Intro

Understanding your merchant services statement can be a daunting task, especially for business owners who are not familiar with the intricacies of payment processing. However, deciphering the various fees, charges, and terminology is essential to ensure you're getting the best deal for your business. In this article, we will break down the five key components of a typical merchant services statement, providing you with the knowledge to make informed decisions about your payment processing needs.

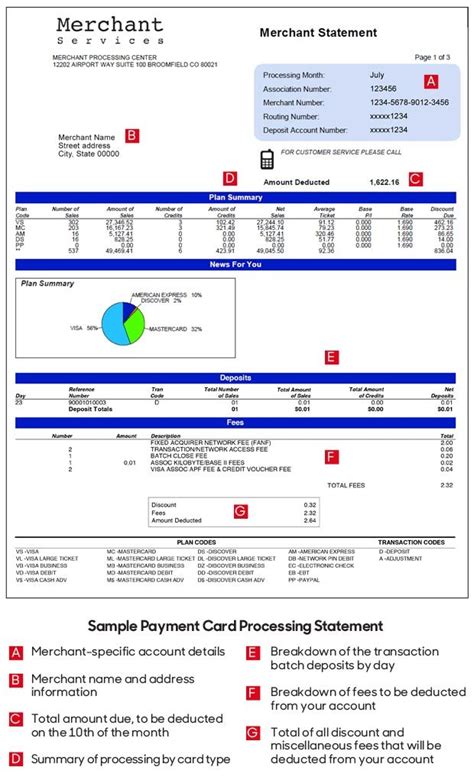

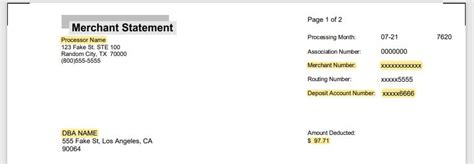

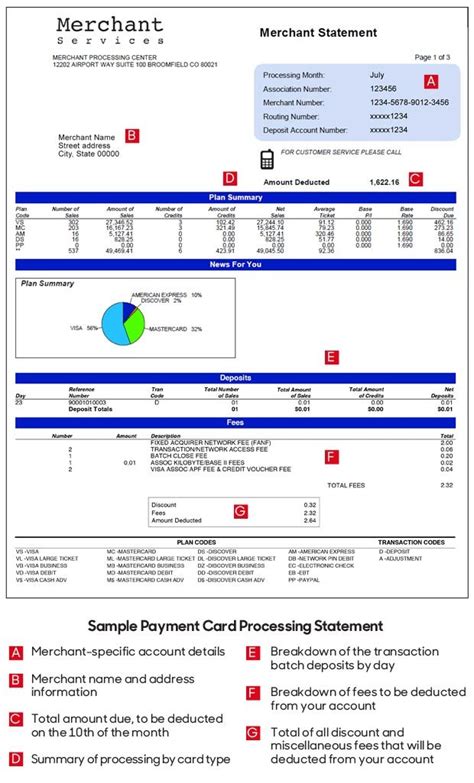

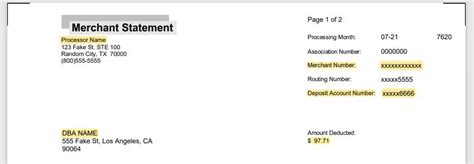

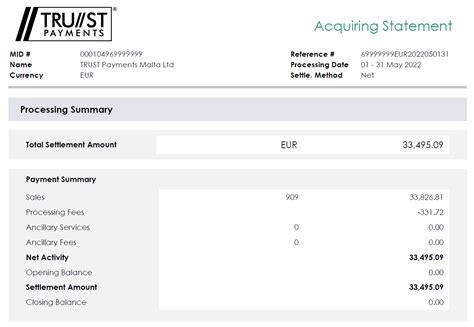

What is a Merchant Services Statement?

A merchant services statement is a detailed report provided by your payment processor, outlining the transactions, fees, and charges associated with your business's payment processing activities. This statement typically includes information on the types of transactions processed, the amount of fees charged, and any adjustments or refunds made to your account.

1. Transaction Fees: Understanding the Different Types

Transaction fees are the charges levied by your payment processor for each transaction processed. These fees can vary depending on the type of transaction, the payment method used, and the specific terms of your merchant services agreement. The most common types of transaction fees include:

- Interchange fees: These fees are paid to the card-issuing bank for each transaction processed. Interchange fees vary depending on the type of card used, the merchant category code, and the transaction amount.

