Intro

Stay on top of your finances with our free Monthly Bill Organizer Template. Easily track and manage your recurring payments, due dates, and amounts in one place. Reduce stress and late fees by staying organized and in control. Download now and simplify your bill tracking with this customizable template.

Staying on top of monthly bills can be a daunting task, especially with the numerous expenses that come with modern living. From rent and utilities to credit cards and subscription services, it's easy to lose track of what needs to be paid and when. However, missing a payment or paying late can result in unnecessary fees, damage to your credit score, and even lead to financial stress.

Having a reliable system in place to organize and track your bills is essential for maintaining financial stability and peace of mind. This is where a monthly bill organizer template comes in handy. By utilizing a bill organizer template, you can simplify your financial management, ensure timely payments, and avoid late fees.

Benefits of Using a Monthly Bill Organizer Template

Using a monthly bill organizer template offers several benefits, including:

• Improved organization: A bill organizer template helps you keep all your bills in one place, making it easier to track and manage your expenses. • Reduced stress: By having a clear overview of your bills, you can avoid last-minute scrambles to make payments, reducing financial stress and anxiety. • Timely payments: A bill organizer template ensures you never miss a payment, helping you avoid late fees and negative impacts on your credit score. • Enhanced budgeting: By tracking your bills, you can identify areas where you can cut back and allocate funds more effectively, leading to improved budgeting and financial management.

