Intro

Discover National Guard drill pay rates, including monthly pay scales, drill pay charts, and compensation benefits for part-time soldiers, to help you understand military pay and allowances.

The National Guard is a vital component of the United States military, providing support and defense for the country and its citizens. As a member of the National Guard, individuals can serve their country while also maintaining a civilian career. One of the benefits of serving in the National Guard is the opportunity to earn drill pay, which is a form of compensation for the time spent training and drilling. In this article, we will explore the National Guard drill pay rates and what factors can affect them.

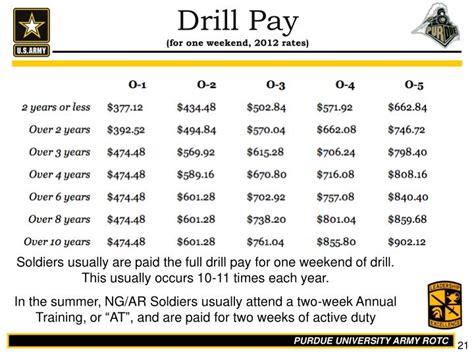

Drill pay is an essential aspect of serving in the National Guard, as it provides financial compensation for the time and effort spent training and preparing for potential deployments. The drill pay rates for National Guard members are based on their rank and the number of drills they attend. The rates are also subject to change over time, so it's essential to stay up-to-date on the current rates. By understanding the drill pay rates and how they work, National Guard members can better plan their finances and make the most of their service.

The National Guard drill pay rates are an attractive benefit for those considering joining the military. Not only do members receive financial compensation for their time, but they also gain valuable skills and experience that can be applied to their civilian careers. Additionally, serving in the National Guard provides a sense of pride and fulfillment, knowing that you are contributing to the defense and security of the country. Whether you're a seasoned veteran or just starting your military career, understanding the drill pay rates is crucial for making the most of your service.

