Intro

Get the latest 2024 Military Drill Pay Chart Rates and Calculator. Learn about military drill pay scales, allowances, and benefits. Calculate your drill pay based on rank, time in service, and duty status. Understand how drill pay affects your overall military compensation, including Basic Pay, BAH, and BAS. Plan your finances with our comprehensive guide.

The United States Armed Forces have a complex system for compensating its personnel, with various forms of pay and allowances. One of the most critical components of military compensation is drill pay, which is paid to reservists and National Guard members for their drill periods. In this article, we will delve into the 2024 military drill pay chart rates and provide a calculator to help you estimate your earnings.

Understanding Military Drill Pay

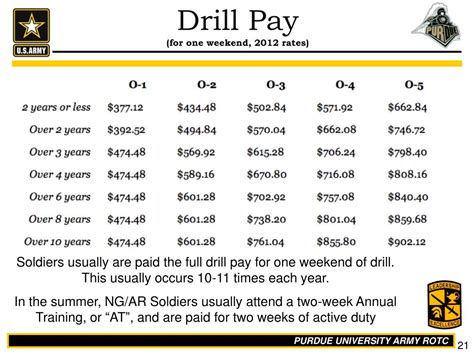

Drill pay is a type of pay that is specific to reservists and National Guard members. It is paid for each drill period, which typically lasts for one weekend per month. The amount of drill pay varies based on factors such as rank, time in service, and the number of drills performed.

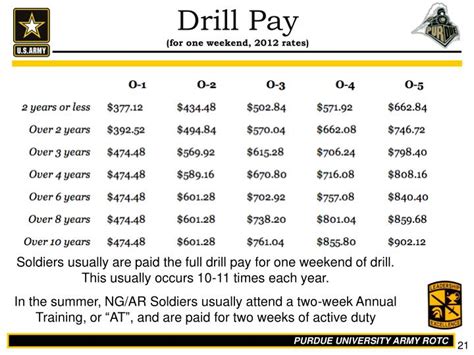

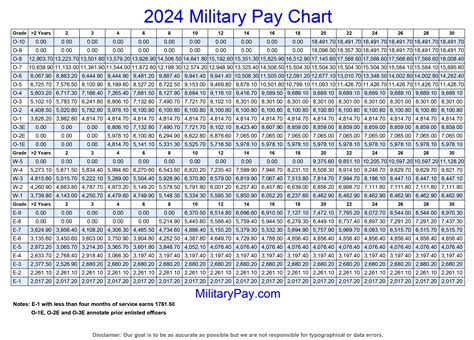

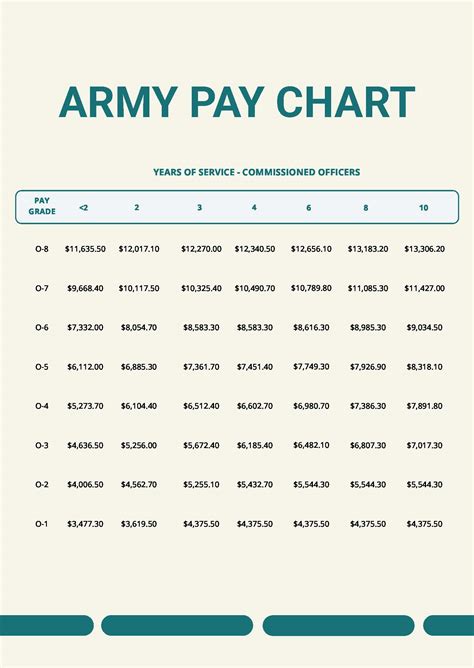

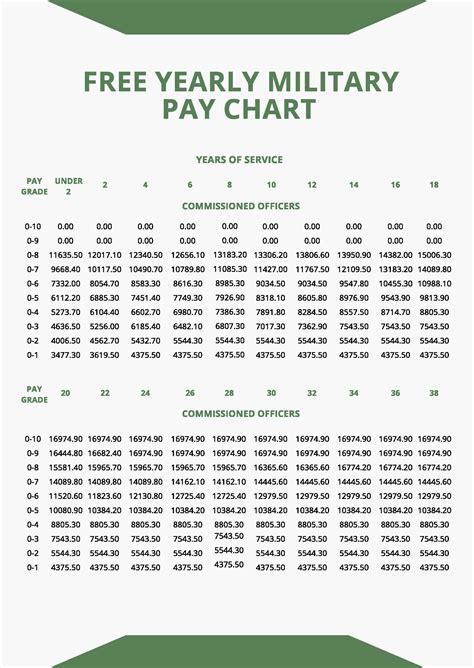

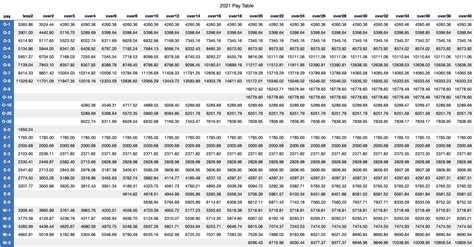

2024 Military Drill Pay Chart Rates

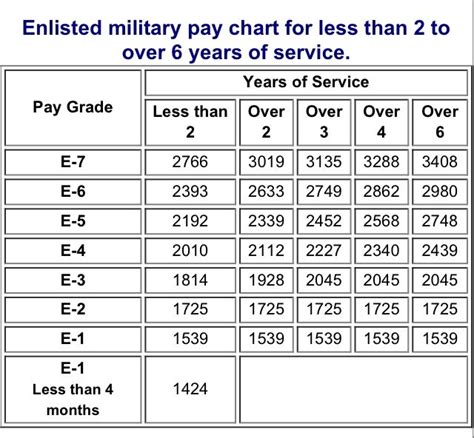

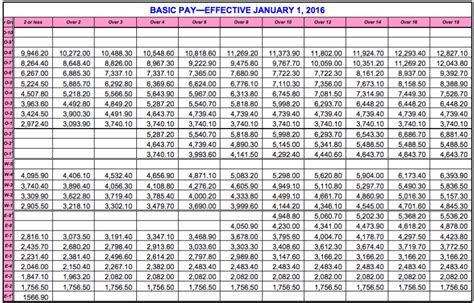

The 2024 military drill pay chart rates are based on the fiscal year 2024 pay scales. The rates are as follows:

