Intro

Unlock the power of Excel to calculate reducing balance loans with ease. Learn how to create a reducing balance loan calculator in Excel, including formulae and examples. Discover how to accurately determine loan repayments, interest rates, and outstanding balances, making personal finance management a breeze. Get instant results with our simple and effective Excel calculator.

Understanding Reducing Balance Loan Calculators

In the world of finance, calculating loan payments and interest can be a daunting task. One type of loan that requires careful calculation is the reducing balance loan, also known as a diminishing balance loan. This type of loan is common in countries like India, where it's used for personal and business loans. A reducing balance loan calculator is a tool that helps borrowers determine their monthly payments and interest charges. In this article, we'll explore how to create a reducing balance loan calculator in Excel, making it easy for you to manage your finances.

What is a Reducing Balance Loan?

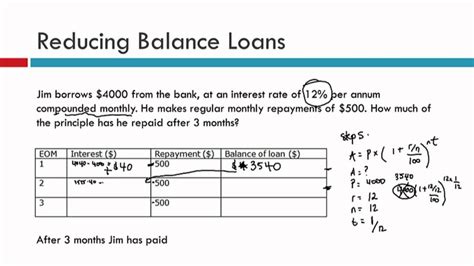

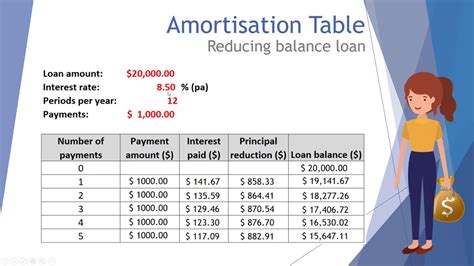

A reducing balance loan is a type of loan where the interest is calculated on the outstanding principal balance, which reduces with each payment. The interest is charged on the outstanding balance, and the borrower pays a fixed amount every month, which includes both interest and principal. This type of loan is different from a flat rate loan, where the interest is calculated on the initial principal amount.

Benefits of a Reducing Balance Loan Calculator

Using a reducing balance loan calculator in Excel offers several benefits:

- Accurate calculations: A calculator ensures that your calculations are accurate, reducing the risk of human error.

- Saves time: With a calculator, you can quickly determine your monthly payments and interest charges, saving you time and effort.

- Helps with financial planning: A calculator helps you plan your finances better by providing you with a clear picture of your loan payments and interest charges.

Creating a Reducing Balance Loan Calculator in Excel

Creating a reducing balance loan calculator in Excel is a straightforward process. Here's a step-by-step guide:

Step 1: Determine the Loan Variables

To create a calculator, you need to determine the loan variables, including:

- Loan amount: The initial amount borrowed.

- Interest rate: The annual interest rate charged on the loan.

- Loan tenure: The number of years the loan is taken for.

- Monthly payment: The fixed amount paid every month.

Step 2: Create a Formula for the Monthly Payment

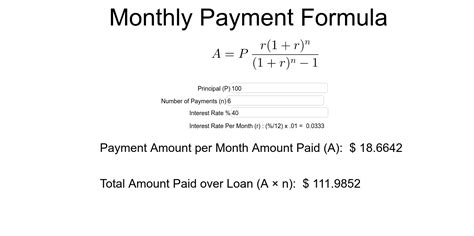

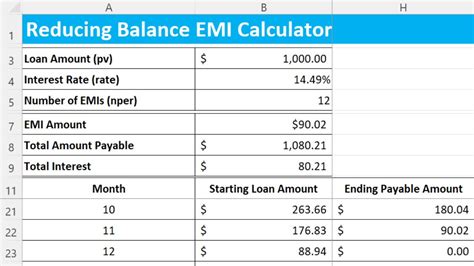

The monthly payment formula is:

M = P [ i (1 + i)^n ] / [ (1 + i)^n - 1 ]

Where:

- M = monthly payment

- P = loan amount

- i = monthly interest rate (annual interest rate / 12)

- n = number of payments (loan tenure * 12)

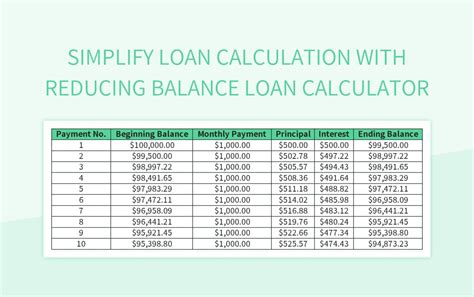

Step 3: Create a Formula for the Outstanding Balance

The outstanding balance formula is:

B = P - (M * n)

Where:

