Intro

Streamline your financial reporting with these 5 essential Excel templates for monthly management accounts. Easily track expenses, income, and cash flow with our customizable templates, featuring automated calculations and visualizations. Boost your accounting efficiency and make informed decisions with our expert-designed templates, perfect for small businesses and finance professionals.

As a business owner or accountant, managing monthly accounts can be a daunting task. Staying on top of finances, tracking expenses, and making informed decisions requires accurate and timely financial data. This is where Excel templates come in handy. In this article, we will explore the benefits of using Excel templates for monthly management accounts and highlight five essential templates to streamline your financial management.

Why Use Excel Templates for Monthly Management Accounts?

Excel templates offer a range of benefits for monthly management accounts, including:

- Time-saving: Pre-designed templates save you time and effort in creating financial reports from scratch.

- Accuracy: Templates reduce errors by providing a standardized format for data entry and calculations.

- Customization: Excel templates can be tailored to meet your specific business needs and financial reporting requirements.

- Enhanced decision-making: Templates provide a clear and concise view of your financial performance, enabling you to make informed decisions.

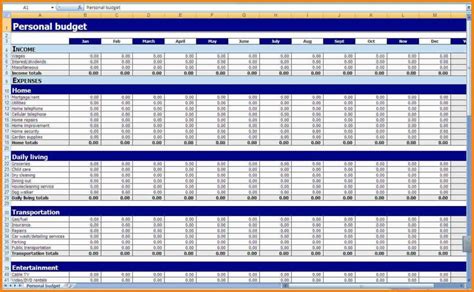

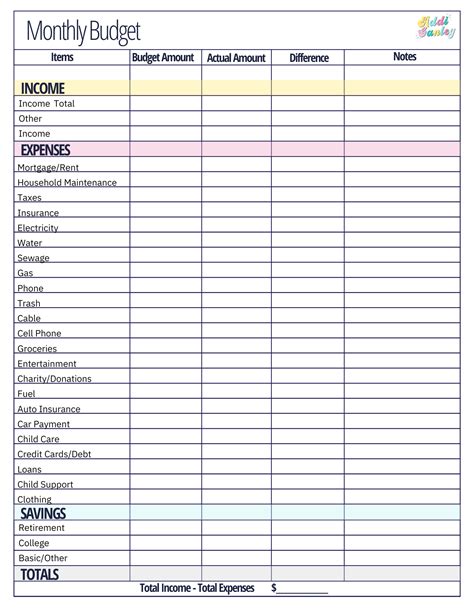

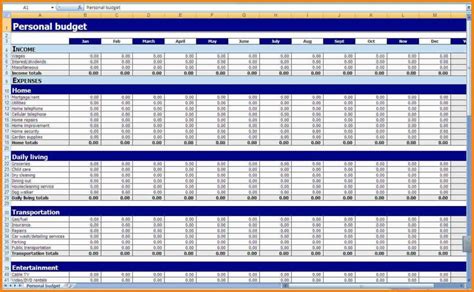

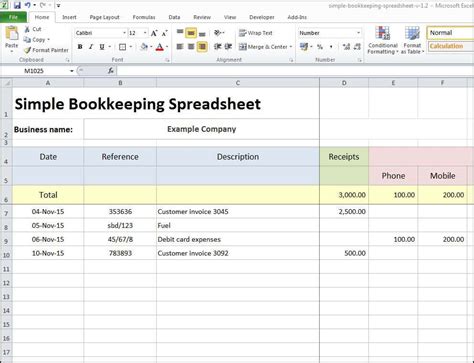

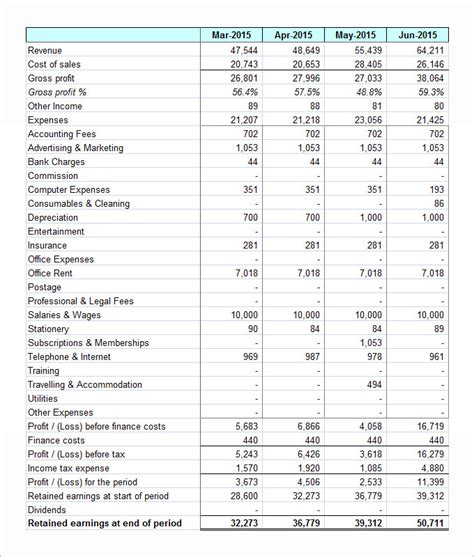

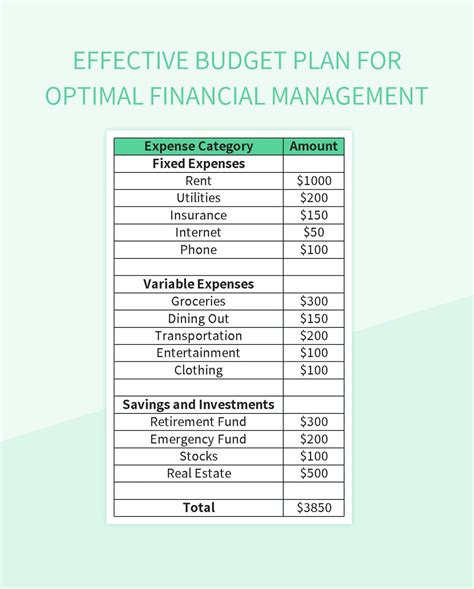

Template 1: Monthly Budget Template

A monthly budget template is a must-have for any business. This template allows you to track income and expenses, identify areas of overspending, and make adjustments to stay within budget.

