Intro

Unlock the secrets of Marine PLC acceptance rates! Discover the top 5 things to know, from application requirements to candidate selection criteria. Learn how to boost your chances of getting accepted into the Marine PLC program, a prestigious gateway to a fulfilling career in the Royal Navy. Get insider knowledge on PLC acceptance rates, entrance exams, and more.

The Marine Plc Acceptance Rates, a crucial aspect of the maritime industry, play a significant role in determining the efficiency and profitability of shipping operations. With the increasing demand for maritime transportation, understanding the acceptance rates of marine placings is vital for shipowners, charterers, and other industry stakeholders. In this article, we will delve into the top 5 things to know about Marine Plc Acceptance Rates.

What are Marine Plc Acceptance Rates?

Marine Plc Acceptance Rates refer to the percentage of marine insurance policies accepted by insurance companies or underwriters for a particular vessel or fleet. These rates are calculated based on various factors, including the vessel's age, type, condition, and operational history, as well as the owner's reputation and creditworthiness. Acceptance rates can significantly impact the overall cost of marine insurance premiums, making it essential for shipowners and charterers to understand the factors influencing these rates.

Factors Affecting Marine Plc Acceptance Rates

Several factors contribute to the determination of Marine Plc Acceptance Rates. Some of the key factors include:

- Vessel type and age: Older vessels or those with a history of accidents or damage may have lower acceptance rates.

- Vessel condition: Vessels with poor maintenance records or those that have been involved in accidents may be considered higher risks.

- Operational history: Vessels with a history of safe operations and minimal claims may have higher acceptance rates.

- Owner's reputation and creditworthiness: Shipowners with a good reputation and strong credit history may be considered lower risks.

- Market conditions: Fluctuations in the maritime market, such as changes in demand or supply, can impact acceptance rates.

How are Marine Plc Acceptance Rates Calculated?

The calculation of Marine Plc Acceptance Rates involves a complex analysis of various factors, including those mentioned earlier. Insurance companies and underwriters use specialized software and algorithms to assess the risk profile of a vessel or fleet and determine the acceptance rate. The calculation typically involves the following steps:

- Data collection: Gathering information about the vessel, including its age, type, condition, and operational history.

- Risk assessment: Analyzing the collected data to determine the vessel's risk profile.

- Rating: Assigning a rating to the vessel based on its risk profile.

- Acceptance rate calculation: Calculating the acceptance rate based on the rating and other factors.

Top 5 Things to Know About Marine Plc Acceptance Rates

Here are the top 5 things to know about Marine Plc Acceptance Rates:

- Acceptance rates can significantly impact insurance premiums: A higher acceptance rate can result in lower insurance premiums, while a lower acceptance rate can lead to higher premiums.

- Vessel condition and maintenance are crucial: Regular maintenance and good vessel condition can improve acceptance rates and reduce insurance premiums.

- Owner's reputation and creditworthiness matter: Shipowners with a good reputation and strong credit history can negotiate better acceptance rates and lower insurance premiums.

- Market conditions can fluctuate: Changes in the maritime market can impact acceptance rates, making it essential for shipowners and charterers to stay informed.

- Acceptance rates can vary between insurance companies: Different insurance companies may offer varying acceptance rates for the same vessel, making it essential to shop around and compare rates.

Benefits of Understanding Marine Plc Acceptance Rates

Understanding Marine Plc Acceptance Rates can have several benefits for shipowners, charterers, and other industry stakeholders. Some of the key benefits include:

- Improved insurance premiums: By understanding the factors that influence acceptance rates, shipowners and charterers can negotiate better insurance premiums.

- Increased efficiency: Understanding acceptance rates can help optimize vessel operations and reduce costs.

- Better risk management: By identifying potential risks and taking proactive measures, shipowners and charterers can reduce the likelihood of accidents and claims.

Best Practices for Improving Marine Plc Acceptance Rates

To improve Marine Plc Acceptance Rates, shipowners and charterers can follow these best practices:

- Regular vessel maintenance: Regular maintenance can improve vessel condition and reduce the risk of accidents and claims.

- Good operational practices: Implementing good operational practices, such as safe navigation and cargo handling, can reduce the risk of accidents and claims.

- Strong reputation and credit history: Maintaining a good reputation and strong credit history can improve acceptance rates and reduce insurance premiums.

- Shopping around: Comparing insurance rates and acceptance rates from different insurance companies can help negotiate better terms.

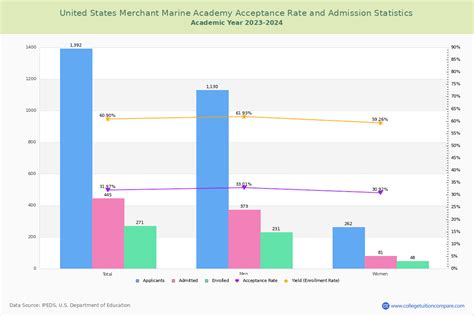

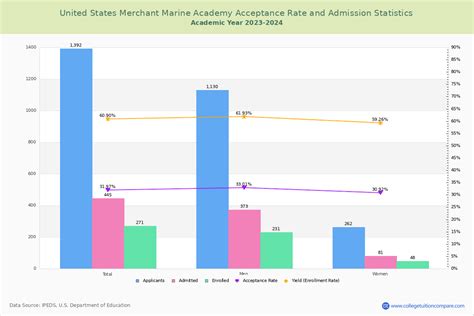

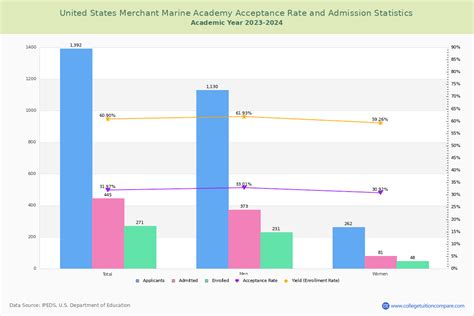

Marine Plc Acceptance Rates Image Gallery

By understanding the factors that influence Marine Plc Acceptance Rates and following best practices, shipowners and charterers can improve their acceptance rates, reduce insurance premiums, and optimize vessel operations. We hope this article has provided valuable insights into the world of Marine Plc Acceptance Rates. Share your thoughts and experiences in the comments section below.