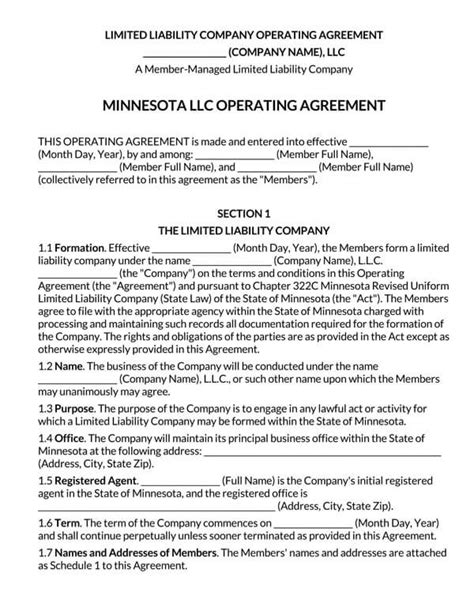

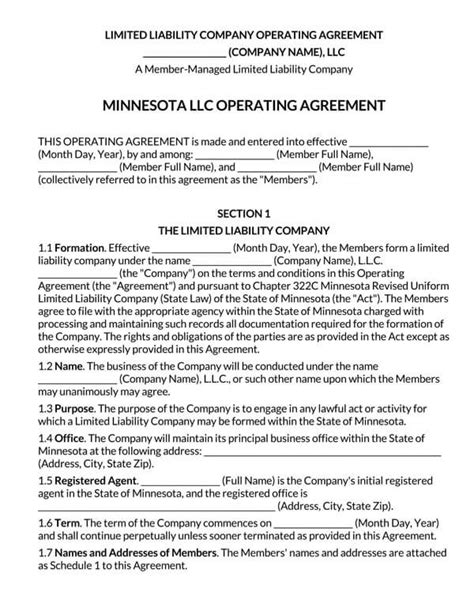

As a business owner in Minnesota, forming a Limited Liability Company (LLC) can provide personal liability protection and tax benefits. However, creating a comprehensive Operating Agreement is crucial to ensure the smooth operation of your LLC. An Operating Agreement is a legally binding document that outlines the ownership, management, and operation of your LLC. In this article, we will discuss the 5 essential provisions that should be included in your Minnesota LLC Operating Agreement.

Why an Operating Agreement is Necessary for Your Minnesota LLC

While Minnesota law does not require an Operating Agreement, having one is essential for several reasons:

- It provides a clear outline of the ownership and management structure of your LLC.

- It helps prevent disputes and misunderstandings among members.

- It outlines the roles and responsibilities of each member.

- It provides a framework for making decisions and resolving conflicts.

Essential Provision 1: Ownership and Capital Contributions

The first essential provision in your Minnesota LLC Operating Agreement should outline the ownership structure of your LLC, including the names and addresses of each member, their ownership percentage, and their capital contributions.

- Member Information: List the names and addresses of each member, including their ownership percentage.

- Capital Contributions: Outline the initial capital contributions of each member, including the amount and type of contribution (e.g., cash, property, or services).

Essential Provision 2: Management and Decision-Making

The second essential provision should outline the management structure of your LLC, including the roles and responsibilities of each member, the decision-making process, and the voting rights of each member.

- Management Structure: Outline the management structure of your LLC, including the roles and responsibilities of each member.

- Decision-Making Process: Outline the decision-making process, including the voting rights of each member and the required majority for making decisions.

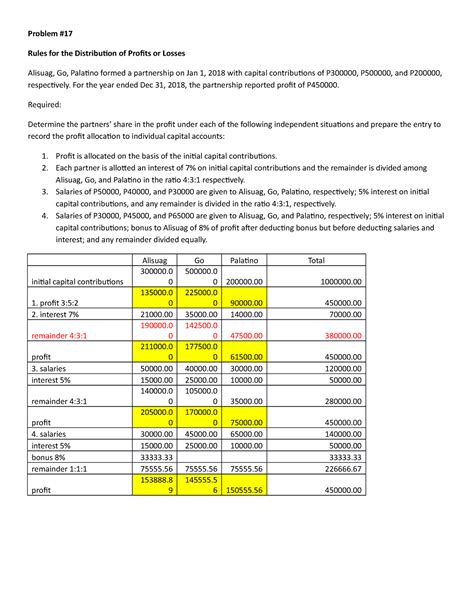

Essential Provision 3: Distribution of Profits and Losses

The third essential provision should outline the distribution of profits and losses among members, including the allocation of profits and losses, the distribution of cash, and the accounting methods used.

- Allocation of Profits and Losses: Outline the allocation of profits and losses among members, including the percentage of allocation.

- Distribution of Cash: Outline the distribution of cash, including the timing and method of distribution.

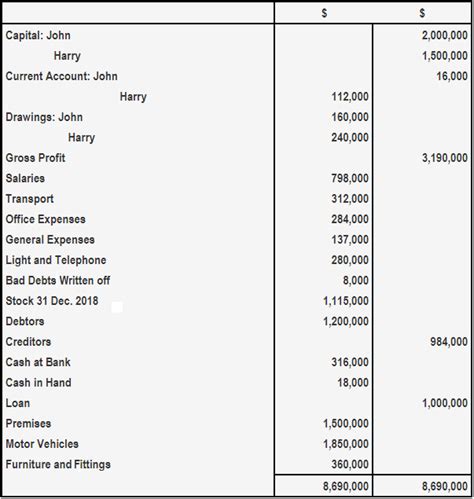

Essential Provision 4: Accounting and Record-Keeping

The fourth essential provision should outline the accounting and record-keeping requirements of your LLC, including the accounting method, the financial statements, and the record-keeping requirements.

- Accounting Method: Outline the accounting method used by your LLC, including the basis of accounting (e.g., cash or accrual).

- Financial Statements: Outline the financial statements required, including the balance sheet, income statement, and cash flow statement.

Essential Provision 5: Dispute Resolution and Termination

The fifth essential provision should outline the dispute resolution process and the termination procedures of your LLC, including the mediation process, the arbitration process, and the termination procedures.

- Dispute Resolution: Outline the dispute resolution process, including the mediation process and the arbitration process.

- Termination Procedures: Outline the termination procedures, including the notice requirements and the distribution of assets.

Gallery of Minnesota LLC Operating Agreement Essentials

Minnesota LLC Operating Agreement Essentials Gallery

By including these 5 essential provisions in your Minnesota LLC Operating Agreement, you can ensure the smooth operation of your LLC and prevent disputes among members. Remember to review and update your Operating Agreement regularly to reflect changes in your LLC's ownership, management, and operation.