- B = outstanding balance

- P = loan amount

- M = monthly payment

- n = number of payments

Step 4: Create a Formula for the Interest Charged

The interest charged formula is:

I = B * i

Where:

- I = interest charged

- B = outstanding balance

- i = monthly interest rate

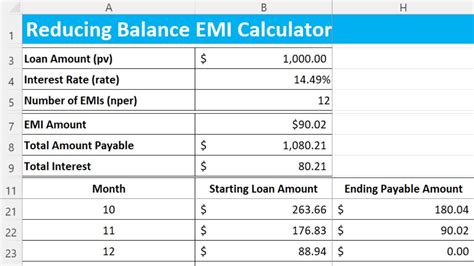

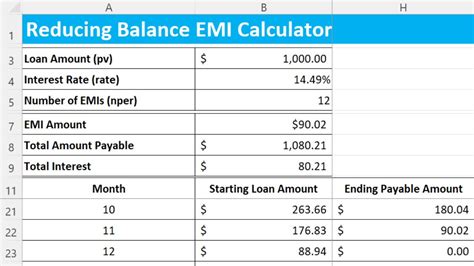

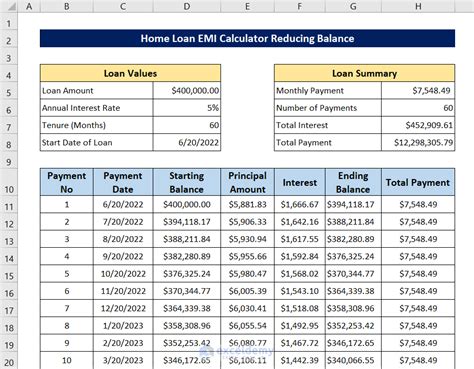

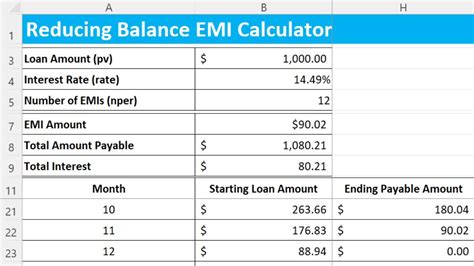

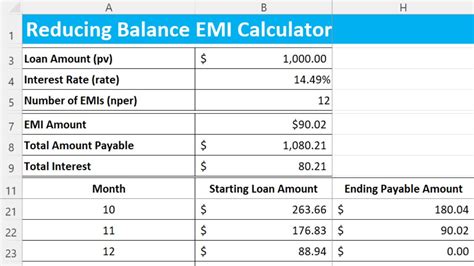

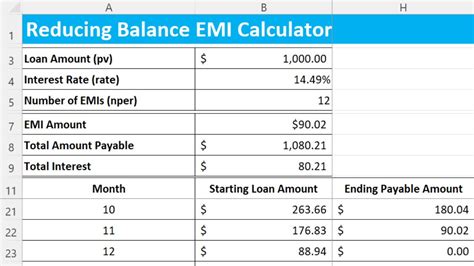

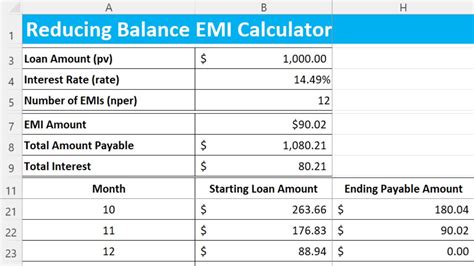

Step 5: Create a Calculator in Excel

Using the formulas above, you can create a reducing balance loan calculator in Excel. Create a table with the following columns:

- Loan Amount

- Interest Rate

- Loan Tenure

- Monthly Payment

- Outstanding Balance

- Interest Charged

Enter the loan variables in the respective columns, and use the formulas to calculate the monthly payment, outstanding balance, and interest charged.

Tips and Variations

Here are some tips and variations to consider when creating a reducing balance loan calculator in Excel:

- Use a template: Use a pre-built template to create a calculator, saving you time and effort.

- Add more features: Add features like amortization schedules, interest rate changes, and prepayment options to make your calculator more comprehensive.

- Use named ranges: Use named ranges to make your formulas more readable and easier to maintain.

- Use conditional formatting: Use conditional formatting to highlight important information, such as the outstanding balance and interest charged.

Gallery of Reducing Balance Loan Calculator Images

Reducing Balance Loan Calculator Images

Conclusion

Creating a reducing balance loan calculator in Excel is a straightforward process that can help you manage your finances better. By using a calculator, you can accurately determine your monthly payments and interest charges, saving you time and effort. Remember to use a template, add more features, and use named ranges to make your calculator more comprehensive.