Discover expert 5 Navy Credit Union Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions about Navy Federal loans, credit union benefits, and personal finance management.

As a member of the Navy Credit Union, you have access to a wide range of financial products and services designed to help you achieve your financial goals. One of the most popular services offered by the Navy Credit Union is its loan program, which provides members with competitive interest rates and flexible repayment terms. Whether you're looking to purchase a new car, consolidate debt, or finance a home improvement project, a Navy Credit Union loan can be a great option. In this article, we'll provide you with five tips to help you get the most out of your Navy Credit Union loan.

The Navy Credit Union has been serving its members for over 80 years, providing them with a safe and secure place to save and borrow money. With over 8 million members and more than $100 billion in assets, the Navy Credit Union is one of the largest and most stable credit unions in the world. Its loan program is designed to help members achieve their financial goals, whether that's purchasing a new home, financing a car, or covering unexpected expenses. By following these five tips, you can make the most of your Navy Credit Union loan and achieve financial success.

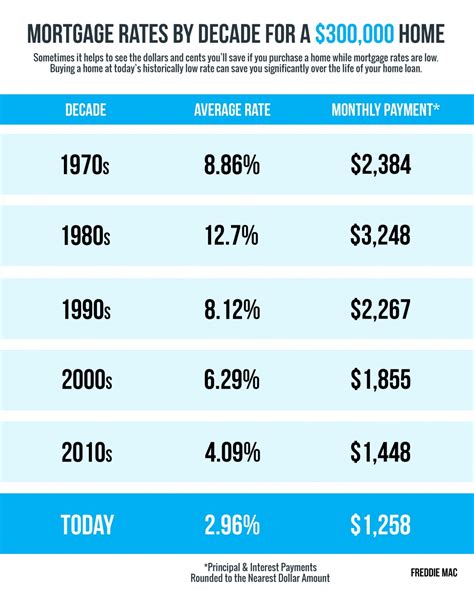

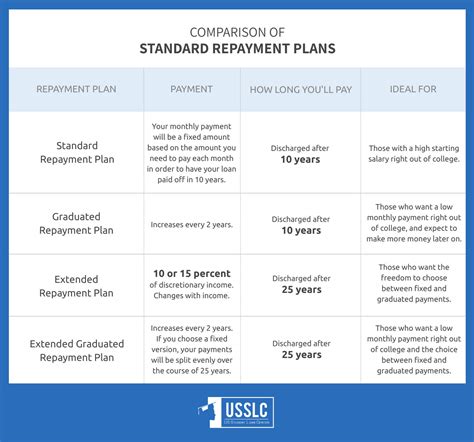

Loans can be a great way to achieve your financial goals, but they can also be intimidating if you're not familiar with the process. That's why it's essential to do your research and understand the terms and conditions of your loan before you apply. The Navy Credit Union offers a range of loan products, including personal loans, auto loans, and home loans, each with its own set of benefits and requirements. By understanding the different types of loans available and how they work, you can make an informed decision and choose the loan that's right for you.

Understanding Your Loan Options

Benefits of Navy Credit Union Loans

The Navy Credit Union offers a range of benefits to its members, including competitive interest rates, flexible repayment terms, and personalized service. With a Navy Credit Union loan, you can enjoy lower interest rates and fees compared to traditional banks and lenders. You'll also have access to a range of repayment options, including online payments, mobile payments, and automatic transfers. Additionally, the Navy Credit Union offers personalized service, with a team of experienced loan officers available to help you every step of the way.Applying for a Navy Credit Union Loan

Required Documents

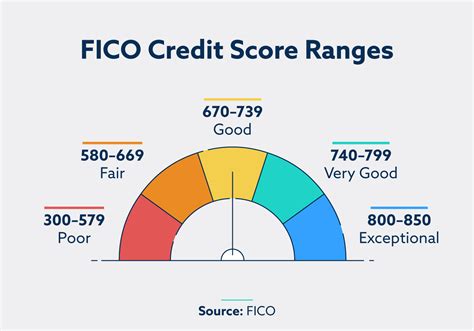

When applying for a Navy Credit Union loan, you'll need to provide several documents to support your application. These may include: * A valid government-issued ID, such as a driver's license or passport * Proof of income, such as a pay stub or W-2 form * Proof of employment, such as a letter from your employer * Proof of address, such as a utility bill or lease agreement * Your credit report and credit scoreManaging Your Loan

Payment Options

The Navy Credit Union offers several payment options to make it easy to manage your loan. These include: * Online payments: You can make payments online through the Navy Credit Union's website or mobile app. * Mobile payments: You can make payments using your mobile device, either through the Navy Credit Union's app or through services like Apple Pay or Google Pay. * Automatic transfers: You can set up automatic transfers from your checking or savings account to make payments. * Phone payments: You can make payments over the phone by calling the Navy Credit Union's customer service number. * In-person payments: You can make payments in person at a Navy Credit Union branch.Tips for Repaying Your Loan

Common Mistakes to Avoid

When repaying your Navy Credit Union loan, there are several common mistakes to avoid. These include: * Missing payments: Missing payments can result in late fees and negative credit reporting. * Making late payments: Making late payments can result in late fees and negative credit reporting. * Underpaying: Underpaying can result in late fees and negative credit reporting. * Not monitoring your account: Not monitoring your account can result in unexpected fees and charges.Conclusion and Next Steps

Final Thoughts

We hope this article has provided you with a comprehensive overview of Navy Credit Union loans and how to make the most of them. Remember to always do your research, read reviews, and talk to a loan officer before applying for a loan. With the right loan and a solid repayment plan, you can achieve your financial goals and enjoy a brighter financial future.Navy Credit Union Loan Image Gallery

We invite you to share your thoughts and experiences with Navy Credit Union loans in the comments below. If you have any questions or need further guidance, don't hesitate to reach out. You can also share this article with friends and family who may be considering a Navy Credit Union loan. By working together, we can achieve financial success and enjoy a brighter financial future.