Intro

Discover the National Guard pay rate and benefits in our comprehensive guide. Learn about the base pay chart, drill pay, and specialty pay for National Guard members. Understand how rank, time in service, and deployment impact your salary. Get the latest information on National Guard compensation and plan your military career.

Serving in the National Guard can be a rewarding and challenging experience, offering a chance to serve one's country, develop new skills, and earn a steady income. However, understanding the National Guard pay rate can be a complex task, with various factors influencing the amount of money a guardsman can earn. In this article, we will delve into the world of National Guard pay, exploring the different types of pay, how it is calculated, and what factors can impact earnings.

Understanding National Guard Pay

The National Guard is a reserve component of the US Armed Forces, consisting of citizen-soldiers who can be called upon to serve in a variety of roles, from combat to humanitarian missions. As a member of the National Guard, individuals can earn a steady income, which is based on their rank, time in service, and the type of duty they perform. National Guard pay is calculated using a complex formula, taking into account factors such as basic pay, allowances, and special pays.

Types of National Guard Pay

There are several types of pay that National Guard members can earn, including:

- Basic Pay: This is the standard pay rate for National Guard members, based on their rank and time in service.

- Allowances: These are additional forms of compensation, such as housing allowances, food allowances, and uniform allowances.

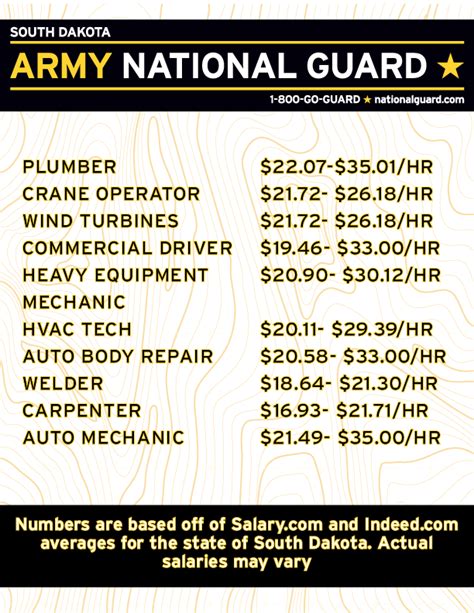

- Special Pays: These are additional forms of compensation for specific duties or skills, such as flying pay, diving pay, or hazardous duty pay.

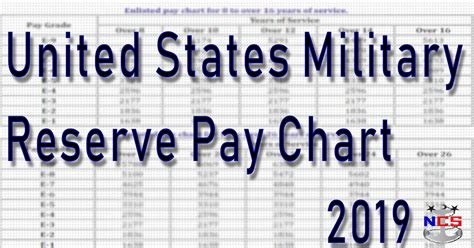

National Guard Pay Chart

The National Guard pay chart is a complex table that outlines the different pay rates for various ranks and time in service. The chart is based on the US military pay scale, which is updated annually. Here is a sample pay chart for the National Guard:

| Rank | Time in Service | Basic Pay |

|---|---|---|

| E-1 (Private) | 0-2 years | $1,733.10 |

| E-2 (Private First Class) | 0-2 years | $1,942.50 |

| E-3 (Specialist/Corporal) | 0-2 years | $2,054.70 |

| E-4 (Sergeant) | 0-2 years | $2,344.80 |

| E-5 (Staff Sergeant) | 0-2 years | $2,664.10 |

Note: These figures are based on the 2022 US military pay scale and may not reflect current pay rates.

How National Guard Pay is Calculated

National Guard pay is calculated using a complex formula, taking into account factors such as rank, time in service, and the type of duty performed. Here are the steps to calculate National Guard pay:

- Determine Rank and Time in Service: The first step is to determine the individual's rank and time in service.

- Determine Basic Pay: Using the pay chart, determine the basic pay rate for the individual's rank and time in service.

- Add Allowances: Add any applicable allowances, such as housing allowances or food allowances.

- Add Special Pays: Add any applicable special pays, such as flying pay or hazardous duty pay.