| Rank | Time in Service | Drill Pay per Month |

|---|---|---|

| E-1 | Less than 2 years | $201.60 |

| E-2 | Less than 2 years | $226.80 |

| E-3 | Less than 2 years | $256.20 |

| E-4 | Less than 2 years | $292.80 |

| E-5 | Less than 2 years | $334.80 |

| E-6 | Less than 2 years | $384.60 |

| E-7 | Less than 2 years | $441.60 |

| E-8 | Less than 2 years | $512.80 |

| E-9 | Less than 2 years | $595.80 |

| W-1 | Less than 2 years | $422.80 |

| W-2 | Less than 2 years | $479.40 |

| W-3 | Less than 2 years | $545.40 |

| W-4 | Less than 2 years | $623.20 |

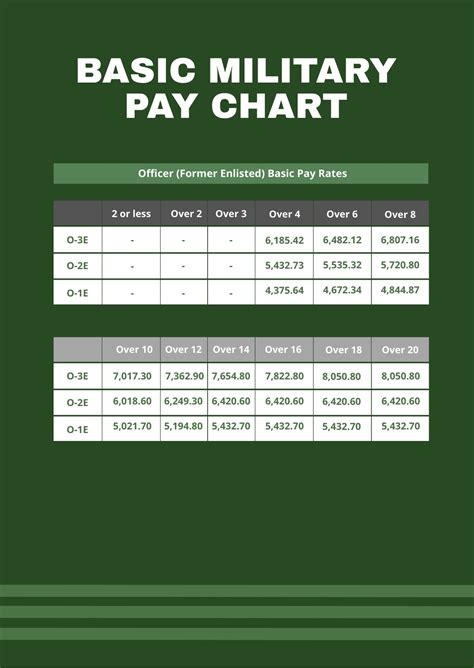

| O-1 | Less than 2 years | $391.40 |

| O-2 | Less than 2 years | $457.40 |

| O-3 | Less than 2 years | $532.40 |

| O-4 | Less than 2 years | $625.80 |

| O-5 | Less than 2 years | $742.40 |

| O-6 | Less than 2 years | $873.20 |

Drill Pay Calculator

To calculate your drill pay, you can use the following formula:

Drill Pay per Month = (Rank Pay x Time in Service Multiplier) x Number of Drills per Month

Here is a calculator to help you estimate your drill pay:

- Rank:

- Time in Service:

- Number of Drills per Month:

Using the calculator, you can input your rank, time in service, and number of drills per month to estimate your drill pay.

How Drill Pay Works

Drill pay is paid for each drill period, which typically lasts for one weekend per month. The amount of drill pay varies based on factors such as rank, time in service, and the number of drills performed.

- Drill pay is paid for each drill period, which typically lasts for one weekend per month.

- Drill pay is based on the rank and time in service of the individual.

- Drill pay is taxable income and is subject to federal income tax withholding.

Types of Drill Pay

There are several types of drill pay, including:

- Basic Drill Pay: This is the standard drill pay rate for each rank and time in service.

- Drill Pay with Dependents: This is an increased drill pay rate for individuals with dependents.

- Drill Pay with Special Pays: This is an increased drill pay rate for individuals with special pays, such as hazardous duty pay or flying pay.

Factors Affecting Drill Pay

Several factors can affect drill pay, including:

- Rank: Drill pay varies based on rank, with higher ranks receiving higher pay.

- Time in Service: Drill pay varies based on time in service, with individuals with more time in service receiving higher pay.

- Number of Drills: Drill pay is paid for each drill period, so individuals with more drills per month receive higher pay.

- Special Pays: Individuals with special pays, such as hazardous duty pay or flying pay, receive increased drill pay.

Drill Pay vs. Active Duty Pay

Drill pay is different from active duty pay in several ways:

- Pay Rate: Drill pay is typically lower than active duty pay.

- Pay Frequency: Drill pay is paid for each drill period, while active duty pay is paid bi-weekly.

- Taxation: Drill pay is taxable income, while active duty pay is exempt from state and local taxes.

Benefits of Drill Pay

Drill pay provides several benefits, including:

- Supplemental Income: Drill pay provides a supplemental income for reservists and National Guard members.

- Career Advancement: Drill pay can provide opportunities for career advancement and professional development.

- Education Benefits: Drill pay can provide education benefits, such as the Montgomery GI Bill Selected Reserve.

Common Questions About Drill Pay

Here are some common questions about drill pay:

- How is drill pay calculated?: Drill pay is calculated based on rank, time in service, and the number of drills per month.

- How often is drill pay paid?: Drill pay is paid for each drill period, typically once per month.

- Is drill pay taxable?: Yes, drill pay is taxable income and is subject to federal income tax withholding.

Conclusion

In conclusion, drill pay is an essential component of military compensation for reservists and National Guard members. Understanding the 2024 military drill pay chart rates and using a calculator can help you estimate your earnings. Remember to consider factors such as rank, time in service, and the number of drills per month when calculating your drill pay.

Drill Pay Chart Rates Image Gallery