Intro

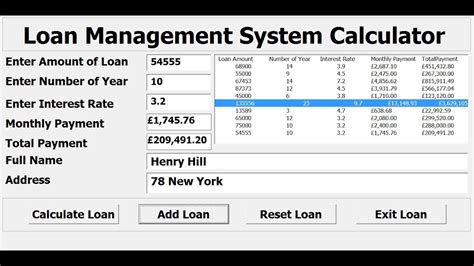

Effortlessly manage your loans with our Microsoft Access database template. Streamline loan tracking, repayment schedules, and interest calculations. Easily monitor borrower information, loan status, and payment history. Simplify loan administration and reduce errors with this customizable and scalable database solution, ideal for lenders and financial institutions.

Managing loans can be a daunting task, especially when dealing with multiple borrowers, interest rates, and payment schedules. However, with the right tools, you can streamline the process and keep track of all the details. One such tool is a Microsoft Access database template, specifically designed to help you manage loans efficiently.

In this article, we will explore the benefits of using a Microsoft Access database template to manage loans and provide a step-by-step guide on how to create and use it.

Benefits of Using a Microsoft Access Database Template

Using a Microsoft Access database template to manage loans offers several benefits, including:

- Streamlined Data Management: A database template allows you to store and manage all loan-related data in one place, making it easy to access and update information.

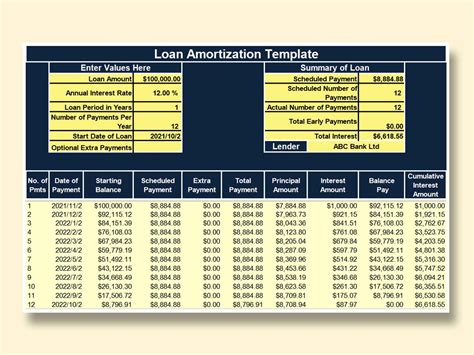

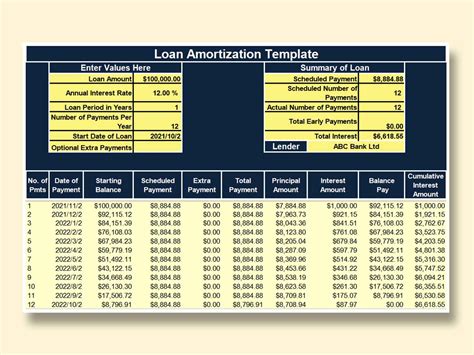

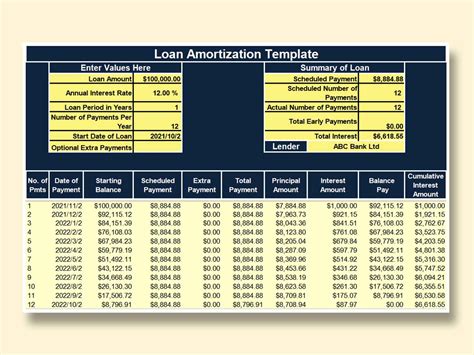

- Automated Calculations: With a database template, you can automate calculations such as interest rates, payment schedules, and loan balances, reducing the risk of human error.

- Customizable: Microsoft Access database templates can be customized to meet your specific needs, allowing you to add or remove fields, tables, and forms as required.

- Improved Reporting: A database template enables you to generate reports on loan performance, borrower information, and payment history, helping you make informed decisions.

Creating a Microsoft Access Database Template

Creating a Microsoft Access database template is a straightforward process. Here's a step-by-step guide to get you started:

- Open Microsoft Access: Launch Microsoft Access and click on the "Blank Database" button to create a new database.

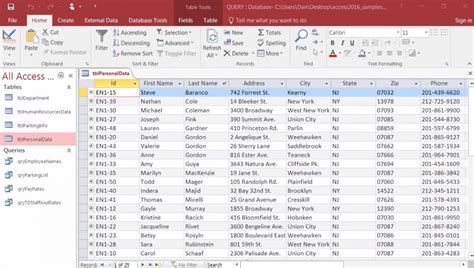

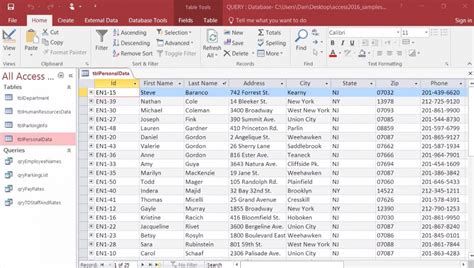

- Create Tables: Create tables to store loan-related data, such as borrower information, loan details, and payment history.

- Design Forms: Design forms to input and view data, such as loan applications, payment schedules, and loan balances.

- Create Queries: Create queries to automate calculations and generate reports, such as loan performance and payment history.

- Add Relationships: Add relationships between tables to link data and enable efficient data management.

Using the Microsoft Access Database Template

Once you've created the database template, you can start using it to manage loans. Here's a step-by-step guide:

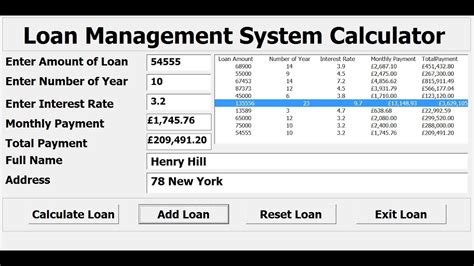

- Input Borrower Information: Input borrower information, such as name, address, and contact details, into the borrower table.

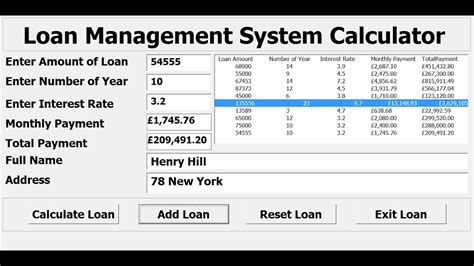

- Enter Loan Details: Enter loan details, such as loan amount, interest rate, and payment schedule, into the loan table.

- Generate Payment Schedule: Use the payment schedule form to generate a payment schedule based on the loan details.

- Track Payments: Track payments made by borrowers and update the payment history table.

- Generate Reports: Use the queries and reports to generate reports on loan performance, borrower information, and payment history.

Gallery of Microsoft Access Database Templates for Loan Management

Loan Management Database Templates

Frequently Asked Questions

Q: What is a Microsoft Access database template? A: A Microsoft Access database template is a pre-designed database that can be used to manage and store data.

Q: How do I create a Microsoft Access database template? A: To create a Microsoft Access database template, open Microsoft Access, click on the "Blank Database" button, and follow the steps outlined in the article.

Q: What are the benefits of using a Microsoft Access database template? A: The benefits of using a Microsoft Access database template include streamlined data management, automated calculations, customizable templates, and improved reporting.

By following the steps outlined in this article, you can create a Microsoft Access database template to manage loans efficiently. Whether you're a lender, borrower, or financial institution, a database template can help you streamline the loan management process and make informed decisions.