Factors that Impact National Guard Pay

There are several factors that can impact National Guard pay, including:

- Rank: Rank is a major factor in determining National Guard pay. Higher-ranking individuals earn more than lower-ranking individuals.

- Time in Service: Time in service is also a factor in determining National Guard pay. Individuals with more time in service earn more than those with less time in service.

- Type of Duty: The type of duty performed can also impact National Guard pay. For example, individuals who perform hazardous duty may earn more than those who do not.

- Location: Location can also impact National Guard pay. Individuals who serve in high-cost areas may earn more than those who serve in low-cost areas.

National Guard Pay vs. Active Duty Pay

National Guard pay is often compared to active duty pay, with many individuals wondering which is more lucrative. Here are some key differences:

- Pay Scale: The pay scale for National Guard members is the same as for active duty members.

- Pay Frequency: National Guard members are typically paid on a monthly basis, while active duty members are paid bi-weekly.

- Allowances: National Guard members may not receive the same allowances as active duty members, such as housing allowances or food allowances.

National Guard Pay Benefits

Serving in the National Guard offers a range of benefits, including:

- Education Benefits: The National Guard offers education benefits, such as the Montgomery GI Bill and the Army National Guard Kicker.

- Health Insurance: National Guard members are eligible for health insurance, including TRICARE and the Veterans Administration.

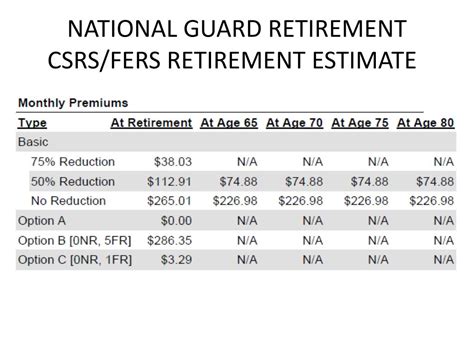

- Retirement Benefits: National Guard members are eligible for retirement benefits, including the Army National Guard Retirement System.

National Guard Pay Taxes

National Guard pay is taxable, and members must pay federal and state income taxes on their earnings. However, there are some tax benefits available to National Guard members, such as the Military Pay Exclusion.

National Guard Pay Raises

National Guard pay raises are typically tied to the federal budget, with pay raises occurring annually. However, pay raises can be impacted by a range of factors, including the state of the economy and the federal budget.

