Discover military retirement life insurance options to secure your financial future after service. Learn about Veterans Group Life Insurance (VGLI), Servicemembers Group Life Insurance (SGLI), and other life insurance alternatives available to veterans. Get informed on coverage, benefits, and application processes to make an informed decision.

Transitioning from military to civilian life can be a significant adjustment, and one of the essential aspects to consider is life insurance. Military personnel have access to unique life insurance options while serving, but these benefits may change or expire after separation. In this article, we will explore the various life insurance options available to military retirees and provide guidance on making informed decisions about their financial future.

Understanding Military Life Insurance Options

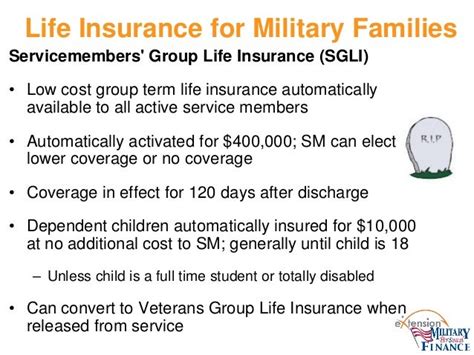

During their service, military personnel are entitled to low-cost life insurance through the Servicemembers' Group Life Insurance (SGLI) program. SGLI provides up to $400,000 in coverage, and the premium rates are relatively low. However, this coverage may not be sufficient for everyone, and the premiums increase with age.

Converting SGLI to VGLI

When leaving the military, service members have the option to convert their SGLI coverage to Veterans' Group Life Insurance (VGLI). VGLI provides similar coverage to SGLI, but with higher premium rates. The conversion process is relatively straightforward, and veterans can apply for VGLI within one year and 120 days of separation.

Private Life Insurance Options

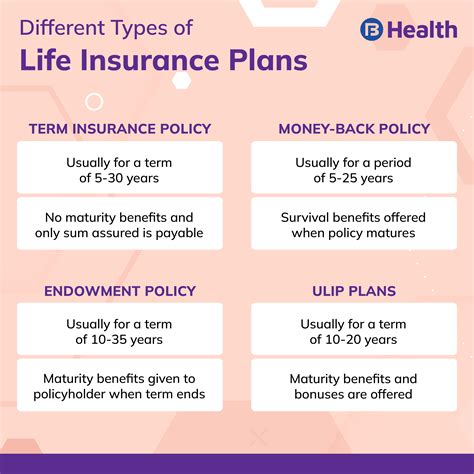

In addition to VGLI, military retirees can also explore private life insurance options. These plans offer more flexibility and customization than SGLI or VGLI, and the coverage amounts can be higher. Some popular private life insurance options include:

- Term life insurance: Provides coverage for a specified period (e.g., 10, 20, or 30 years) and pays a death benefit if the insured dies during that term.

- Whole life insurance: Offers lifetime coverage and a cash value component that grows over time.

- Universal life insurance: Combines a death benefit with a savings component that earns interest.

Factors to Consider When Choosing Private Life Insurance

When selecting a private life insurance policy, military retirees should consider the following factors:

- Coverage amount: Determine how much coverage is needed to support dependents and cover final expenses.

- Premium rates: Compare rates from different insurance providers to find the best option.

- Policy riders: Consider adding riders to customize the policy and provide additional benefits.

- Insurer reputation: Research the insurance company's financial stability and customer service reputation.

Additional Life Insurance Options for Military Retirees

In addition to VGLI and private life insurance, military retirees may be eligible for other life insurance options, including:

- TRICARE: A health insurance program for military retirees and their families, which includes a life insurance component.

- Military retiree associations: Some associations, such as the Military Officers Association of America (MOAA), offer life insurance plans specifically designed for military retirees.

- Group life insurance: Some employers offer group life insurance plans as a benefit to their employees.

Tips for Military Retirees When Choosing Life Insurance

When selecting a life insurance policy, military retirees should keep the following tips in mind:

- Assess your needs: Consider your income, expenses, and dependents when determining how much coverage is needed.

- Compare options: Research and compare different life insurance policies to find the best option.

- Consider additional benefits: Some policies offer additional benefits, such as waiver of premium or long-term care riders.

- Review and adjust: Regularly review your life insurance policy and adjust as needed to ensure it continues to meet your needs.

Life Insurance Options for Military Retirees Image Gallery

In conclusion, military retirees have various life insurance options to consider after leaving the military. By understanding the benefits and limitations of each option, they can make informed decisions about their financial future. We encourage military retirees to take the time to research and compare different life insurance policies to find the best option for their needs.

Final Thoughts

We hope this article has provided valuable insights into the world of life insurance options for military retirees. As a military retiree, it's essential to take control of your financial future and make informed decisions about your life insurance coverage. Don't hesitate to reach out to a licensed insurance professional or a veterans' organization for guidance and support.

What's Next?

If you're a military retiree looking for more information on life insurance options, we encourage you to explore our website for additional resources and articles. You can also share your thoughts and experiences with life insurance in the comments section below. Don't forget to share this article with fellow military retirees who may benefit from this information.