Intro

Discover how Navy BAH (Basic Allowance for Housing) can significantly impact your finances. Learn 5 essential ways BAH affects your budget, from reducing taxable income to increasing savings. Understand the nuances of BAH and optimize your financial planning to maximize your benefits and minimize debt.

Navy Basic Allowance for Housing (BAH) is a significant component of military compensation, designed to help offset the cost of housing for Navy personnel. While BAH can provide a substantial financial boost, it's essential to understand its implications on your overall finances. In this article, we'll delve into five ways Navy BAH can impact your finances and provide valuable insights to help you navigate these effects.

Understanding Navy BAH

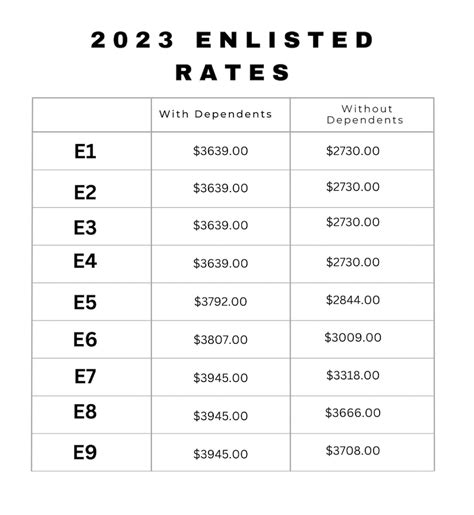

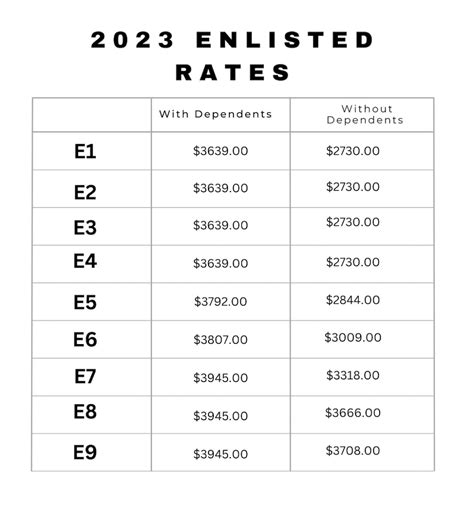

Before we dive into the financial implications of Navy BAH, it's crucial to understand what it entails. BAH is a tax-free allowance paid to Navy personnel to help cover housing expenses. The amount is based on the member's pay grade, dependency status, and the location of their duty station. BAH rates vary depending on the region, urban or rural, and can be adjusted annually.

BAH and Your Take-Home Pay

BAH can significantly impact your take-home pay, especially if you're not careful with your housing choices. On one hand, BAH can increase your overall compensation package, providing a higher standard of living. On the other hand, if you choose housing that exceeds the BAH rate, you may end up with higher out-of-pocket expenses. It's essential to find a balance between enjoying the benefits of BAH and managing your expenses wisely.

The Impact of BAH on Your Budget

BAH can have a substantial impact on your budget, and it's essential to understand these effects to make informed financial decisions. Here are a few ways BAH can influence your budget:

- Increased expenses: If you choose housing that exceeds the BAH rate, you may end up with higher out-of-pocket expenses, which can strain your budget.

- Opportunity costs: Spending more on housing due to BAH rates may limit your ability to save for other goals, such as retirement or large purchases.

- Credit score implications: Failing to manage BAH-related expenses can lead to debt and negatively impact your credit score.

Managing BAH-Related Expenses

To mitigate the potential negative effects of BAH on your budget, it's essential to manage your expenses carefully. Here are a few tips:

- Choose housing wisely: Select housing that aligns with the BAH rate for your area to avoid excessive out-of-pocket expenses.

- Create a budget: Track your income and expenses to ensure you're not overspending due to BAH.

- Prioritize savings: Allocate a portion of your BAH to savings and emergency funds to maintain a healthy financial safety net.

BAH and Your Tax Liability

As a tax-free allowance, BAH can have a significant impact on your tax liability. Here are a few key points to consider:

- Tax-free income: BAH is not subject to federal income tax, which can reduce your tax liability.

- State tax implications: Some states may tax BAH, while others exempt it. Understand your state's tax laws to plan accordingly.