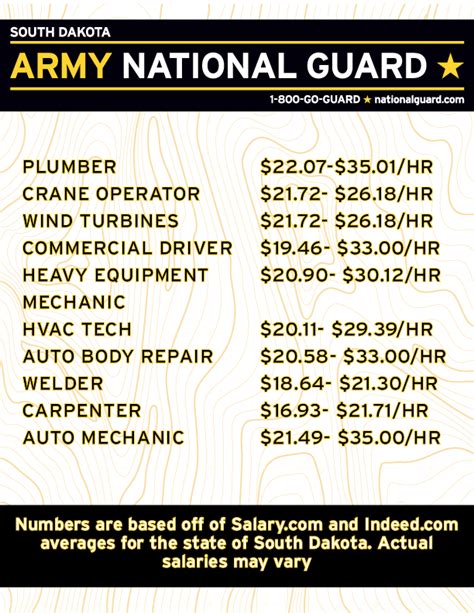

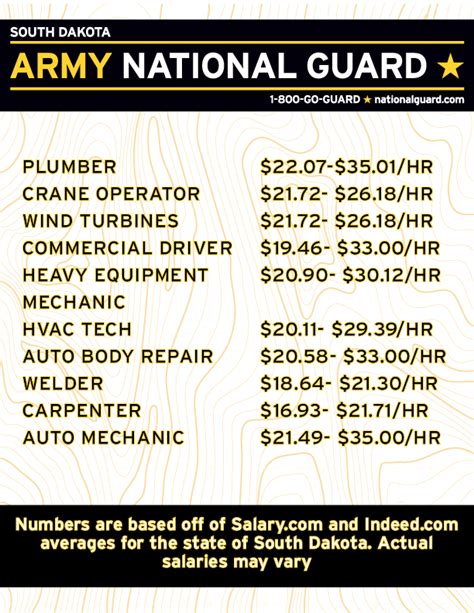

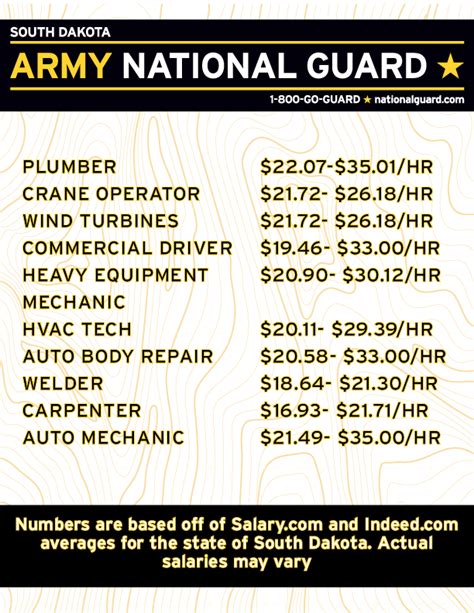

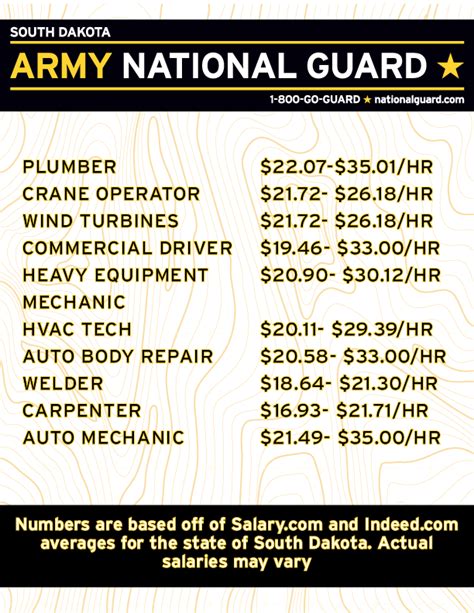

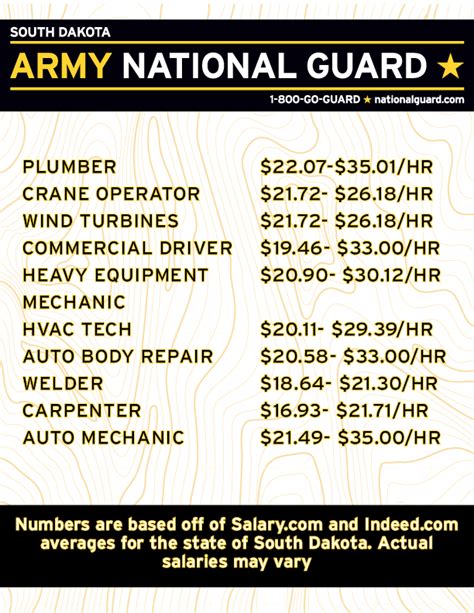

Gallery of National Guard Pay Images

National Guard Pay Image Gallery

Frequently Asked Questions

- Q: How is National Guard pay calculated? A: National Guard pay is calculated using a complex formula, taking into account factors such as rank, time in service, and the type of duty performed.

- Q: What is the difference between National Guard pay and active duty pay? A: National Guard pay is typically paid on a monthly basis, while active duty pay is paid bi-weekly. Additionally, National Guard members may not receive the same allowances as active duty members.

- Q: Do National Guard members pay taxes on their earnings? A: Yes, National Guard pay is taxable, and members must pay federal and state income taxes on their earnings.

Call to Action

If you're considering joining the National Guard, it's essential to understand the pay rate and benefits. We hope this comprehensive guide has provided you with the information you need to make an informed decision. If you have any further questions or would like to learn more about National Guard pay, please don't hesitate to comment below.