Intro

Create a personalized budget with our free monthly budget template for Goodnotes. Easily track expenses, income, and savings goals in a customizable digital notebook. Streamline financial planning with a intuitive template, perfect for digital bullet journaling and budgeting. Download now and start managing your finances with ease.

Managing your finances effectively is crucial for achieving financial stability and securing your future. One of the most effective ways to manage your finances is by creating a monthly budget. A budget helps you track your income and expenses, making it easier to identify areas where you can cut back and allocate your resources more efficiently. In this article, we will explore the benefits of using a free monthly budget template for Goodnotes and provide a comprehensive guide on how to create and use one.

Benefits of Using a Free Monthly Budget Template for Goodnotes

Using a free monthly budget template for Goodnotes offers several benefits, including:

- Easy to use: Goodnotes is a popular note-taking app that allows you to create and edit documents easily. A budget template designed specifically for Goodnotes makes it easy to track your finances and make adjustments as needed.

- Customizable: A free monthly budget template for Goodnotes can be customized to suit your specific financial needs. You can add or remove categories, adjust the layout, and change the formatting to make it more user-friendly.

- Convenient: With a budget template on your Goodnotes app, you can access your budget anywhere, anytime. This makes it easy to track your expenses and stay on top of your finances, even when you're on the go.

- Reduces financial stress: Creating a budget can help reduce financial stress and anxiety. By tracking your income and expenses, you can identify areas where you can cut back and allocate your resources more efficiently.

How to Create a Free Monthly Budget Template for Goodnotes

Creating a free monthly budget template for Goodnotes is easy. Here are the steps to follow:

- Determine your income: Start by determining your total monthly income. Include all sources of income, such as your salary, investments, and any side hustles.

- Identify your expenses: Next, identify your monthly expenses. Include categories such as housing, transportation, food, entertainment, and savings.

- Categorize your expenses: Categorize your expenses into needs and wants. Needs include essential expenses such as housing and food, while wants include non-essential expenses such as entertainment and hobbies.

- Assign percentages: Assign percentages to each category based on your income. For example, you may allocate 30% of your income to housing and 10% to entertainment.

- Create a template: Create a template using Goodnotes. You can use a table or a list to track your income and expenses.

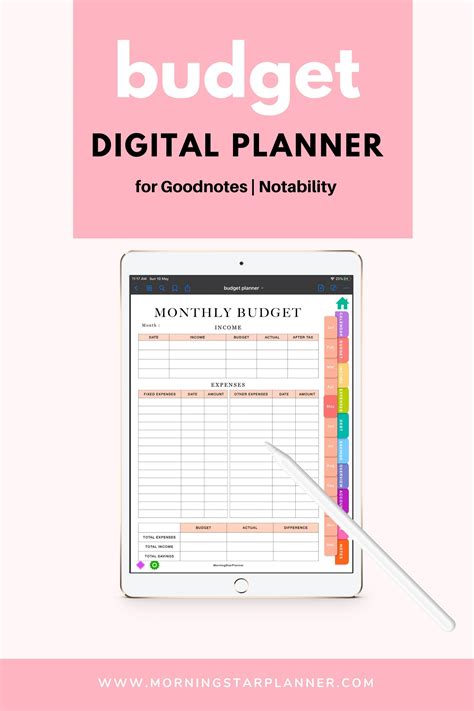

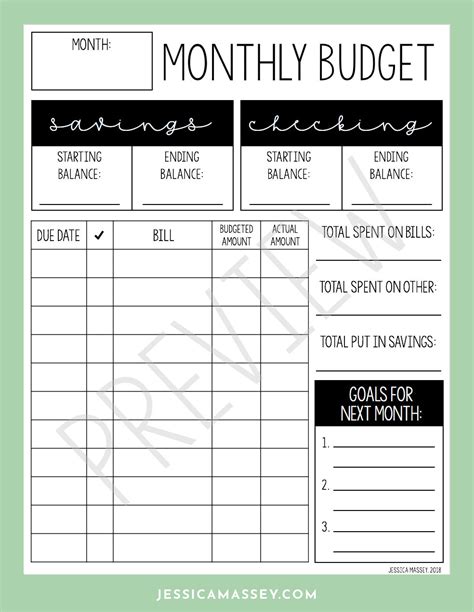

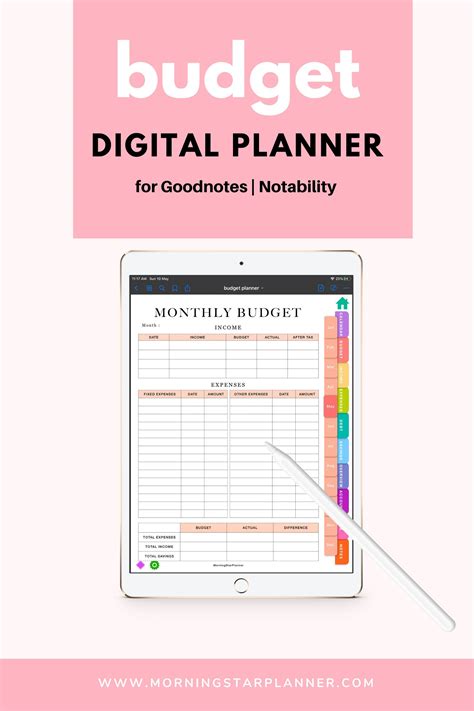

Example of a Free Monthly Budget Template for Goodnotes

Here's an example of a free monthly budget template for Goodnotes:

| Category | Income | Expenses | Balance |

|---|---|---|---|

| Housing | $1,500 | ||

| Transportation | $500 | ||

| Food | $800 | ||

| Entertainment | $200 | ||

| Savings | $500 | ||

| Total | $4,000 | $3,000 | $1,000 |

Tips for Using a Free Monthly Budget Template for Goodnotes

Here are some tips for using a free monthly budget template for Goodnotes:

- Track your expenses regularly: Track your expenses regularly to ensure you're staying within your budget.

- Adjust your budget as needed: Adjust your budget as needed to reflect changes in your income or expenses.

- Use the 50/30/20 rule: Use the 50/30/20 rule to allocate your income. 50% of your income should go towards essential expenses, 30% towards non-essential expenses, and 20% towards savings and debt repayment.

- Avoid impulse purchases: Avoid impulse purchases by creating a shopping list and sticking to it.

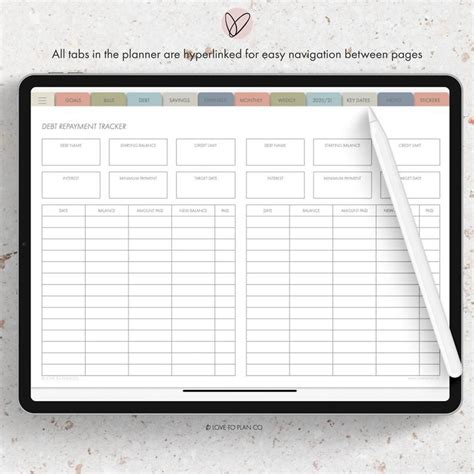

Gallery of Free Monthly Budget Templates for Goodnotes

Free Monthly Budget Templates for Goodnotes

Using a free monthly budget template for Goodnotes can help you manage your finances effectively and achieve financial stability. By following the tips outlined in this article, you can create a budget that works for you and helps you achieve your financial goals.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to ask.