- Impact on tax credits: BAH can affect your eligibility for certain tax credits, such as the Earned Income Tax Credit (EITC).

Minimizing Tax Liability

To minimize your tax liability, consider the following:

- Understand state tax laws: Familiarize yourself with your state's tax laws regarding BAH to plan accordingly.

- Consult a tax professional: A tax professional can help you navigate the complexities of BAH and tax liability.

- Take advantage of tax credits: Claim eligible tax credits, such as the Child Tax Credit, to reduce your tax liability.

BAH and Your Retirement Savings

BAH can also impact your retirement savings, particularly if you're not careful with your financial planning. Here are a few key considerations:

- Retirement account contributions: BAH can affect your eligibility for retirement account contributions, such as the Thrift Savings Plan (TSP).

- Matching contributions: Some retirement accounts offer matching contributions, which can be impacted by BAH.

- Retirement savings goals: BAH can influence your retirement savings goals, particularly if you're relying on it for a significant portion of your income.

Maximizing Retirement Savings

To maximize your retirement savings, consider the following:

- Understand retirement account rules: Familiarize yourself with the rules and regulations surrounding retirement accounts, such as the TSP.

- Contribute consistently: Make consistent contributions to your retirement accounts to take advantage of compound interest.

- Diversify your income: Diversify your income streams to reduce reliance on BAH and ensure a more stable retirement.