- Assessment fees: These fees are paid to the card network (e.g., Visa, Mastercard) for each transaction processed. Assessment fees are typically a flat rate per transaction.

- Discount rates: These fees are paid to the payment processor for each transaction processed. Discount rates vary depending on the type of transaction, the payment method used, and the specific terms of your merchant services agreement.

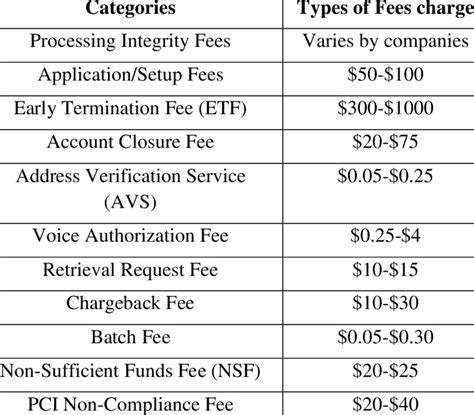

2. Monthly Fees: What You Need to Know

Monthly fees are recurring charges levied by your payment processor for the provision of merchant services. These fees can include:

- Monthly minimum fees: These fees are charged by the payment processor to ensure a minimum amount of revenue is generated from your account each month.

- Statement fees: These fees are charged by the payment processor for providing a detailed statement of your transactions and fees.

- Customer service fees: These fees are charged by the payment processor for providing customer support and assistance.

Monthly Fee Examples

- Monthly minimum fee: $25

- Statement fee: $10

- Customer service fee: $5

3. Incidentals: Understanding Additional Fees and Charges

Incidental fees are one-time charges levied by your payment processor for specific services or activities. These fees can include:

- Setup fees: These fees are charged by the payment processor for setting up your merchant services account.

- Cancellation fees: These fees are charged by the payment processor for cancelling your merchant services account.

- Chargeback fees: These fees are charged by the payment processor for processing chargebacks and disputes.

4. Reserves: Understanding How They Work

Reserves are funds held by the payment processor to cover potential losses or disputes. These funds are typically withheld from your transactions and can be released back to your account after a specified period. There are two types of reserves:

- Rolling reserves: These reserves are funds held by the payment processor for a specified period, typically 180 days.

- Fixed reserves: These reserves are funds held by the payment processor for a fixed period, typically 12 months.

Reserve Examples

- Rolling reserve: 10% of monthly transactions held for 180 days

- Fixed reserve: $1,000 held for 12 months

5. Adjustments and Refunds: What You Need to Know

Adjustments and refunds are corrections made to your merchant services statement to reflect changes in transaction amounts or fees. These adjustments can include:

- Transaction adjustments: These adjustments are made to correct errors in transaction amounts or fees.

- Fee adjustments: These adjustments are made to correct errors in fees charged or credited to your account.

- Refunds: These refunds are issued to your account for overpaid fees or incorrect charges.

By understanding these five key components of a typical merchant services statement, you can gain valuable insights into your payment processing activities and make informed decisions about your merchant services agreement.

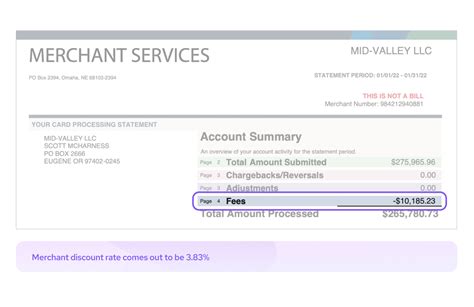

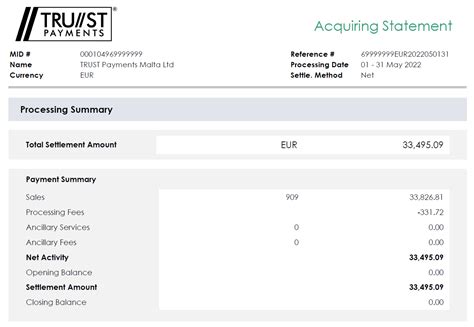

Gallery of Merchant Services Statement Examples

Merchant Services Statement Examples

Now that you've read this article, we encourage you to share your thoughts and experiences with merchant services statements in the comments below. Have you ever had difficulty understanding your statement? What steps did you take to resolve the issue? Your feedback is valuable to us, and we look forward to hearing from you!