Intro

Discover how Dave Ramseys budget template can transform your finances with 7 simple yet effective strategies. Learn how to prioritize needs over wants, create a zero-based budget, and tackle debt with a proven plan. Achieve financial peace and save money with this practical, step-by-step guide to budgeting success.

Are you tired of living paycheck to paycheck? Do you struggle to make ends meet and save for the future? If so, you're not alone. According to a recent survey, over 60% of Americans don't have enough savings to cover a $1,000 emergency expense. However, with the right tools and strategies, you can take control of your finances and start building wealth. One powerful resource is Dave Ramsey's budget template.

Dave Ramsey is a well-known personal finance expert who has helped millions of people get out of debt and build wealth. His budget template is a simple yet effective tool that helps you track your income and expenses, identify areas for improvement, and make a plan to achieve your financial goals. In this article, we'll explore seven ways that Dave Ramsey's budget template can help you save money.

1. Creates a Clear Picture of Your Finances

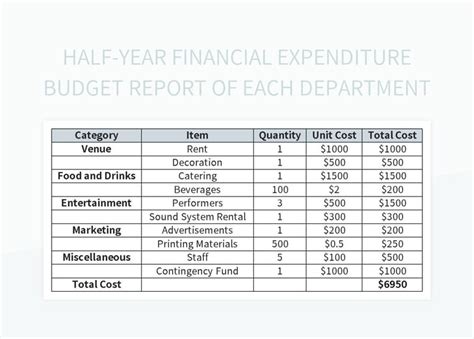

One of the most significant benefits of Dave Ramsey's budget template is that it gives you a clear picture of your finances. By tracking your income and expenses, you'll be able to see where your money is going and identify areas where you can cut back. This will help you make informed decisions about how to allocate your resources and achieve your financial goals.

How to Use the Budget Template

Using the budget template is straightforward. Simply fill in the columns with your income and expenses, and then use the formulas to calculate your totals. You can also customize the template to fit your specific needs and goals.

2. Helps You Prioritize Your Spending

Another way that Dave Ramsey's budget template can help you save money is by helping you prioritize your spending. By categorizing your expenses into needs and wants, you'll be able to see where you can cut back on non-essential spending and allocate that money towards more important goals.

Needs vs. Wants

When it comes to prioritizing your spending, it's essential to distinguish between needs and wants. Needs include essential expenses like housing, food, and transportation, while wants include discretionary expenses like dining out or entertainment.

3. Enables You to Set Financial Goals

Dave Ramsey's budget template also enables you to set financial goals, which is a crucial step in achieving financial success. By setting specific, measurable, and achievable goals, you'll be able to focus your efforts and make progress towards achieving financial freedom.

Types of Financial Goals

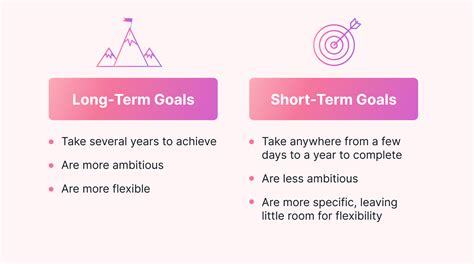

There are several types of financial goals you can set using the budget template, including:

- Short-term goals, such as saving for a emergency fund or paying off debt

- Long-term goals, such as saving for retirement or a down payment on a house

- Intermediate goals, such as saving for a car or a vacation

4. Allows You to Track Your Progress

Another benefit of Dave Ramsey's budget template is that it allows you to track your progress over time. By regularly reviewing your budget and comparing it to your goals, you'll be able to see how far you've come and make adjustments as needed.

How to Track Your Progress

To track your progress using the budget template, simply fill in the columns with your income and expenses each month, and then use the formulas to calculate your totals. You can also use the template to track your progress towards specific financial goals, such as saving for a emergency fund or paying off debt.

5. Helps You Avoid Debt

Dave Ramsey's budget template can also help you avoid debt by giving you a clear picture of your finances and enabling you to make informed decisions about how to allocate your resources. By prioritizing your spending and setting financial goals, you'll be able to avoid debt and achieve financial freedom.

Types of Debt

There are several types of debt, including:

- High-interest debt, such as credit card debt

- Low-interest debt, such as student loans or mortgages

- Debt with no interest, such as personal loans from friends or family

6. Enables You to Build an Emergency Fund

Another way that Dave Ramsey's budget template can help you save money is by enabling you to build an emergency fund. By setting aside a portion of your income each month, you'll be able to cover unexpected expenses and avoid going into debt.

How to Build an Emergency Fund

To build an emergency fund using the budget template, simply set aside a portion of your income each month and allocate it towards your emergency fund goal. You can also use the template to track your progress towards building an emergency fund.

7. Helps You Achieve Long-Term Financial Goals

Finally, Dave Ramsey's budget template can help you achieve long-term financial goals, such as saving for retirement or a down payment on a house. By prioritizing your spending and setting financial goals, you'll be able to make progress towards achieving financial freedom.

Types of Long-Term Financial Goals

There are several types of long-term financial goals, including:

- Retirement savings

- Saving for a down payment on a house

- Saving for a car or other large purchase

7 Ways Dave Ramseys Budget Template Saves Money Image Gallery

In conclusion, Dave Ramsey's budget template is a powerful tool that can help you save money and achieve financial freedom. By creating a clear picture of your finances, prioritizing your spending, setting financial goals, and tracking your progress, you'll be able to make informed decisions about how to allocate your resources and achieve financial success.