Intro

Master the art of ACH payment processing with our 7 expert Nacha file template Excel tips. Learn how to efficiently manage payment files, automate formatting, and troubleshoot common errors. Discover best practices for Direct Deposit, Direct Payment, and vendor payment processing, ensuring seamless and compliant transactions every time.

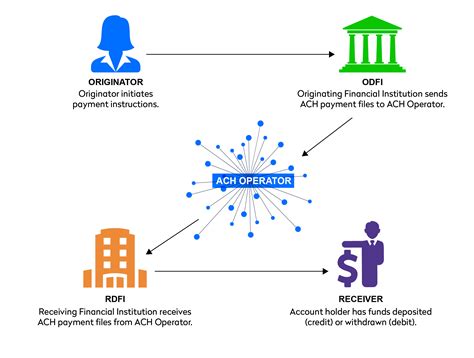

Managing finances and transactions efficiently is crucial for businesses and organizations. One tool that can help streamline this process is the Nacha file template in Excel. Nacha, which stands for National Automated Clearing House Association, is a set of standards for exchanging financial information electronically. In this article, we will explore 7 Nacha file template Excel tips to help you make the most out of this tool.

Understanding Nacha File Template Excel

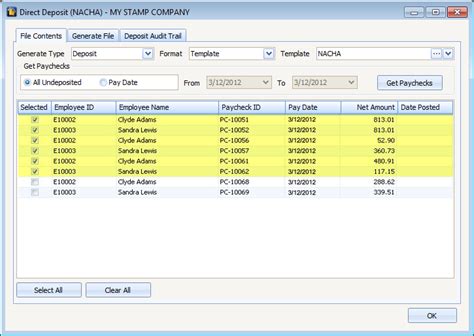

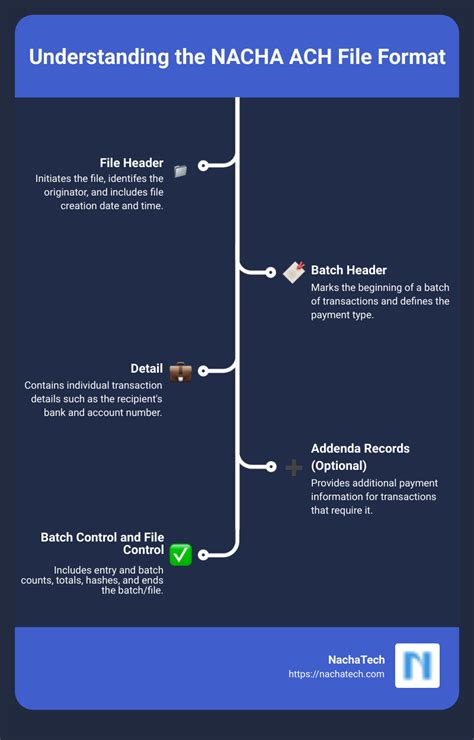

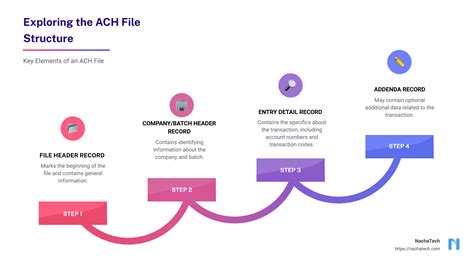

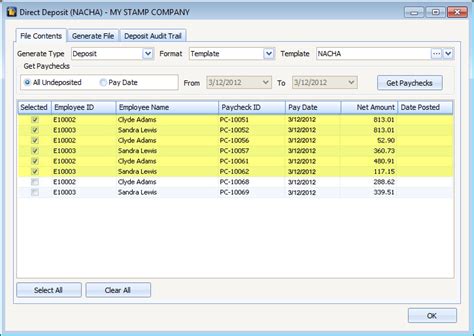

Before we dive into the tips, it's essential to understand what a Nacha file template in Excel is. A Nacha file template is a pre-designed Excel spreadsheet that helps you create and manage Nacha files. These files contain information about transactions, such as payment amounts, recipient information, and payment dates. The template helps you organize this information in a standardized format, making it easier to exchange financial data with banks and other financial institutions.

