Intro

Boost your financial clarity with Dave Ramseys Monthly Cash Flow Template. Learn how to track income, expenses, and savings with ease. Discover 5 practical ways to utilize this template, including budgeting, debt reduction, and emergency fund building. Take control of your finances and achieve financial peace with this simple yet powerful tool.

Managing your finances effectively is crucial for achieving financial stability and securing your future. One of the most effective tools for managing your finances is the Monthly Cash Flow Template created by Dave Ramsey. This template is designed to help you track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your resources. In this article, we will explore five ways to use Dave Ramsey's Monthly Cash Flow Template to improve your financial health.

Understanding the Template

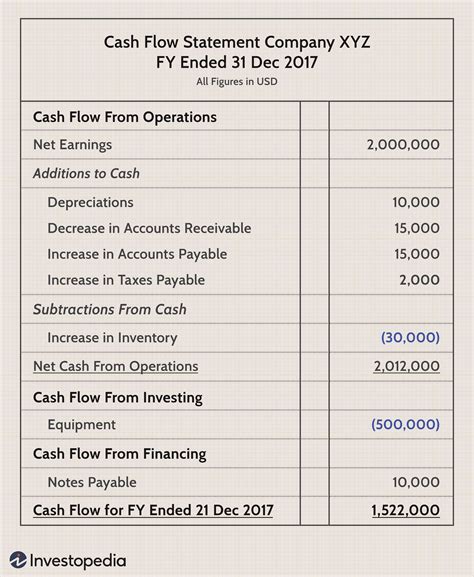

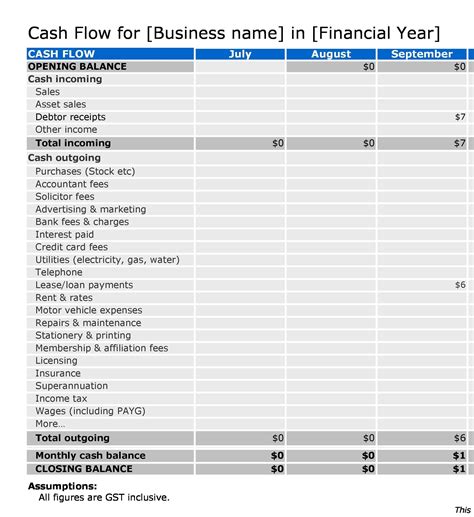

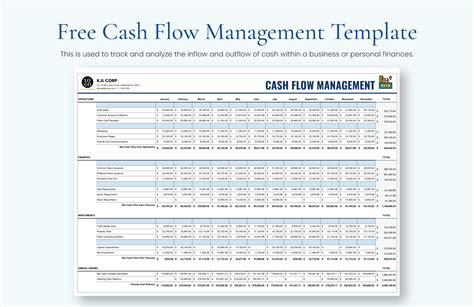

Before we dive into the ways to use the template, let's take a moment to understand how it works. The Monthly Cash Flow Template is a simple, yet powerful tool that helps you track your income and expenses. It's divided into several categories, including income, fixed expenses, variable expenses, and debt repayment. By filling out the template each month, you'll get a clear picture of where your money is going and identify areas where you can make adjustments.

1. Tracking Your Income

The first step in using the Monthly Cash Flow Template is to track your income. This includes all sources of income, such as your salary, investments, and any side hustles. By tracking your income, you'll get a clear picture of how much money you have coming in each month. This will help you make informed decisions about how to allocate your resources.

- Use the template to track your income from all sources

- Include any irregular income, such as bonuses or freelance work

- Use the total income amount to inform your spending decisions

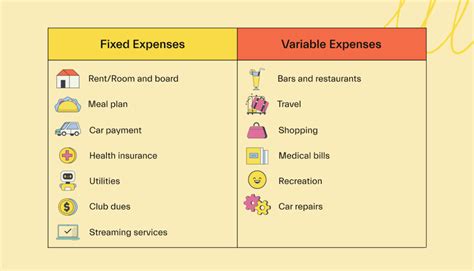

2. Identifying Fixed Expenses

Fixed expenses are expenses that remain the same each month, such as your rent/mortgage, car payment, and insurance. By identifying your fixed expenses, you'll be able to see where your money is going and make adjustments as needed.

- Use the template to list all your fixed expenses

- Include expenses such as rent/mortgage, car payment, insurance, and minimum debt payments

- Use the total fixed expense amount to determine how much you have available for variable expenses

3. Managing Variable Expenses

Variable expenses are expenses that can vary from month to month, such as groceries, entertainment, and travel. By tracking your variable expenses, you'll be able to identify areas where you can cut back and make adjustments as needed.