National Guard Drill Pay Rates Overview

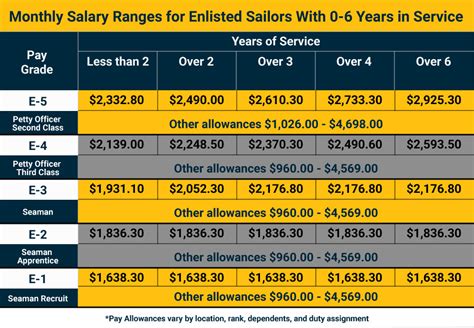

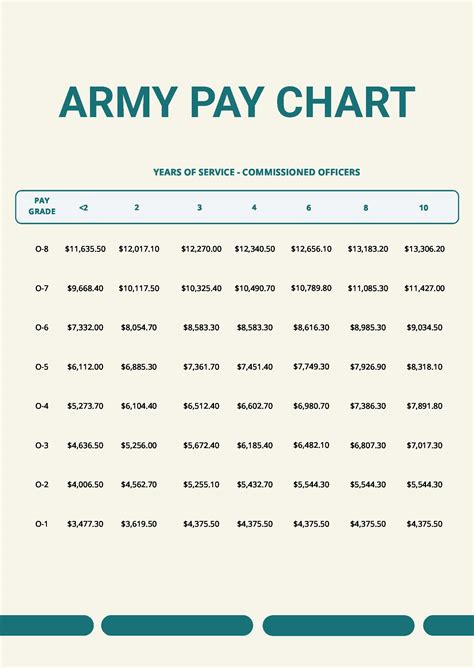

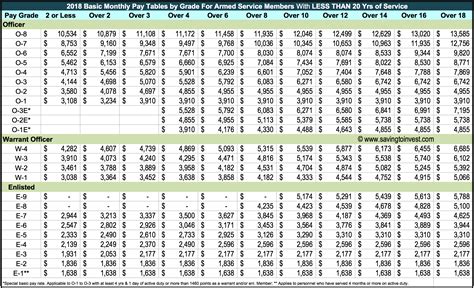

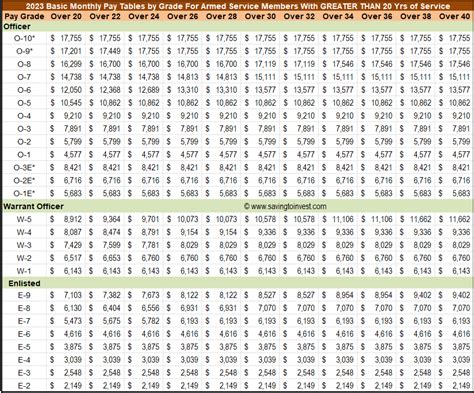

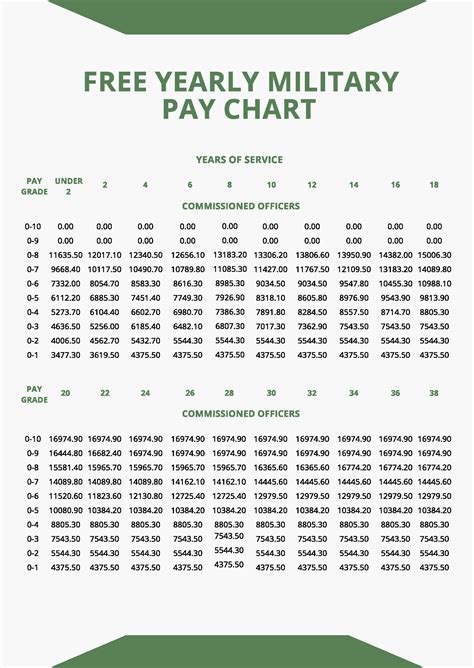

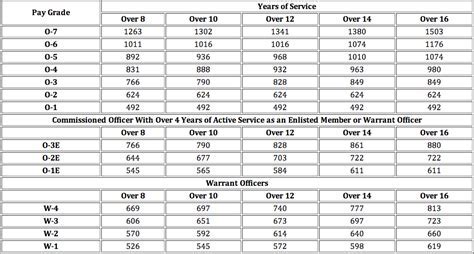

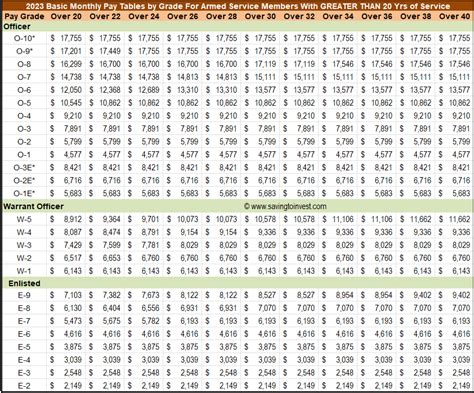

The National Guard drill pay rates are based on the military pay tables, which are published annually by the Department of Defense. The rates are determined by the member's rank and the number of drills they attend. The drill pay rates are typically higher for higher-ranking members and those who attend more drills. The current drill pay rates for National Guard members are as follows:

- Basic pay: This is the monthly pay rate for National Guard members, which ranges from $1,733.40 for an E-1 (Private) to $8,324.10 for an O-10 (General).

- Drill pay: This is the pay rate for attending drills, which ranges from $129.65 per drill for an E-1 to $241.88 per drill for an O-10.

Factors Affecting Drill Pay Rates

Several factors can affect the drill pay rates for National Guard members, including: * Rank: The higher the rank, the higher the drill pay rate. * Time in service: Members with more time in service may be eligible for higher drill pay rates. * Number of drills: The more drills attended, the higher the total drill pay. * Deployment status: Members who are deployed may be eligible for higher drill pay rates or special pay.Drill Pay Rates by Rank

The drill pay rates for National Guard members vary by rank, with higher-ranking members receiving higher pay rates. The following are the current drill pay rates by rank:

