Intro

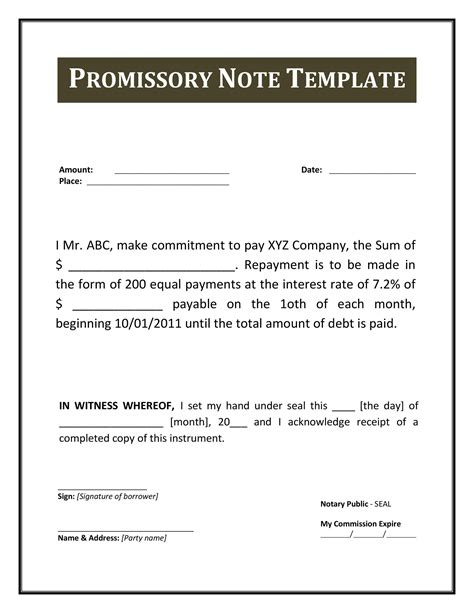

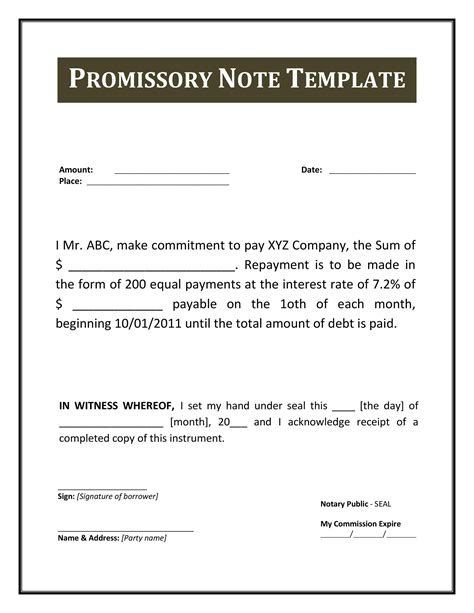

Streamline your business transactions with our 7 essential Microsoft Office promissory note templates. Download customizable and printable templates to create legally binding loan agreements. Easily track payments, interest rates, and due dates. Perfect for lenders and borrowers, these templates ensure a clear understanding of loan terms and conditions, saving you time and hassle.

Understanding the Importance of a Promissory Note Template

In today's business world, agreements and contracts are a crucial part of any transaction. A promissory note is a written agreement that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment terms. Using a promissory note template can help ensure that all necessary details are included and that the agreement is enforceable.

What is a Promissory Note Template?

A promissory note template is a pre-designed document that outlines the terms of a loan. It typically includes information such as:

- The amount borrowed

- The interest rate

- The repayment terms

- The loan duration

- The borrower's and lender's information

Using a promissory note template can save time and ensure that all necessary details are included.

Benefits of Using a Promissory Note Template

There are several benefits to using a promissory note template:

- Saves time: A promissory note template can save time by providing a pre-designed document that outlines the terms of the loan.

- Ensures accuracy: A promissory note template can help ensure that all necessary details are included, reducing the risk of errors or omissions.

- Provides clarity: A promissory note template can provide clarity on the terms of the loan, reducing the risk of misunderstandings or disputes.

- Protects both parties: A promissory note template can provide protection for both the borrower and lender by outlining the terms of the loan and providing a clear understanding of the agreement.

7 Essential Microsoft Office Promissory Note Templates

Here are 7 essential Microsoft Office promissory note templates:

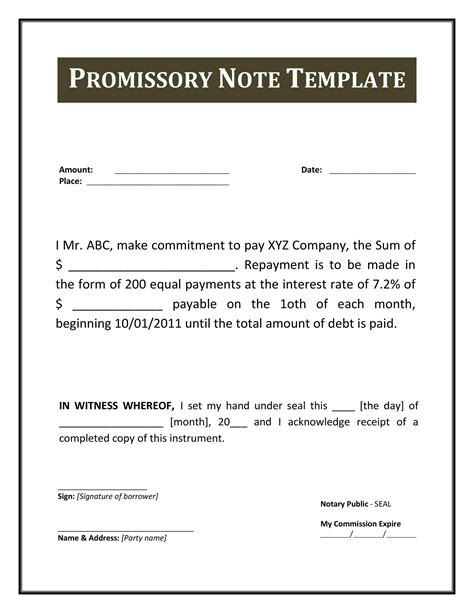

- Basic Promissory Note Template: This template provides a basic outline of the terms of the loan, including the amount borrowed, interest rate, and repayment terms.

- Secured Promissory Note Template: This template is used for secured loans, where the borrower provides collateral to secure the loan.

- Unsecured Promissory Note Template: This template is used for unsecured loans, where the borrower does not provide collateral.

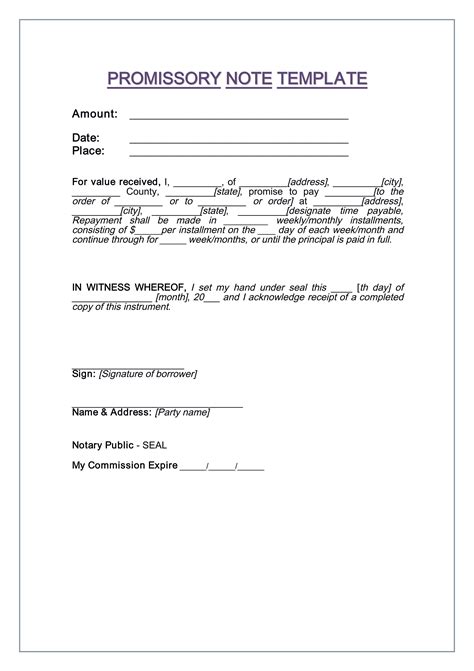

- Installment Promissory Note Template: This template is used for loans that are repaid in installments, such as a car loan or mortgage.

