Get current Navy FCU mortgage rates today, including VA loans, refinancing, and home equity options, with competitive APRs and flexible terms for military members and their families.

As a homeowner or a potential buyer, it's essential to stay informed about the current mortgage rates. Navy Federal Credit Union (NFCU) is one of the largest and most reputable credit unions in the world, offering a wide range of mortgage products to its members. In this article, we will delve into the world of Navy FCU mortgage rates, exploring the current rates, benefits, and factors that affect them.

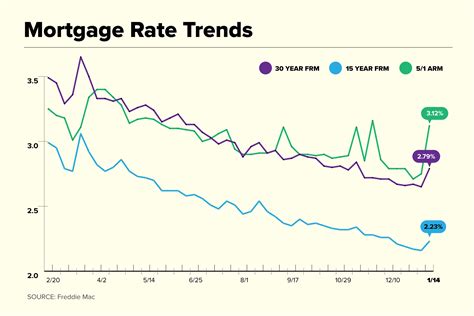

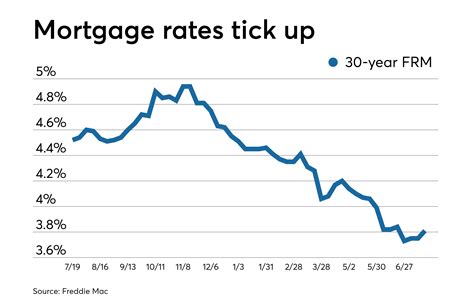

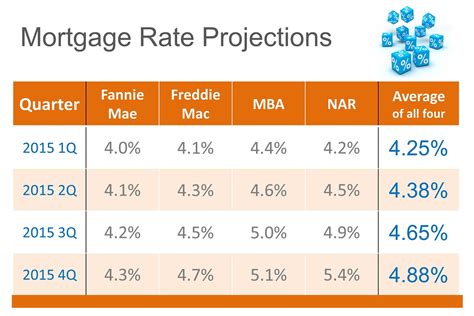

The mortgage market is constantly fluctuating, and rates can change daily. As of today, Navy FCU mortgage rates are competitive, offering borrowers a range of options to suit their needs. Whether you're a first-time buyer, a seasoned homeowner, or an investor, understanding the current mortgage rates is crucial in making informed decisions. With the ever-changing landscape of the mortgage market, it's essential to stay up-to-date with the latest rates and trends.

Mortgage rates can significantly impact the overall cost of a loan, and even a small difference in rates can save you thousands of dollars over the life of the loan. Navy FCU offers a variety of mortgage products, including fixed-rate and adjustable-rate loans, jumbo loans, and government-backed loans. Each product has its unique features, benefits, and rates, which we will explore in more detail later. By understanding the current mortgage rates and the factors that affect them, you can make a more informed decision when choosing a mortgage product that suits your needs.

Navy FCU Mortgage Rates Overview

Navy FCU mortgage rates are influenced by various factors, including the state of the economy, inflation, and monetary policy. The credit union offers a range of mortgage products, each with its unique features and benefits. Some of the most popular mortgage products offered by Navy FCU include:

- Fixed-rate mortgages: These loans offer a fixed interest rate for the entire term of the loan, providing borrowers with predictable monthly payments.

- Adjustable-rate mortgages: These loans offer an initial fixed interest rate, which can adjust periodically based on market conditions.

- Jumbo loans: These loans are designed for borrowers who need to finance larger loan amounts, often with more flexible terms and conditions.

- Government-backed loans: These loans are insured by government agencies, such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), offering more lenient credit score requirements and lower down payments.

Factors Affecting Navy FCU Mortgage Rates

The mortgage rates offered by Navy FCU are influenced by a range of factors, including:- Economic conditions: The state of the economy, including inflation, employment rates, and GDP growth, can impact mortgage rates.

- Monetary policy: The actions of central banks, such as the Federal Reserve, can influence mortgage rates by adjusting interest rates and regulating the money supply.

- Market conditions: The demand for mortgage-backed securities, the level of investor confidence, and the overall health of the housing market can all impact mortgage rates.

- Credit score: Borrowers with higher credit scores can qualify for lower mortgage rates, as they are considered less risky by lenders.

- Loan-to-value ratio: The loan-to-value ratio, which is the percentage of the loan amount compared to the value of the property, can also impact mortgage rates.

Navy FCU Mortgage Products

Navy FCU offers a range of mortgage products to suit the needs of its members. Some of the most popular products include:

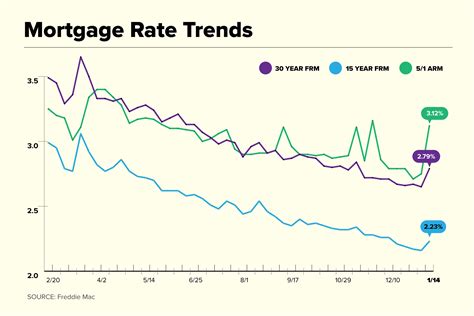

- 30-year fixed-rate mortgage: This loan offers a fixed interest rate for the entire 30-year term, providing borrowers with predictable monthly payments.

