Intro

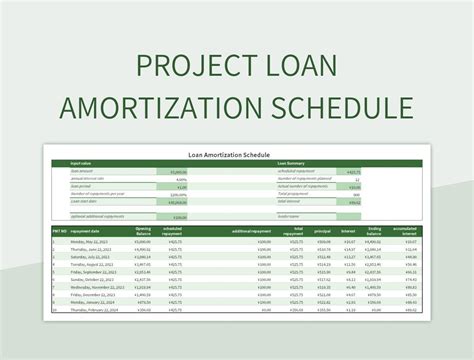

Are you tired of struggling to understand your loan repayments and how much you're actually paying in interest? Do you wish there was a simple way to visualize your loan amortization schedule and make informed decisions about your finances? Look no further! In this article, we'll show you 5 easy ways to use a loan amortization template in Google Sheets to take control of your loan repayments and save money.

Why Use a Loan Amortization Template in Google Sheets?

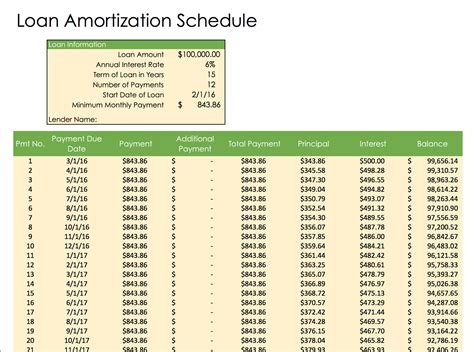

Using a loan amortization template in Google Sheets can help you understand how much of your monthly payment is going towards interest and principal, and how much you'll pay over the life of the loan. This can be especially useful for mortgages, car loans, and personal loans. With a template, you can easily see the impact of different interest rates, loan terms, and payment amounts on your loan repayments.

Benefits of Using a Loan Amortization Template in Google Sheets

- Easily visualize your loan amortization schedule

- Understand how much you're paying in interest and principal each month

- See the impact of different interest rates, loan terms, and payment amounts on your loan repayments

- Make informed decisions about your finances and loan repayments

- Save time and money by optimizing your loan repayments

5 Easy Ways to Use a Loan Amortization Template in Google Sheets

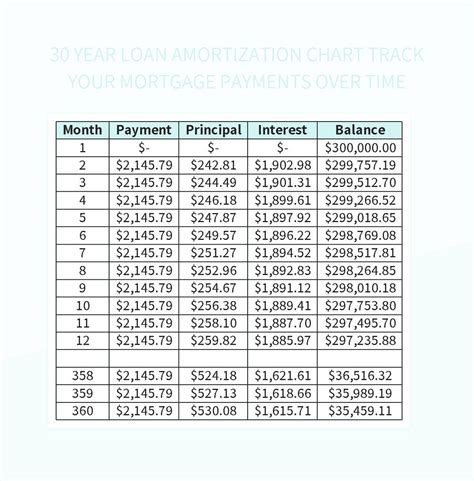

1. Create a Basic Loan Amortization Schedule

To get started, you'll need to create a basic loan amortization schedule. You can do this by setting up a table with the following columns:

- Month

- Payment

- Interest

- Principal

- Balance

You can then use formulas to calculate the interest and principal paid each month, and the outstanding balance.

2. Use Formulas to Calculate Interest and Principal

To calculate the interest and principal paid each month, you can use the following formulas:

- Interest: =IPMT(rate, period, present value, future value, type)

- Principal: =PPMT(rate, period, present value, future value, type)

Where:

- rate is the monthly interest rate

- period is the number of payments

- present value is the initial loan amount

- future value is the outstanding balance

- type is the payment type (0 for end-of-period, 1 for beginning-of-period)

3. Visualize Your Loan Amortization Schedule

Once you have your loan amortization schedule set up, you can use charts and graphs to visualize your loan repayments. This can help you see the impact of different interest rates, loan terms, and payment amounts on your loan repayments.

4. Use What-If Scenarios to Optimize Your Loan Repayments

To optimize your loan repayments, you can use what-if scenarios to see the impact of different interest rates, loan terms, and payment amounts on your loan repayments. For example, you could see how much you could save by increasing your monthly payment amount or reducing the loan term.

5. Share Your Loan Amortization Schedule with Others

Finally, you can share your loan amortization schedule with others, such as a financial advisor or partner. This can help you get a second opinion on your loan repayments and make informed decisions about your finances.

Common Mistakes to Avoid When Using a Loan Amortization Template in Google Sheets

- Not updating the interest rate or loan term

- Not accounting for fees or charges

- Not considering the impact of inflation

- Not reviewing and updating the loan amortization schedule regularly

Conclusion

Using a loan amortization template in Google Sheets can help you take control of your loan repayments and make informed decisions about your finances. By following the 5 easy ways outlined in this article, you can create a basic loan amortization schedule, use formulas to calculate interest and principal, visualize your loan amortization schedule, use what-if scenarios to optimize your loan repayments, and share your loan amortization schedule with others.

We hope this article has been helpful in showing you how to use a loan amortization template in Google Sheets. Do you have any questions or comments about using a loan amortization template? Share them with us in the comments below!

Loan Amortization Template Google Sheets Image Gallery