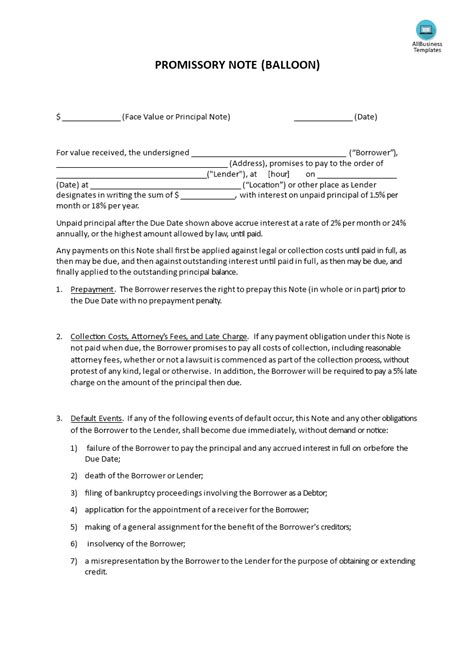

- Balloon Promissory Note Template: This template is used for loans that have a balloon payment, where the borrower makes regular payments and then makes a large payment at the end of the loan term.

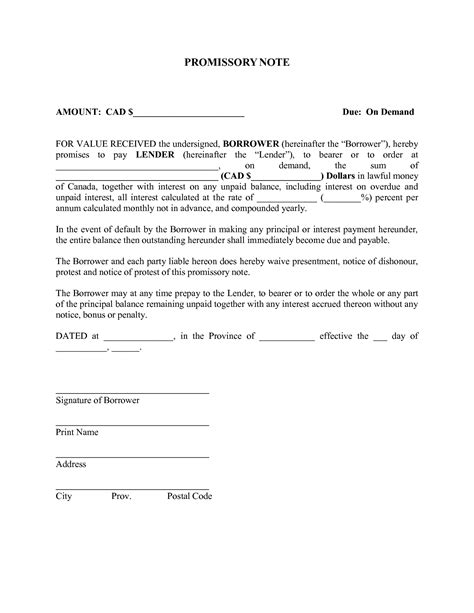

- Demand Promissory Note Template: This template is used for loans that are repayable on demand, where the lender can demand repayment at any time.

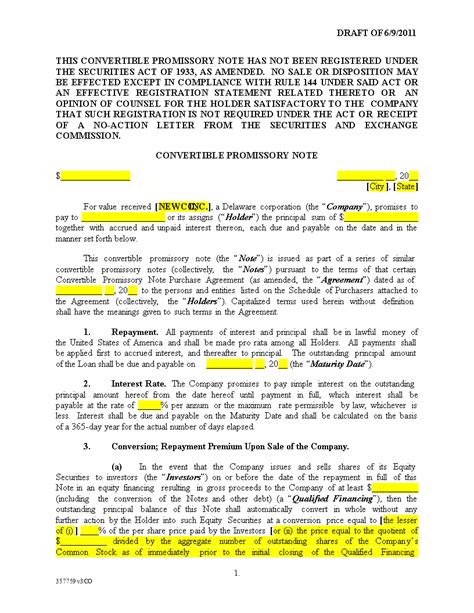

- Convertible Promissory Note Template: This template is used for loans that can be converted into equity, such as a loan to a startup company.

How to Use a Promissory Note Template

To use a promissory note template, follow these steps:

- Choose a template: Choose a promissory note template that meets your needs, such as a basic promissory note template or a secured promissory note template.

- Fill in the blanks: Fill in the blanks with the relevant information, such as the amount borrowed, interest rate, and repayment terms.

- Review and edit: Review and edit the template to ensure that it meets your needs and is accurate.

- Sign and date: Sign and date the template to make it a binding agreement.

Common Mistakes to Avoid When Using a Promissory Note Template

Here are some common mistakes to avoid when using a promissory note template:

- Not filling in all the blanks: Make sure to fill in all the blanks with the relevant information to avoid errors or omissions.

- Not reviewing and editing: Review and edit the template to ensure that it meets your needs and is accurate.

- Not signing and dating: Sign and date the template to make it a binding agreement.

- Not keeping a record: Keep a record of the promissory note, including the date and amount borrowed, to avoid disputes or misunderstandings.

Gallery of Promissory Note Templates

Promissory Note Templates

Conclusion

Using a promissory note template can help ensure that all necessary details are included in a loan agreement and that the agreement is enforceable. By following the steps outlined above and avoiding common mistakes, you can create a valid and binding promissory note. Remember to review and edit the template carefully and to sign and date it to make it a binding agreement.

We hope this article has provided you with useful information on promissory note templates and how to use them. If you have any questions or comments, please feel free to share them below.