- Use the template to track your variable expenses

- Include expenses such as groceries, entertainment, travel, and hobbies

- Use the total variable expense amount to determine if you need to make adjustments

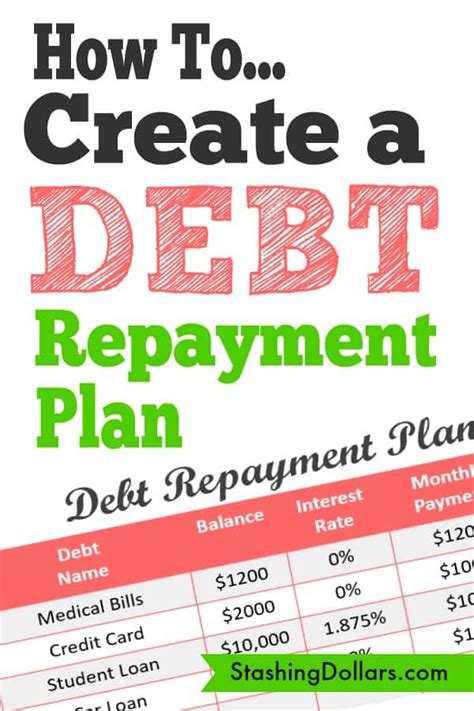

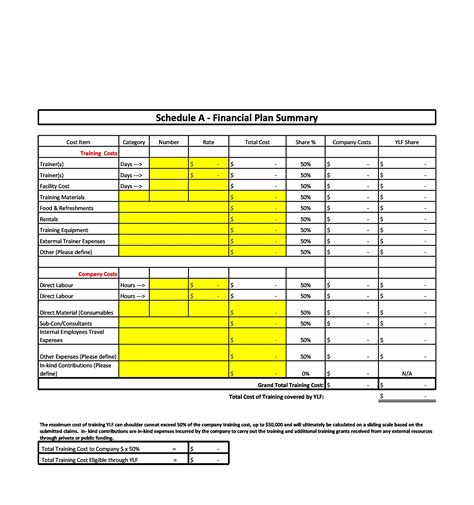

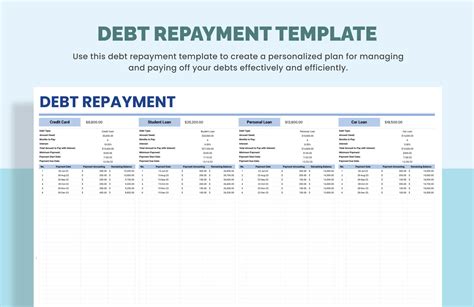

4. Creating a Debt Repayment Plan

If you have debt, such as credit card debt or student loans, creating a debt repayment plan is crucial for getting out of debt. The Monthly Cash Flow Template can help you create a plan and track your progress.

- Use the template to list all your debts

- Include the balance, interest rate, and minimum payment for each debt

- Use the total debt repayment amount to determine how much you need to pay each month

5. Making Adjustments and Tracking Progress

The final step in using the Monthly Cash Flow Template is to make adjustments and track your progress. By regularly reviewing your template, you'll be able to identify areas where you need to make changes and track your progress over time.

- Use the template to make adjustments to your spending and debt repayment plan

- Track your progress over time to see how far you've come

- Use the template to make informed decisions about your finances

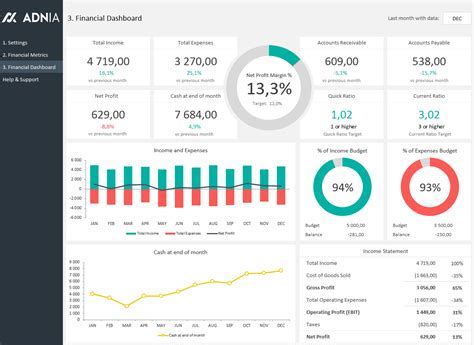

Gallery of Budgeting and Cash Flow Templates

Budgeting and Cash Flow Templates Gallery

Conclusion

Using Dave Ramsey's Monthly Cash Flow Template is a powerful way to take control of your finances and achieve financial stability. By tracking your income, identifying fixed expenses, managing variable expenses, creating a debt repayment plan, and making adjustments, you'll be well on your way to financial freedom. Remember to regularly review your template and make adjustments as needed. With the right tools and a commitment to your financial health, you can achieve your financial goals and secure your future.

Share Your Thoughts

Have you used Dave Ramsey's Monthly Cash Flow Template to manage your finances? Share your experience in the comments below. If you have any questions or need help with creating a budget, feel free to ask. Don't forget to share this article with your friends and family who may be struggling with their finances.