Intro

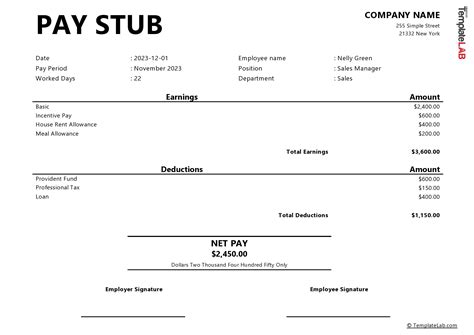

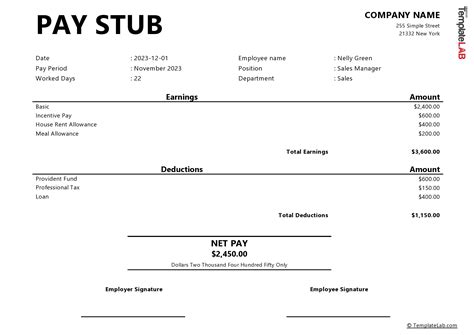

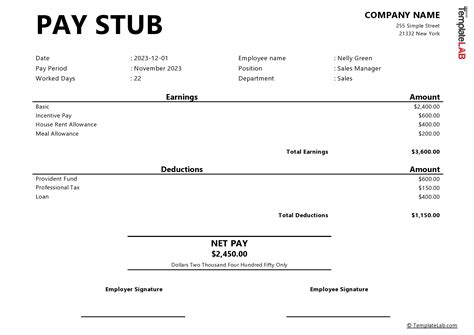

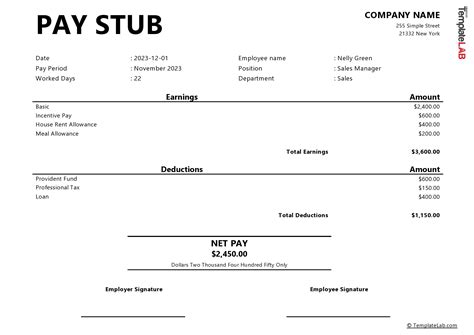

Streamline your payroll process with a modern pay stub template. Discover the 5 essential elements to include, from employee details to tax deductions. Ensure compliance and transparency with a clear, concise design. Explore LSI keywords: payroll processing, pay stub format, salary slip template, payment stubs, and employee compensation statements.

A pay stub, also known as a payslip, is a document that provides employees with a detailed breakdown of their wages, taxes, and other deductions. With the increasing demand for transparency and clarity in payroll processing, a modern pay stub template has become an essential tool for businesses. In this article, we will explore the 5 essential elements of a modern pay stub template that can help you create a clear, concise, and compliant pay stub.

The Benefits of a Modern Pay Stub Template

A modern pay stub template is more than just a simple document. It's a powerful tool that can help you streamline your payroll processing, reduce errors, and improve employee satisfaction. Here are some of the benefits of using a modern pay stub template:

- Increased transparency: A modern pay stub template provides employees with a clear and detailed breakdown of their wages, taxes, and deductions, helping to reduce confusion and disputes.

- Improved compliance: A modern pay stub template ensures that you are meeting all relevant payroll regulations and laws, reducing the risk of fines and penalties.

- Enhanced employee satisfaction: A modern pay stub template provides employees with a professional and easy-to-understand document, helping to improve their overall satisfaction with the payroll process.