- E-1 (Private): $129.65 per drill

- E-2 (Private First Class): $146.45 per drill

- E-3 (Specialist/Corporal): $163.25 per drill

- E-4 (Sergeant): $180.05 per drill

- E-5 (Staff Sergeant): $197.85 per drill

- E-6 (Sergeant First Class): $215.65 per drill

- E-7 (Master Sergeant/First Sergeant): $233.45 per drill

- E-8 (Master Sergeant/First Sergeant): $251.25 per drill

- E-9 (Sergeant Major): $269.05 per drill

- W-1 (Warrant Officer 1): $186.55 per drill

- W-2 (Chief Warrant Officer 2): $215.65 per drill

- W-3 (Chief Warrant Officer 3): $244.75 per drill

- W-4 (Chief Warrant Officer 4): $273.85 per drill

- W-5 (Chief Warrant Officer 5): $302.95 per drill

- O-1 (Second Lieutenant): $186.55 per drill

- O-2 (First Lieutenant): $215.65 per drill

- O-3 (Captain): $244.75 per drill

- O-4 (Major): $273.85 per drill

- O-5 (Lieutenant Colonel): $302.95 per drill

- O-6 (Colonel): $332.05 per drill

- O-7 (Brigadier General): $361.15 per drill

- O-8 (Major General): $390.25 per drill

- O-9 (Lieutenant General): $419.35 per drill

- O-10 (General): $448.45 per drill

Special Pay and Allowances

In addition to drill pay, National Guard members may be eligible for special pay and allowances, including: * Basic Allowance for Housing (BAH): This is a monthly allowance to help offset the cost of housing. * Basic Allowance for Subsistence (BAS): This is a monthly allowance to help offset the cost of food. * Special Duty Pay: This is a pay rate for members who perform special duties, such as flight pay or hazardous duty pay. * Deployment pay: This is a pay rate for members who are deployed, which can include hazardous duty pay, combat pay, and other special pay.Calculating Drill Pay

Calculating drill pay can be complex, as it depends on several factors, including rank, time in service, and number of drills attended. The following is a general outline of how to calculate drill pay:

- Determine the member's rank and time in service.

- Determine the number of drills attended.

- Look up the drill pay rate for the member's rank and time in service.

- Multiply the drill pay rate by the number of drills attended.

- Add any special pay or allowances, such as BAH or BAS.

Drill Pay Examples

Here are a few examples of how drill pay can be calculated: * Example 1: An E-4 (Sergeant) with 6 years of service attends 12 drills per year. The drill pay rate for an E-4 with 6 years of service is $180.05 per drill. The total drill pay for the year would be $2,160.60 (12 drills x $180.05 per drill). * Example 2: An O-3 (Captain) with 10 years of service attends 12 drills per year. The drill pay rate for an O-3 with 10 years of service is $244.75 per drill. The total drill pay for the year would be $2,937.00 (12 drills x $244.75 per drill).National Guard Drill Pay Benefits

The National Guard drill pay benefits are numerous, including:

- Financial compensation for time spent training and drilling

- Opportunities for advancement and promotion

- Access to education and training benefits, such as the GI Bill

- Opportunities for deployment and travel

- Sense of pride and fulfillment from serving in the military

Drill Pay and Taxes

Drill pay is considered taxable income, and National Guard members must report their drill pay on their tax returns. The taxes owed on drill pay will depend on the member's tax bracket and other factors.National Guard Drill Pay and Retirement

The National Guard drill pay and retirement benefits are an important consideration for members who are planning for their future. The drill pay can be used to supplement retirement income, and the retirement benefits can provide a sense of security and stability.

Retirement Benefits

The National Guard retirement benefits include: * Pension: A monthly pension based on the member's rank and time in service. * Thrift Savings Plan: A retirement savings plan that allows members to contribute a portion of their drill pay to a retirement account. * Social Security: National Guard members may be eligible for Social Security benefits based on their drill pay.Gallery of National Guard Drill Pay Images

National Guard Drill Pay Image Gallery

In conclusion, the National Guard drill pay rates are an essential aspect of serving in the military. By understanding the drill pay rates and how they work, National Guard members can better plan their finances and make the most of their service. Whether you're a seasoned veteran or just starting your military career, it's crucial to stay up-to-date on the current drill pay rates and benefits. We invite you to share your thoughts and experiences with National Guard drill pay in the comments below. If you found this article informative, please share it with others who may be interested in learning more about National Guard drill pay rates.