How to Create a Monthly Bill Organizer Template

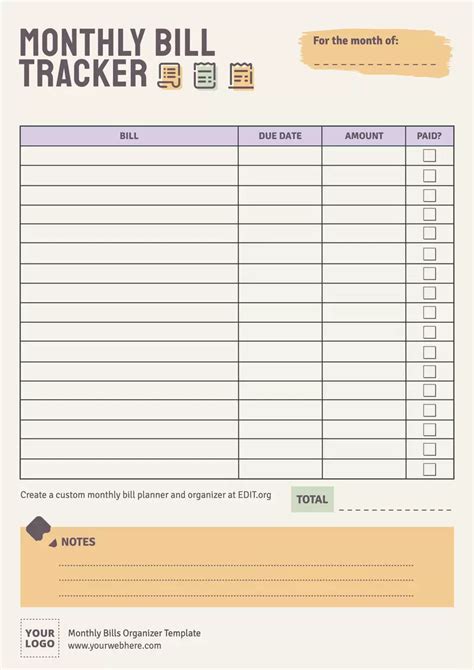

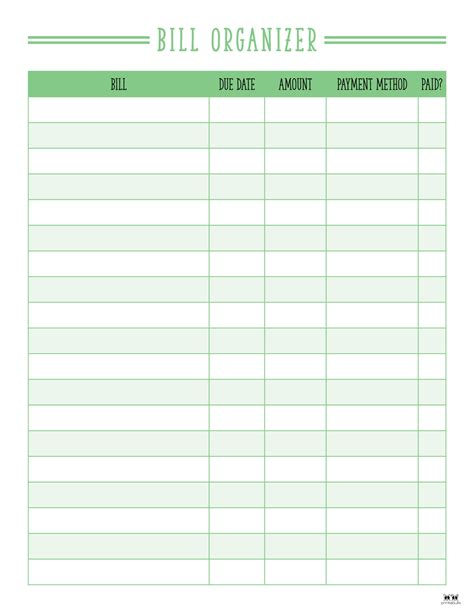

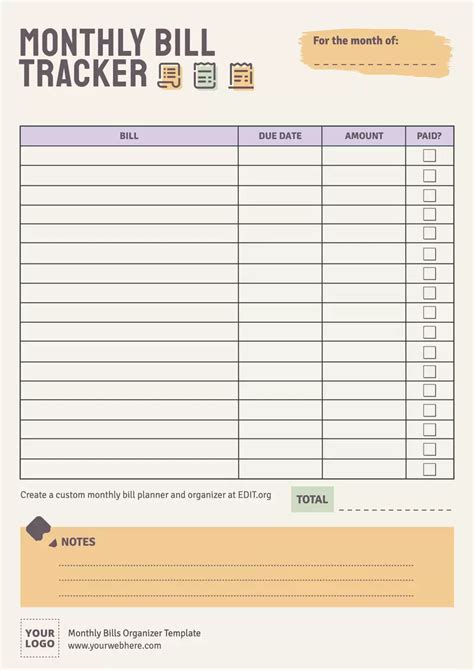

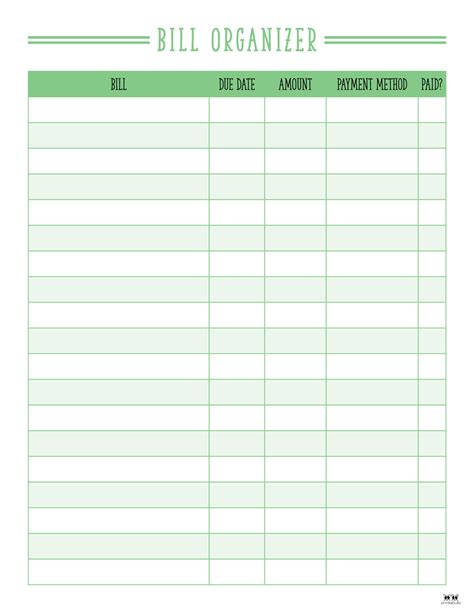

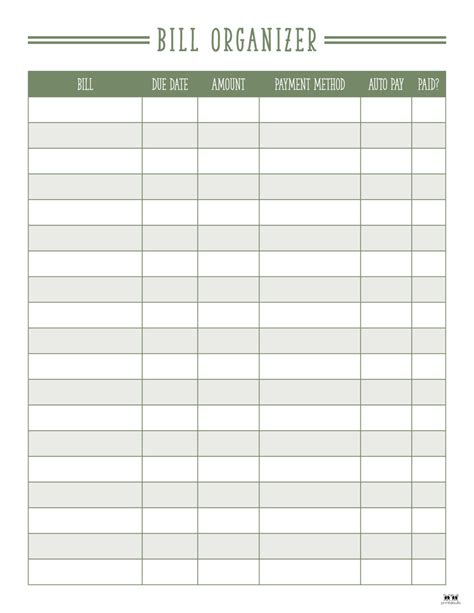

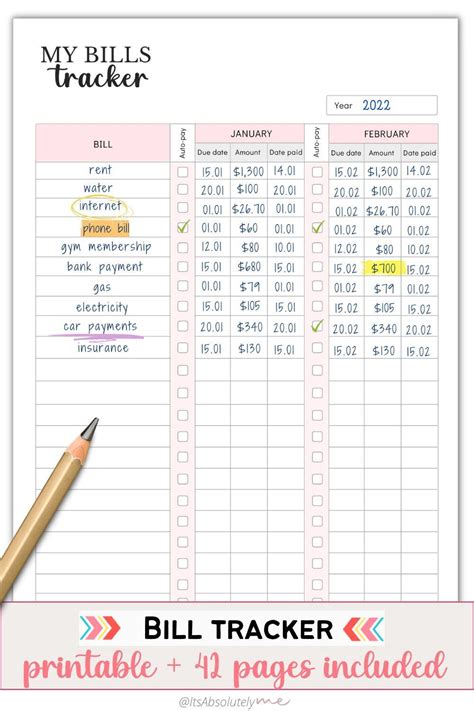

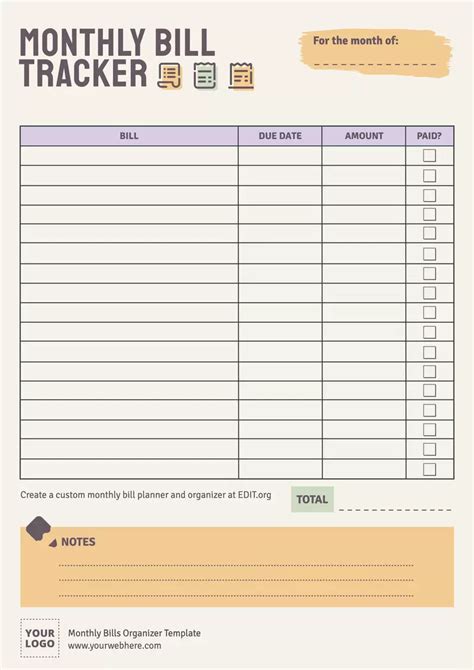

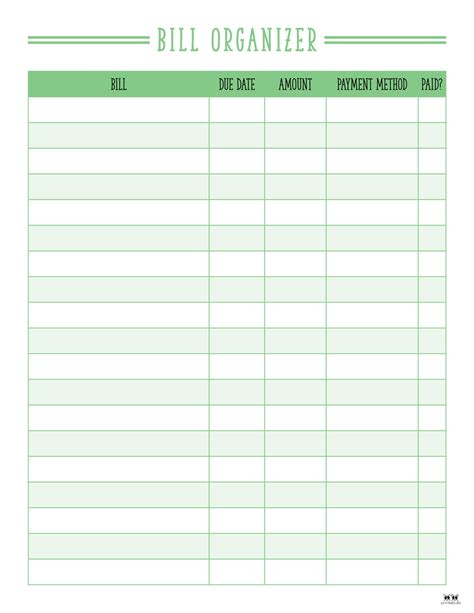

Creating a monthly bill organizer template is straightforward. You can use a spreadsheet software like Microsoft Excel or Google Sheets to create a table with the following columns:

• Bill Name: List the name of each bill, such as rent, electricity, or credit card. • Due Date: Enter the due date for each bill. • Amount: Record the amount due for each bill. • Payment Method: Note the payment method for each bill, such as online, check, or automatic bank transfer. • Payment Status: Track the status of each payment, such as "paid" or "pending".

Tips for Using a Monthly Bill Organizer Template Effectively

To get the most out of your monthly bill organizer template, follow these tips:

• Regularly update the template: Ensure you update the template regularly to reflect changes in your bills, such as new due dates or amounts. • Set reminders: Set reminders for upcoming due dates to avoid late payments. • Track payments: Record each payment in the template to maintain an accurate record of your expenses. • Review and adjust: Regularly review your template to identify areas for improvement and adjust your budget accordingly.