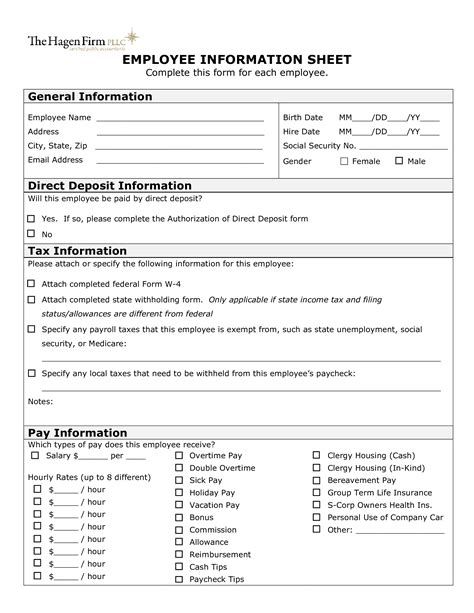

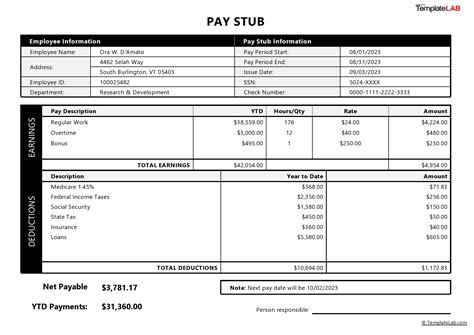

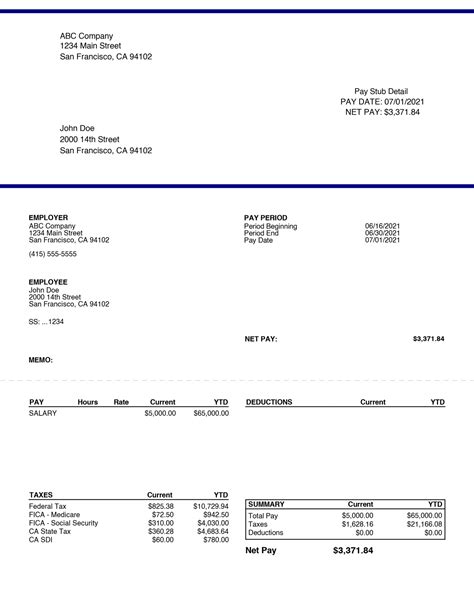

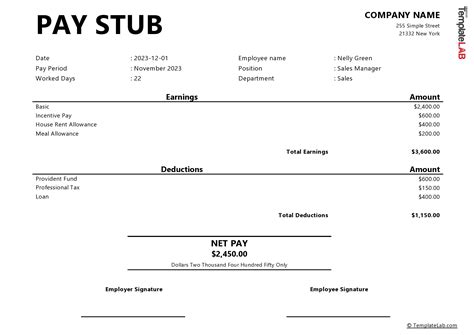

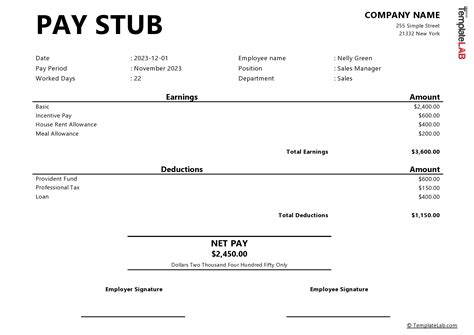

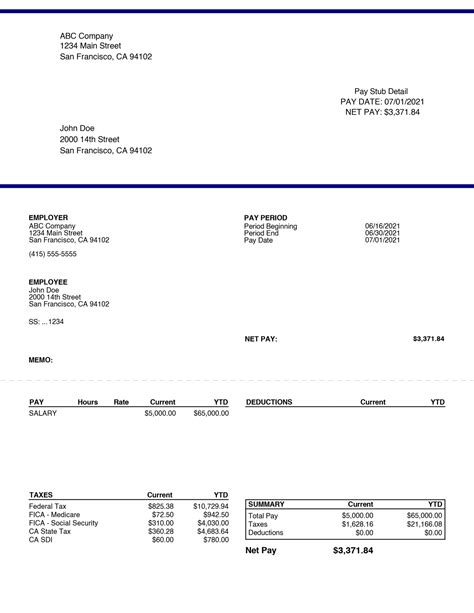

Element 1: Employee Information

The first essential element of a modern pay stub template is employee information. This section should include the employee's name, address, and social security number or employee ID number.