Tip 1: Set Up Your Template Correctly

The first step in using a Nacha file template in Excel is to set it up correctly. Make sure you download a template that is specifically designed for Nacha files, and not a generic Excel template. You can find Nacha file templates online or through your bank's website. Once you have the template, set up the columns and rows according to the instructions provided. This will ensure that your data is organized correctly and easily importable into your bank's system.

Tip 2: Use the Correct File Format

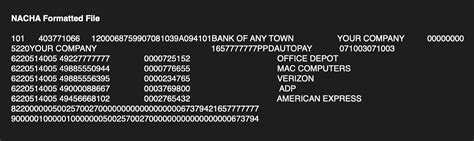

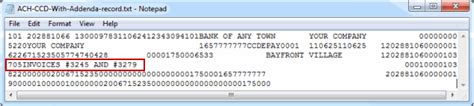

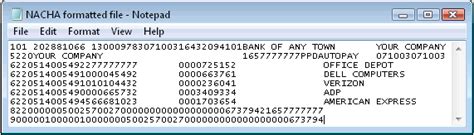

Nacha files have specific formatting requirements, and using the correct file format is crucial. Make sure your template is set up to export files in the Nacha format, which is typically a text file (.txt). You can also use the Nacha CSV (Comma Separated Values) format, but this is less common. If you're unsure about the file format, check with your bank or financial institution to confirm their requirements.

Tip 3: Validate Your Data

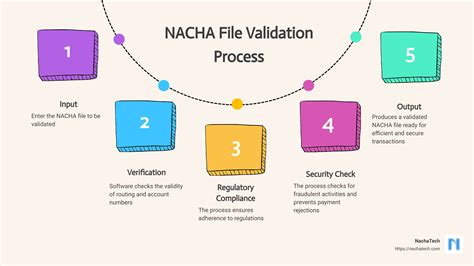

Validating your data is essential to ensure that your Nacha file is accurate and complete. Use Excel's built-in data validation tools to check for errors, such as incorrect dates, invalid account numbers, or missing information. You can also use third-party add-ins or plugins to help validate your data.

Tip 4: Use Batch Headers and Trailers

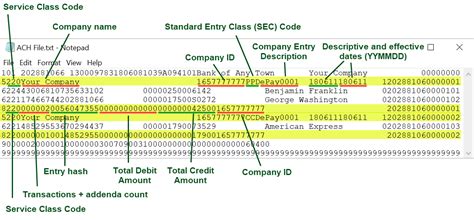

Batch headers and trailers are essential components of a Nacha file. The batch header contains information about the batch, such as the batch ID, date, and time. The batch trailer contains a summary of the transactions in the batch, including the total number of transactions and the total amount. Make sure your template includes batch headers and trailers to ensure that your file is complete and accurate.

Tip 5: Handle Addenda Records Correctly

Addenda records are additional information that is attached to a transaction, such as a payment memo or a receipt. Make sure your template handles addenda records correctly, including the correct formatting and placement of the addenda record.

Tip 6: Use the Correct Priorities

Nacha files have different priorities, such as same-day, next-day, or standard. Make sure your template uses the correct priority for each transaction, based on the payment date and time.

Tip 7: Test Your File

Finally, test your Nacha file to ensure that it is accurate and complete. Use a test file to verify that your template is working correctly, and that the file is being exported in the correct format. You can also use third-party testing tools or services to help test your file.

Nacha File Template Excel Tips Image Gallery

By following these 7 Nacha file template Excel tips, you can ensure that your financial transactions are processed efficiently and accurately. Remember to set up your template correctly, use the correct file format, validate your data, use batch headers and trailers, handle addenda records correctly, use the correct priorities, and test your file. With these tips, you can streamline your financial transactions and reduce errors.

We hope this article has been helpful in providing you with useful tips for using a Nacha file template in Excel. If you have any further questions or would like to share your experiences with using Nacha file templates, please leave a comment below.