Common Types of Monthly Bills to Track

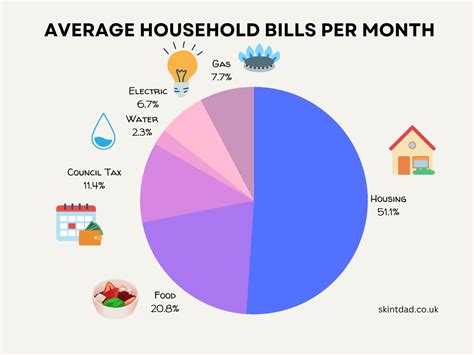

When creating your monthly bill organizer template, be sure to include the following common types of bills:

• Rent/Mortgage: Track your rent or mortgage payments, including the due date and amount. • Utilities: Include bills for electricity, gas, water, and internet services. • Credit Cards: Track your credit card payments, including the minimum payment due and the total balance. • Subscription Services: Include bills for subscription services like Netflix, gym memberships, and software subscriptions. • Insurance: Track your insurance premiums, including health, auto, and home insurance.

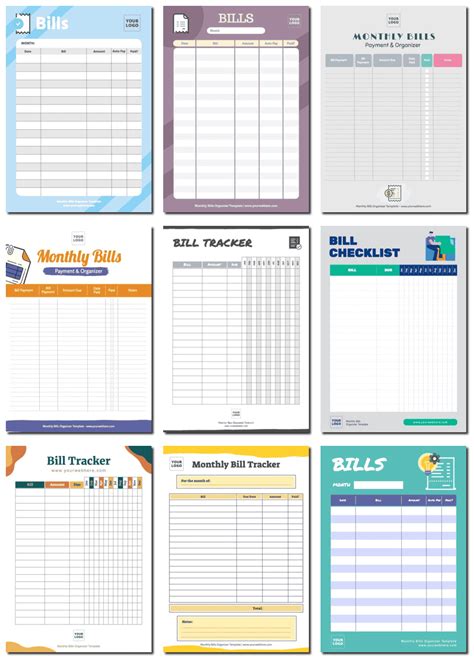

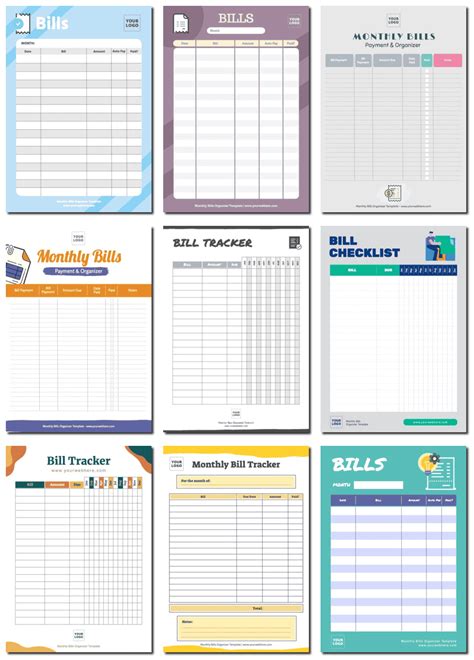

Free Monthly Bill Organizer Templates

If you're not comfortable creating your own bill organizer template, you can find free templates online. Some popular options include:

• Microsoft Excel templates: Microsoft offers a range of free bill organizer templates that you can download and customize. • Google Sheets templates: Google Sheets also offers a range of free templates, including bill organizers. • Printable templates: You can find printable bill organizer templates online that you can print and fill out by hand.

Conclusion

A monthly bill organizer template is a simple yet effective tool for managing your finances and staying on top of your bills. By creating a template and regularly updating it, you can reduce financial stress, avoid late fees, and improve your overall financial well-being. Whether you create your own template or use a free one, a bill organizer template is an essential tool for anyone looking to take control of their finances.

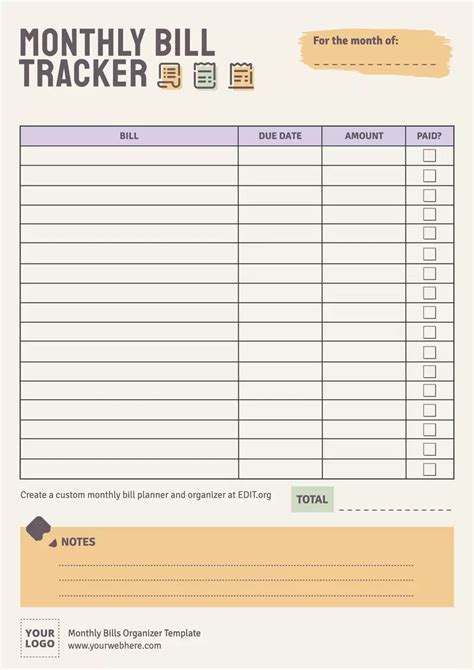

Monthly Bill Organizer Template Gallery

We hope this article has helped you understand the importance of using a monthly bill organizer template and how to create one. If you have any questions or comments, please feel free to share them below.