Why is employee information important?

- Identifies the employee: Employee information helps to identify the employee and ensure that the pay stub is being sent to the correct person.

- Compliance: Including employee information on the pay stub helps to ensure compliance with relevant payroll regulations and laws.

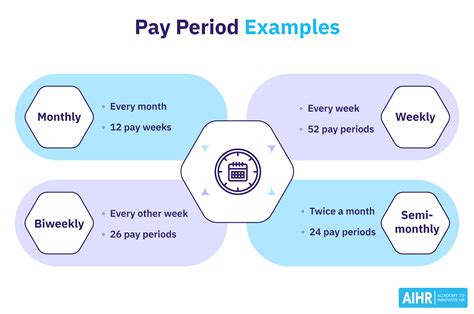

Element 2: Pay Period Information

The second essential element of a modern pay stub template is pay period information. This section should include the pay period dates, pay date, and pay frequency.

Why is pay period information important?

- Provides context: Pay period information provides context for the employee's wages, taxes, and deductions, helping to ensure that they understand their pay.

- Compliance: Including pay period information on the pay stub helps to ensure compliance with relevant payroll regulations and laws.

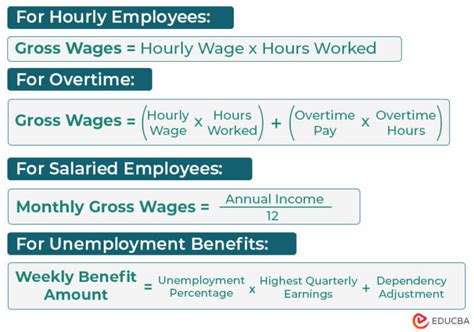

Element 3: Gross Wages

The third essential element of a modern pay stub template is gross wages. This section should include the employee's gross wages for the pay period, including any overtime or bonuses.

Why are gross wages important?

- Provides a clear breakdown: Gross wages provide a clear breakdown of the employee's wages, helping to ensure that they understand their pay.

- Compliance: Including gross wages on the pay stub helps to ensure compliance with relevant payroll regulations and laws.

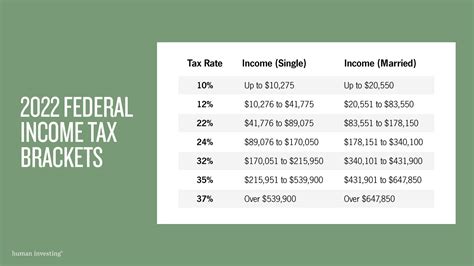

Element 4: Taxes and Deductions

The fourth essential element of a modern pay stub template is taxes and deductions. This section should include the employee's taxes and deductions for the pay period, including federal, state, and local taxes, as well as any benefits or other deductions.

Why are taxes and deductions important?

- Provides a clear breakdown: Taxes and deductions provide a clear breakdown of the employee's taxes and deductions, helping to ensure that they understand their pay.

- Compliance: Including taxes and deductions on the pay stub helps to ensure compliance with relevant payroll regulations and laws.

Element 5: Net Wages

The fifth and final essential element of a modern pay stub template is net wages. This section should include the employee's net wages for the pay period, which is the amount of money that the employee will take home.

Why are net wages important?

- Provides a clear breakdown: Net wages provide a clear breakdown of the employee's take-home pay, helping to ensure that they understand their pay.

- Compliance: Including net wages on the pay stub helps to ensure compliance with relevant payroll regulations and laws.

Gallery of Pay Stub Templates

Pay Stub Template Gallery

Conclusion: Creating a Modern Pay Stub Template

Creating a modern pay stub template requires attention to detail and a clear understanding of the essential elements that make up a compliant and effective pay stub. By including employee information, pay period information, gross wages, taxes and deductions, and net wages, you can create a pay stub template that meets the needs of your employees and helps to streamline your payroll processing.