Calculate take-home pay with Michigans paycheck calculator tool, considering state taxes, deductions, and exemptions for accurate salary estimates and financial planning.

The state of Michigan is renowned for its stunning natural beauty, vibrant cities, and a thriving economy that encompasses various industries such as manufacturing, tourism, and agriculture. For individuals living and working in Michigan, understanding their paycheck and how taxes affect their income is crucial for financial planning and stability. This is where a Michigan paycheck calculator tool comes into play, offering a valuable resource for both employees and employers to navigate the complexities of payroll and taxation.

Calculating one's paycheck can be a daunting task, especially considering the various factors that influence net pay, such as federal and state income taxes, deductions, and benefits. A paycheck calculator specifically designed for Michigan takes into account the state's unique tax laws and regulations, providing users with an accurate estimate of their take-home pay. This tool is not only beneficial for individuals who want to understand their financial situation better but also for employers seeking to ensure compliance with tax laws and to attract and retain employees by offering competitive compensation packages.

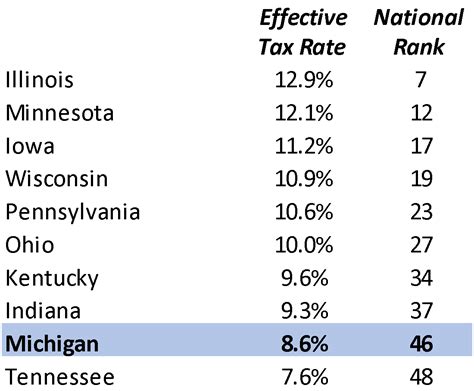

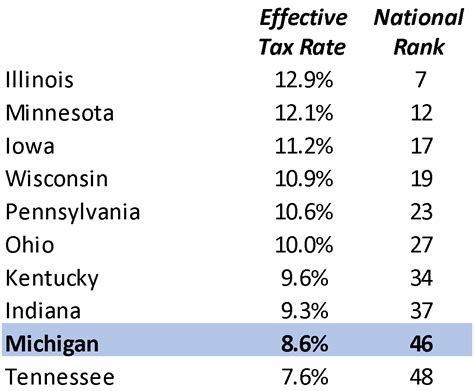

The importance of using a paycheck calculator cannot be overstated, especially in a state like Michigan, which has its own set of tax rules. For instance, Michigan has a flat state income tax rate, which simplifies certain aspects of tax calculation but still requires careful consideration of other factors such as local taxes, deductions, and exemptions. By utilizing a Michigan paycheck calculator tool, individuals can make informed decisions about their finances, plan for the future, and even explore how changes in their employment status or income level might affect their taxes and overall financial health.