Key features:

- Income and expense tracking

- Budget variance analysis

- Rolling budgeting (e.g., 12-month rolling budget)

Example use case:

- Use the template to create a monthly budget for your business, allocating funds to different departments and expense categories.

- Track actual spending and compare it to your budget to identify areas for improvement.

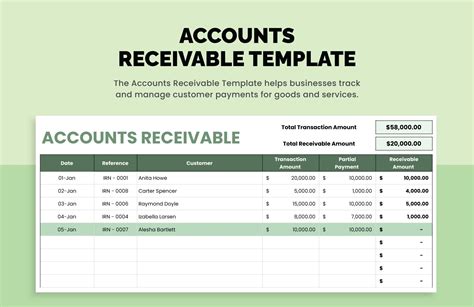

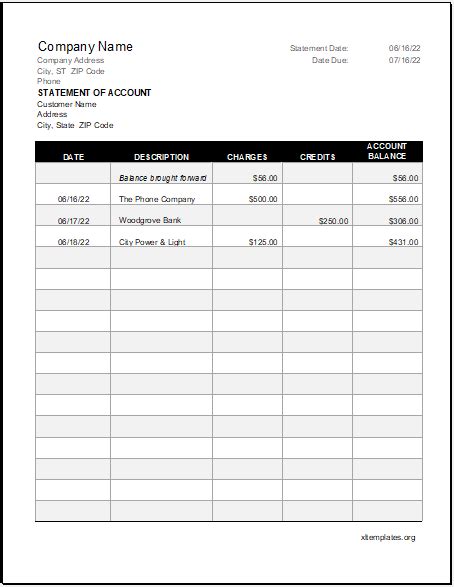

Template 2: Accounts Receivable and Payable Template

Effective management of accounts receivable and payable is crucial for maintaining a healthy cash flow. This template helps you track invoices, payments, and credit notes, ensuring timely follow-up and minimizing the risk of bad debts.

Key features:

- Invoice and payment tracking

- Credit note management

- Aging analysis (e.g., 30, 60, 90 days)

Example use case:

- Use the template to manage your accounts receivable, sending reminders and follow-up emails to customers with outstanding invoices.

- Track accounts payable, ensuring timely payment to suppliers and avoiding late fees.

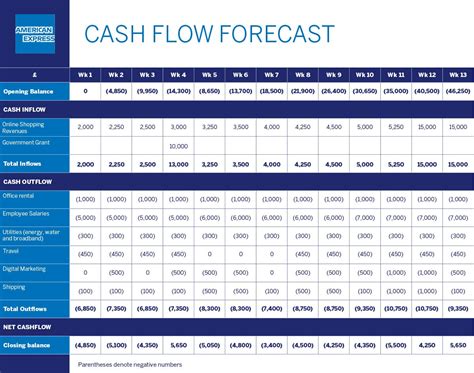

Template 3: Cash Flow Forecast Template

A cash flow forecast template helps you predict your business's future cash inflows and outflows, enabling you to make informed decisions about investments, funding, and other financial matters.

Key features:

- Cash inflow and outflow forecasting

- Rolling cash flow forecasting (e.g., 12-month rolling forecast)

- Break-even analysis

Example use case:

- Use the template to create a cash flow forecast for the next quarter, identifying potential shortfalls and opportunities for growth.

- Adjust your forecast based on changes in your business, such as new contracts or unexpected expenses.