BAH and Your Home Buying Decisions

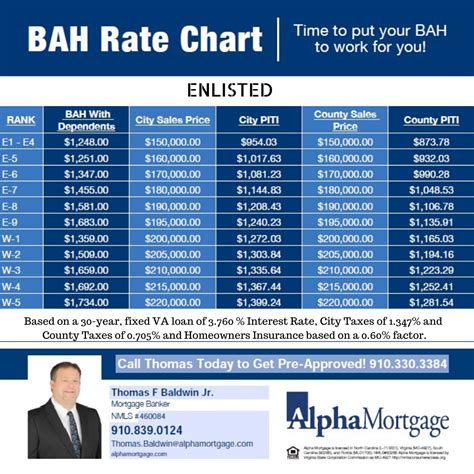

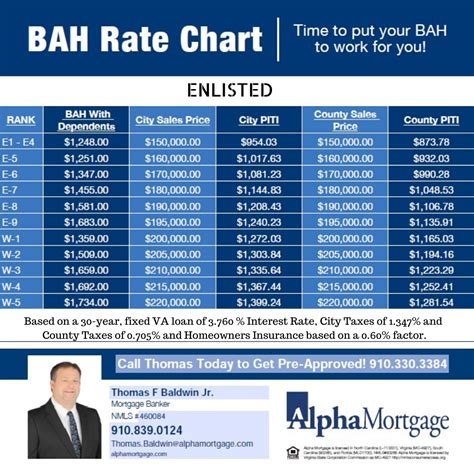

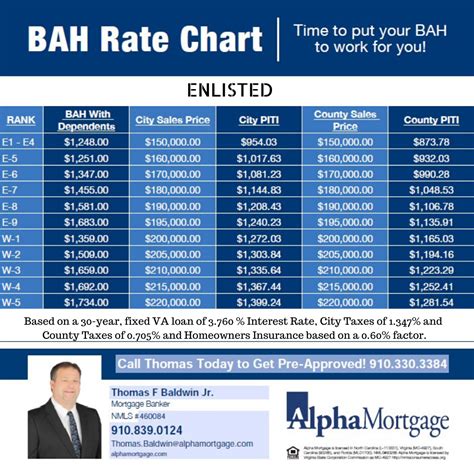

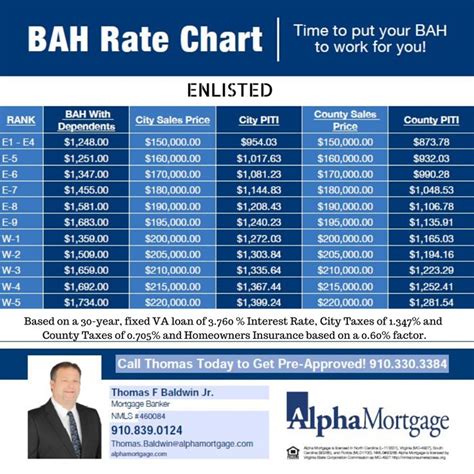

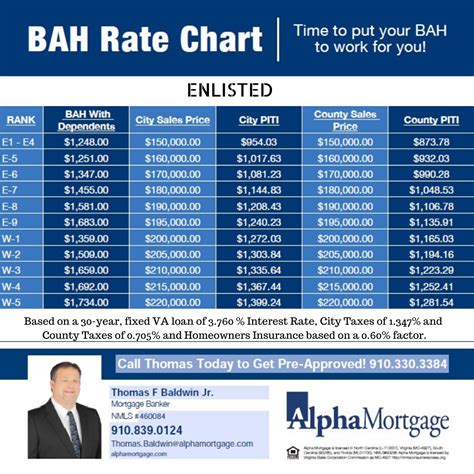

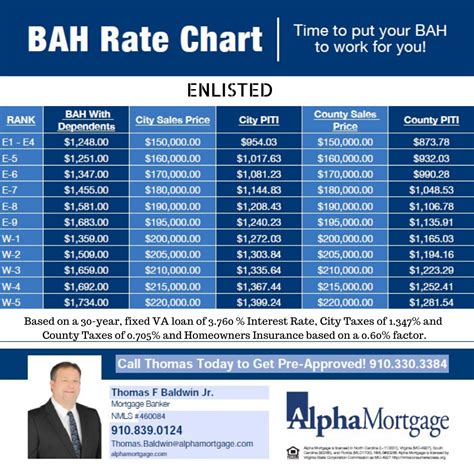

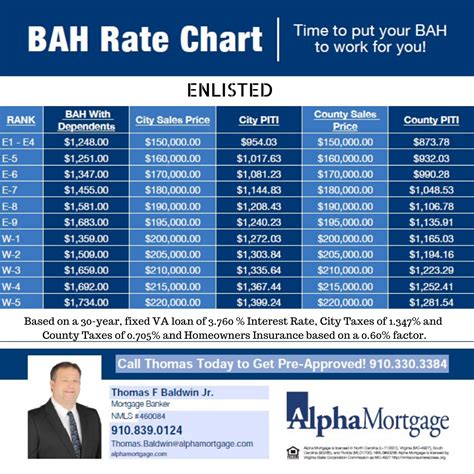

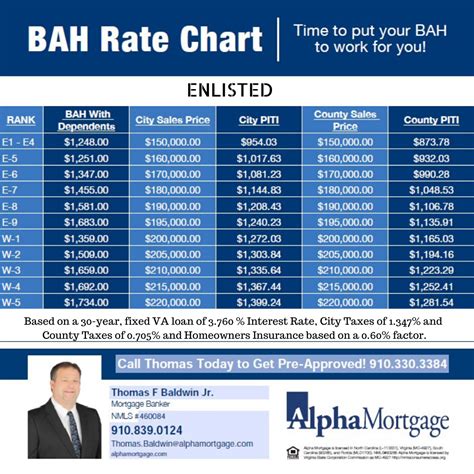

Finally, BAH can also impact your home buying decisions, particularly if you're considering purchasing a home near your duty station. Here are a few key considerations:

- BAH rates: BAH rates can affect the affordability of homes in your area.

- Housing market fluctuations: BAH can influence housing market fluctuations, particularly in areas with high concentrations of military personnel.

- Home buying goals: BAH can impact your home buying goals, particularly if you're relying on it for a significant portion of your income.

Making Informed Home Buying Decisions

To make informed home buying decisions, consider the following:

- Research local housing markets: Understand the local housing market, including BAH rates and market fluctuations.

- Consult a real estate expert: A real estate expert can help you navigate the complexities of home buying in a military-influenced market.

- Prioritize your goals: Prioritize your home buying goals and consider factors beyond BAH, such as your long-term career plans and family needs.

Navy BAH Image Gallery

As you can see, Navy BAH can have a significant impact on your finances, from your take-home pay and budget to your tax liability and retirement savings. By understanding the implications of BAH and making informed financial decisions, you can maximize the benefits of this allowance and achieve your long-term financial goals.

We hope this article has provided valuable insights into the world of Navy BAH and its financial implications. Share your thoughts and experiences with us in the comments below, and don't forget to share this article with your fellow Navy personnel to help them navigate the complexities of BAH.