Understanding Michigan Taxes

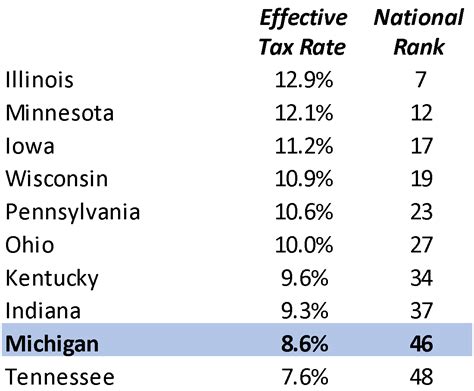

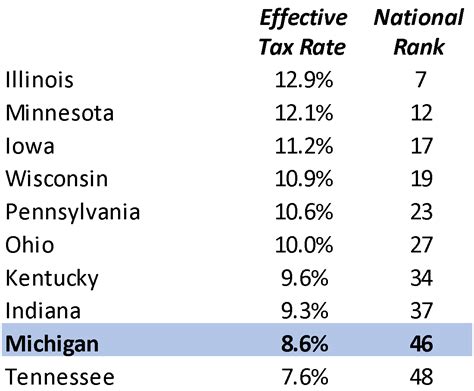

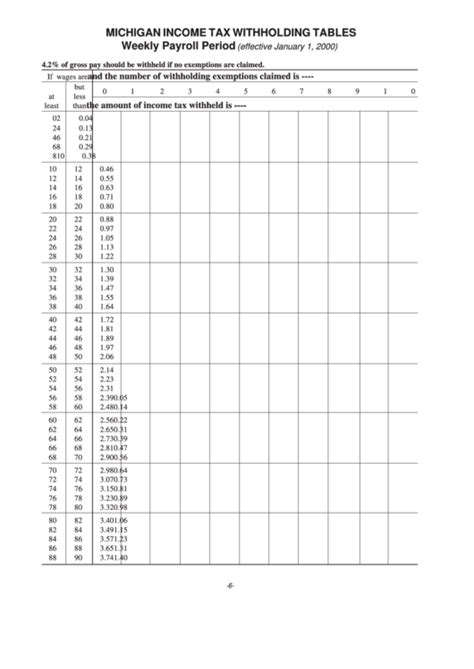

To effectively use a Michigan paycheck calculator, it's essential to have a basic understanding of how taxes work in the state. Michigan imposes a flat state income tax rate of 4.25% on most types of income. This means that regardless of one's income level, the same tax rate applies. However, it's worth noting that some types of income, such as certain retirement benefits, may be exempt from state income tax. Additionally, Michigan allows for some deductions and exemptions that can reduce one's taxable income, such as the personal exemption and deductions for charitable contributions.

Key Components of a Paycheck Calculator

A comprehensive paycheck calculator for Michigan should include several key components to ensure accuracy and usability. These include: - **Gross Income**: The total amount of money earned before any deductions or taxes are taken out. - **Federal Income Taxes**: Calculated based on the federal income tax brackets and the user's filing status. - **State Income Taxes**: For Michigan, this would be a flat rate of 4.25%, but the calculator should also account for any local taxes if applicable. - **Deductions**: Such as 401(k) contributions, health insurance premiums, and other pre-tax deductions. - **Benefits**: Like health insurance, life insurance, and other benefits that may affect net pay. - **Exemptions and Credits**: Including personal exemptions, dependent exemptions, and any tax credits the user may be eligible for.Benefits of Using a Paycheck Calculator

The benefits of utilizing a paycheck calculator extend beyond just understanding one's take-home pay. Some of the advantages include:

- Financial Planning: By knowing exactly how much money will be available each month, individuals can create more accurate budgets and make smarter financial decisions.

- Tax Planning: A paycheck calculator can help identify opportunities to reduce tax liability through strategic use of deductions and credits.

- Career Decisions: When considering a job offer or promotion, a paycheck calculator can help compare the financial implications of different scenarios, including how changes in income, benefits, and location might affect taxes and net pay.

How to Use a Paycheck Calculator Effectively

To get the most out of a Michigan paycheck calculator tool, follow these steps: 1. **Gather Necessary Information**: This includes your gross income, filing status, number of dependents, and any deductions or benefits you receive. 2. **Input Your Data**: Enter the gathered information into the calculator, ensuring to select Michigan as your state of residence. 3. **Review and Adjust**: Look over the calculated results to understand your estimated net pay and how different factors affect it. Adjust the inputs to see how changes might impact your financial situation. 4. **Consult a Professional**: For complex tax situations or for advice tailored to your specific circumstances, consider consulting a tax professional or financial advisor.FAQs About Michigan Paycheck Calculators

- Q: Are Michigan paycheck calculators accurate? A: While paycheck calculators are designed to provide accurate estimates, actual taxes and net pay may vary due to individual circumstances and changes in tax laws.

- Q: Can I use a paycheck calculator for tax planning? A: Yes, a paycheck calculator can be a useful tool for identifying potential tax savings strategies and understanding how different scenarios might affect your tax liability.

- Q: Are there any free paycheck calculators available for Michigan? A: Yes, several websites offer free paycheck calculators that can be used for Michigan. However, the accuracy and comprehensiveness of these tools can vary.

Gallery of Michigan Paycheck Calculator Images

Michigan Paycheck Calculator Tool Images

In conclusion, a Michigan paycheck calculator tool is an indispensable resource for anyone looking to navigate the complexities of payroll and taxation in the state. By understanding how to use these tools effectively and staying informed about Michigan's tax laws and regulations, individuals can make more informed financial decisions, plan for the future, and ensure compliance with all tax requirements. Whether you're an employee, employer, or simply someone interested in personal finance, exploring the capabilities of a Michigan paycheck calculator can provide valuable insights into your financial situation and help you achieve your long-term financial goals. We invite you to share your experiences with paycheck calculators, ask questions, or provide feedback on how these tools have helped you in your financial journey.