Discover how to calculate military pay after taxes with ease. Our expert guide breaks down the complexities of military compensation, including Basic Allowance for Housing (BAH), Basic Allowance for Subsistence (BAS), and tax deductions. Get accurate estimates and optimize your finances with our military pay calculator.

Understanding military pay can be a complex task, especially when it comes to calculating take-home pay after taxes. With various allowances, deductions, and tax rates, it's easy to get lost in the numbers. However, having a clear understanding of your military pay after taxes is essential for managing your finances effectively.

In this article, we will break down the process of calculating military pay after taxes, making it easier for you to understand and manage your finances. We will also provide a comprehensive guide on how to use a military pay calculator to get an accurate estimate of your take-home pay.

Understanding Military Pay

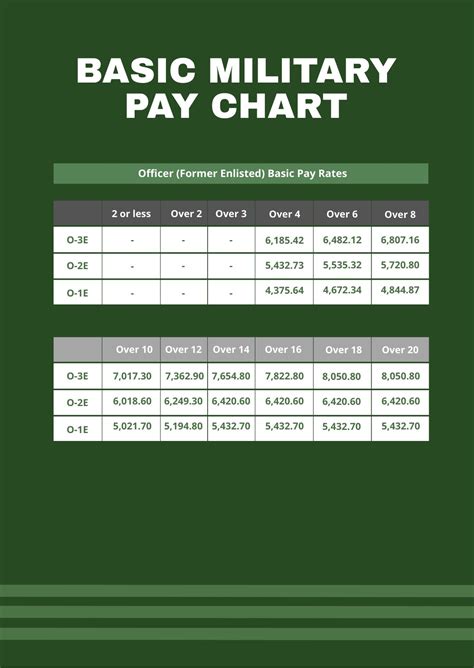

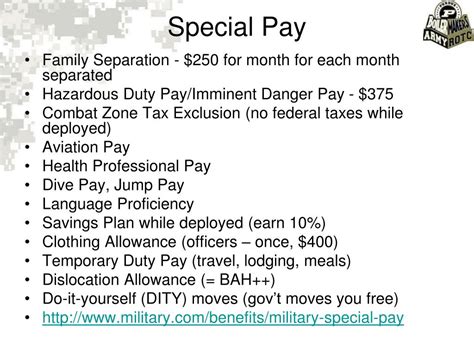

Military pay consists of basic pay, allowances, and special pays. Basic pay is the primary component of military pay and is based on rank and time in service. Allowances, such as Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS), are provided to help offset the cost of living expenses. Special pays, such as combat pay and hazardous duty pay, are provided for specific assignments or duties.

Factors Affecting Military Pay After Taxes

Several factors can affect your military pay after taxes, including:

- Tax filing status (single, married, etc.)

- Number of dependents

- State of residence (some states tax military pay, while others do not)

- Allowances and special pays

- Deductions and exemptions

Calculating Military Pay After Taxes

To calculate your military pay after taxes, you can use a military pay calculator or create a spreadsheet to estimate your take-home pay. Here's a step-by-step guide to calculating military pay after taxes:

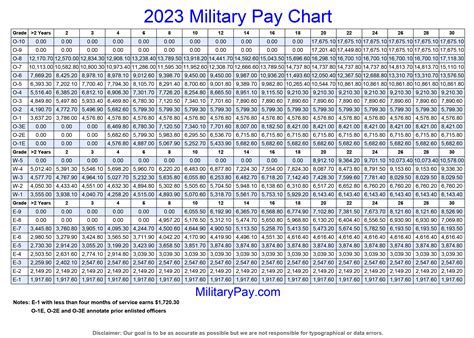

- Determine your basic pay: Use the military pay charts to determine your basic pay based on your rank and time in service.

- Add allowances: Add your allowances, such as BAH and BAS, to your basic pay.

- Add special pays: Add any special pays you receive, such as combat pay or hazardous duty pay.

- Calculate gross income: Calculate your gross income by adding your basic pay, allowances, and special pays.

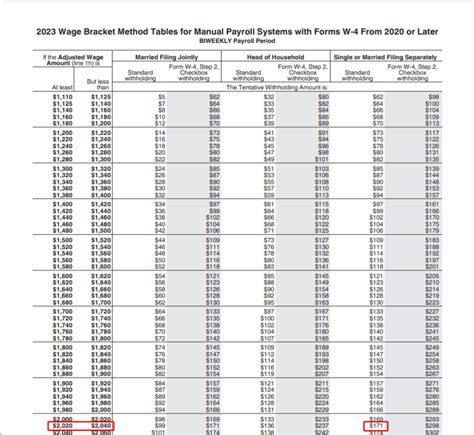

- Determine tax filing status: Determine your tax filing status (single, married, etc.) and number of dependents.

- Calculate federal income tax: Use the IRS tax tables to calculate your federal income tax based on your gross income and tax filing status.

- Calculate state income tax: If you live in a state that taxes military pay, calculate your state income tax based on your gross income and state tax rate.

- Calculate deductions and exemptions: Calculate any deductions and exemptions you're eligible for, such as the military housing deduction.

- Calculate take-home pay: Subtract your federal and state income taxes, as well as any deductions and exemptions, from your gross income to calculate your take-home pay.

Using a Military Pay Calculator

Using a military pay calculator can simplify the process of calculating your take-home pay. These calculators typically require you to input your rank, time in service, tax filing status, and number of dependents. They then estimate your take-home pay based on the military pay charts and tax tables.

Some popular military pay calculators include:

- The Military Pay Calculator provided by the Defense Finance and Accounting Service (DFAS)

- The Military Pay Calculator provided by the Military Pay website

- The Military Pay Calculator provided by the NerdWallet website

Benefits of Using a Military Pay Calculator

Using a military pay calculator can provide several benefits, including:

- Accurate estimates: Military pay calculators provide accurate estimates of your take-home pay based on the military pay charts and tax tables.

- Time-saving: Using a military pay calculator can save you time and effort compared to creating a spreadsheet or calculating your take-home pay manually.

- Easy to use: Military pay calculators are typically easy to use and require minimal input.

- Up-to-date information: Military pay calculators are often updated regularly to reflect changes in military pay and tax rates.

Common Mistakes to Avoid When Using a Military Pay Calculator

When using a military pay calculator, it's essential to avoid common mistakes that can affect the accuracy of your estimates. Here are some common mistakes to avoid:

- Incorrect rank or time in service: Ensure you input your correct rank and time in service to get an accurate estimate of your basic pay.

- Incorrect tax filing status: Ensure you input your correct tax filing status and number of dependents to get an accurate estimate of your federal and state income taxes.

- Failure to account for allowances and special pays: Ensure you account for all allowances and special pays you receive to get an accurate estimate of your gross income.

Conclusion

Calculating military pay after taxes can be a complex task, but using a military pay calculator can simplify the process. By understanding the factors that affect your military pay and avoiding common mistakes, you can get an accurate estimate of your take-home pay. Remember to always review and update your estimates regularly to ensure you're getting the most accurate information possible.

Military Pay Calculator Image Gallery

Share Your Thoughts

We hope this article has helped you understand how to calculate military pay after taxes using a military pay calculator. If you have any questions or comments, please share them below. Additionally, if you've used a military pay calculator before, please share your experience and any tips you may have for getting the most accurate estimates.