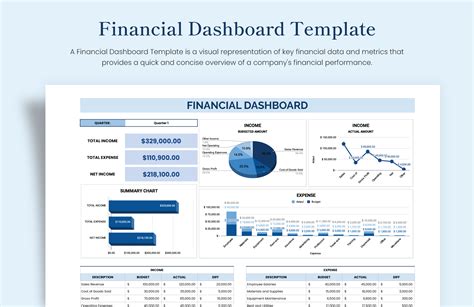

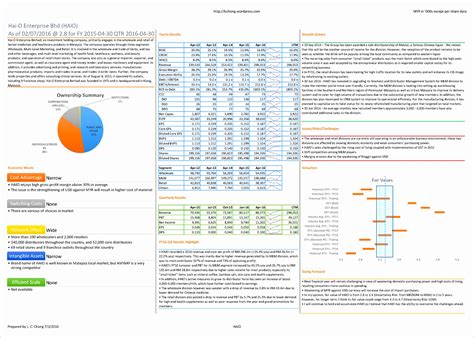

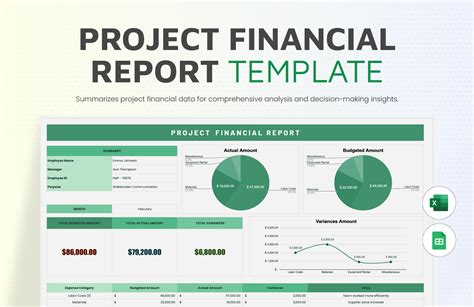

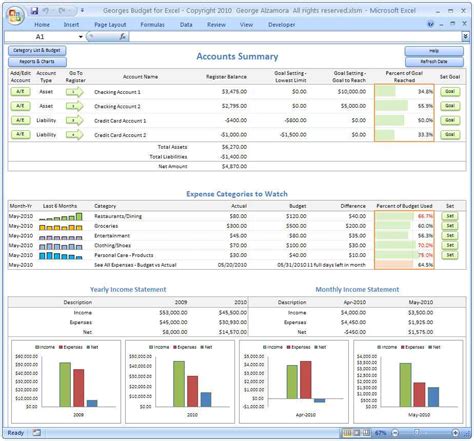

Template 4: Financial Dashboard Template

A financial dashboard template provides a comprehensive overview of your business's financial performance, enabling you to track key performance indicators (KPIs) and make data-driven decisions.

Key features:

- Financial KPI tracking (e.g., revenue growth, profit margin)

- Chart and graph visualization

- Drill-down analysis

Example use case:

- Use the template to create a financial dashboard for your business, tracking revenue, expenses, and profit margin.

- Analyze trends and identify areas for improvement, adjusting your strategy accordingly.

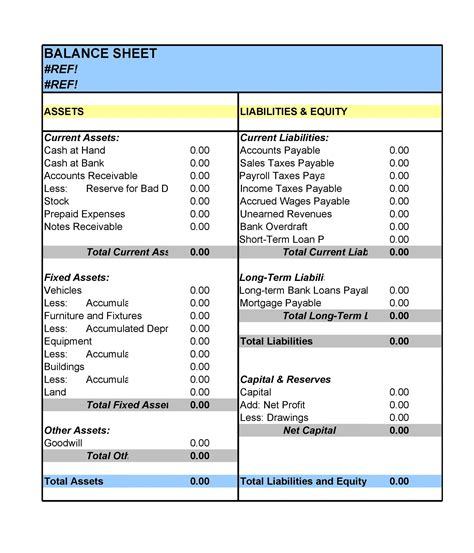

Template 5: Balance Sheet Template

A balance sheet template helps you track your business's assets, liabilities, and equity, providing a snapshot of your financial position at a specific point in time.

Key features:

- Asset, liability, and equity tracking

- Financial ratio analysis (e.g., debt-to-equity ratio)

- Rolling balance sheet reporting (e.g., 12-month rolling balance sheet)

Example use case:

- Use the template to create a balance sheet for your business, tracking changes in assets, liabilities, and equity over time.

- Analyze financial ratios to identify trends and areas for improvement.

Gallery of Excel Templates for Monthly Management Accounts

Excel Templates for Monthly Management Accounts Gallery

By implementing these five essential Excel templates, you'll be able to streamline your monthly management accounts, make informed decisions, and drive business growth. Remember to customize the templates to meet your specific needs and financial reporting requirements. Share your experiences and tips for using Excel templates in the comments below!