Intro

Separation and food stamps - whats fact, whats fiction? Discover the truth behind common myths and misconceptions about eligibility, application processes, and benefits. Get the inside scoop on divorce, separation, and food stamp policies, and learn how to navigate the system with confidence.

Separation and food stamps - two topics that often spark intense debate and misinformation. As we navigate the complexities of relationships and social welfare, it's essential to separate fact from fiction. In this article, we'll delve into the world of separation and food stamps, exposing five common lies that have been perpetuated.

Understanding Separation and Food Stamps

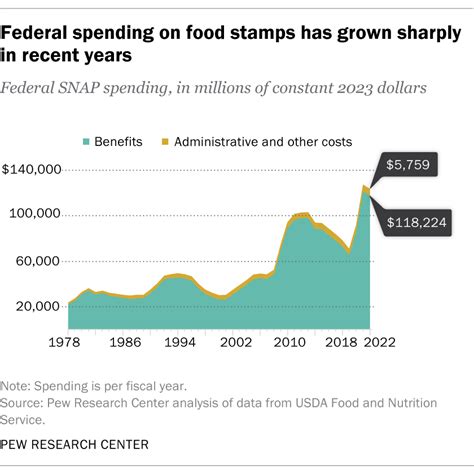

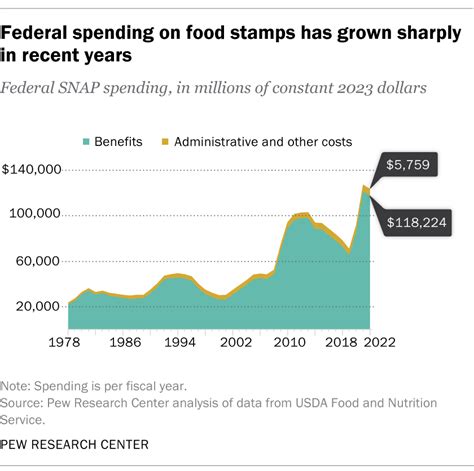

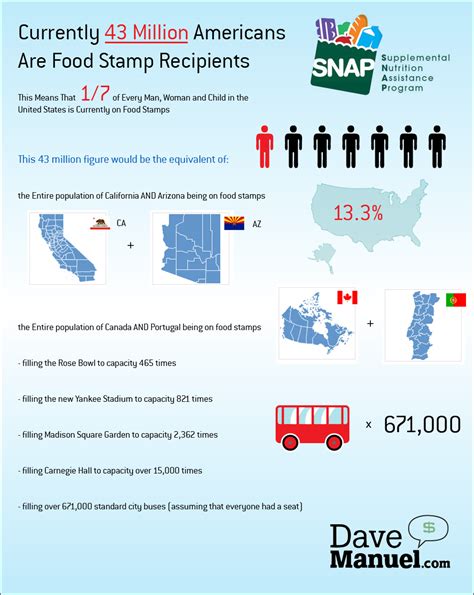

Separation, whether it's a trial separation or a permanent one, can be a challenging and emotional experience for all parties involved. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are designed to provide financial assistance to low-income individuals and families to purchase food. However, the intersection of separation and food stamps is often shrouded in misconceptions.

Lie #1: Separated Couples Are Always Eligible for Food Stamps

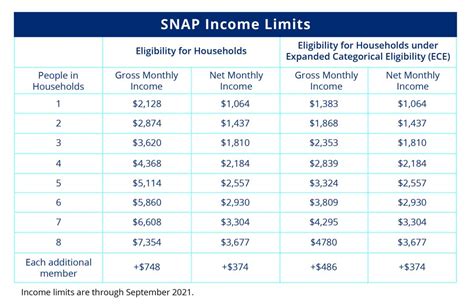

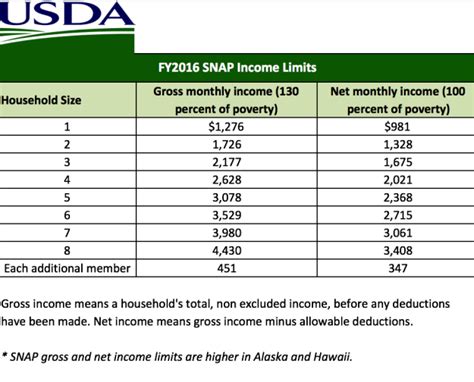

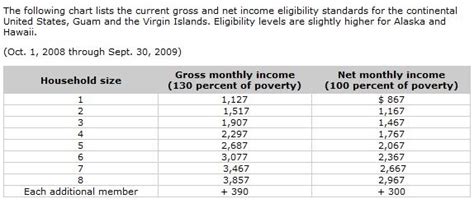

This myth assumes that all separated couples are automatically eligible for food stamps. However, eligibility for SNAP benefits is determined by the individual's or family's income, expenses, and resources. Even if a couple is separated, they may not necessarily qualify for food stamps. The eligibility criteria vary by state, and the specific circumstances of the separation can impact eligibility.

Eligibility Factors

- Income: Gross income must be at or below 130% of the federal poverty level.

- Expenses: Eligible expenses, such as rent/mortgage, utilities, and child support, are considered.

- Resources: Assets, such as cash, savings, and property, are evaluated.

Lie #2: Separated Individuals Can't Receive Food Stamps If They're Living Together

This myth claims that separated individuals living together are ineligible for food stamps. While it's true that living together can impact eligibility, it's not a hard and fast rule. If the separated individuals can demonstrate that they're living together for reasons other than financial convenience, they may still be eligible for food stamps.

Exceptions

- Shared housing due to financial necessity

- Shared care of a child or disabled family member

- Other extenuating circumstances

Lie #3: Food Stamps Can Only Be Used for Groceries

This myth assumes that food stamps can only be used for groceries. While it's true that the primary purpose of SNAP is to provide financial assistance for food purchases, there are some exceptions. In some states, food stamps can be used for other essential items, such as seeds and plants for home gardens, or even restaurant meals for the elderly or disabled.

Exceptions

- Seeds and plants for home gardens

- Restaurant meals for the elderly or disabled

- Other state-specific exceptions

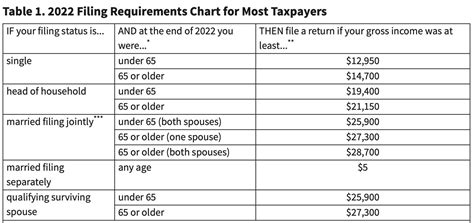

Lie #4: Separated Individuals Must File Taxes Jointly to Receive Food Stamps

This myth claims that separated individuals must file taxes jointly to receive food stamps. However, this is not necessarily true. While tax filing status can impact eligibility, separated individuals can file taxes separately and still receive food stamps.

Tax Filing Options

- Married filing jointly

- Married filing separately

- Head of household

Lie #5: Separated Individuals Can't Appeal a Food Stamps Denial

This myth assumes that separated individuals can't appeal a food stamps denial. However, this is not true. If a separated individual is denied food stamps, they have the right to appeal the decision.

Apeal Process

- Request a fair hearing

- Provide additional documentation or evidence

- Receive a decision from the appeals committee

Separation and Food Stamps Image Gallery

We hope this article has shed light on the common misconceptions surrounding separation and food stamps. If you're going through a separation and are unsure about your eligibility for food stamps, it's essential to consult with a qualified professional or your local social services department.