- 15-year fixed-rate mortgage: This loan offers a fixed interest rate for the entire 15-year term, allowing borrowers to pay off their loan faster and save on interest.

- 5/1 adjustable-rate mortgage: This loan offers an initial fixed interest rate for the first five years, which can adjust periodically based on market conditions.

- VA loan: This loan is designed for eligible veterans, active-duty military personnel, and surviving spouses, offering more lenient credit score requirements and lower down payments.

- FHA loan: This loan is designed for borrowers who may not qualify for conventional loans, offering more flexible credit score requirements and lower down payments.

Benefits of Navy FCU Mortgage Rates

Navy FCU mortgage rates offer a range of benefits to borrowers, including:- Competitive rates: Navy FCU offers competitive mortgage rates, which can help borrowers save on interest and reduce their monthly payments.

- Flexible terms: Navy FCU offers a range of mortgage products with flexible terms, allowing borrowers to choose the loan that best suits their needs.

- Low fees: Navy FCU offers low fees and charges, which can help borrowers save on upfront costs.

- Personalized service: Navy FCU offers personalized service to its members, providing them with expert guidance and support throughout the mortgage process.

Navy FCU Mortgage Application Process

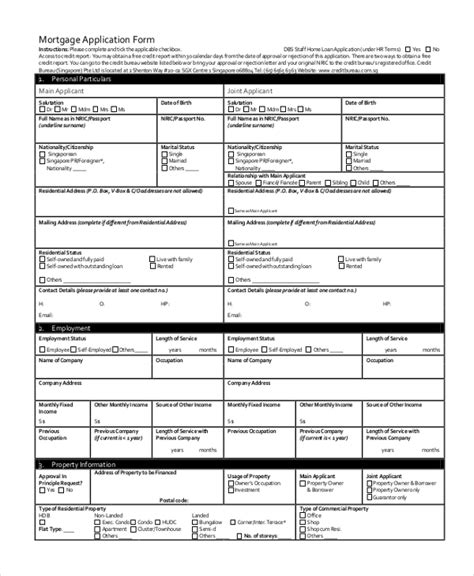

The mortgage application process at Navy FCU is designed to be straightforward and efficient. Here are the steps involved:

- Pre-approval: Borrowers can apply for pre-approval, which provides them with an estimate of how much they can borrow.

- Application: Borrowers can submit their mortgage application, either online or in-person, providing required documentation, such as income verification and credit reports.

- Processing: The mortgage application is processed, and the borrower's creditworthiness is evaluated.

- Approval: The borrower receives approval, and the loan is finalized.

- Closing: The borrower signs the loan documents, and the loan is disbursed.

Tips for Getting the Best Navy FCU Mortgage Rates

To get the best Navy FCU mortgage rates, borrowers should:- Check their credit score: A higher credit score can qualify borrowers for lower mortgage rates.

- Compare rates: Borrowers should compare rates from different lenders to find the best deal.

- Consider a shorter loan term: A shorter loan term can result in lower interest payments over the life of the loan.

- Make a larger down payment: A larger down payment can reduce the loan-to-value ratio, resulting in lower mortgage rates.

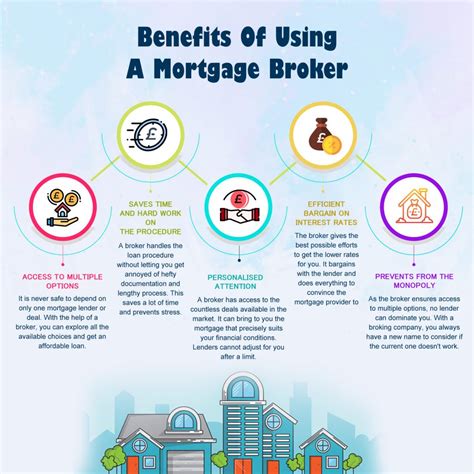

- Work with a mortgage broker: A mortgage broker can help borrowers navigate the mortgage process and find the best rates.

Navy FCU Mortgage Rates FAQs

Here are some frequently asked questions about Navy FCU mortgage rates:

- What are the current Navy FCU mortgage rates?

- How do I apply for a mortgage with Navy FCU?

- What are the benefits of choosing a Navy FCU mortgage?

- How do I qualify for the best Navy FCU mortgage rates?

- Can I refinance my existing mortgage with Navy FCU?

Gallery of Navy FCU Mortgage Rates

Navy FCU Mortgage Rates Image Gallery

In conclusion, Navy FCU mortgage rates are competitive and offer a range of benefits to borrowers. By understanding the current mortgage rates, the factors that affect them, and the benefits of choosing a Navy FCU mortgage, borrowers can make informed decisions when selecting a mortgage product. Whether you're a first-time buyer or a seasoned homeowner, Navy FCU has a range of mortgage products to suit your needs. We invite you to share your thoughts and experiences with Navy FCU mortgage rates in the comments below. If you found this article helpful, please share it with your friends and family who may be in the market for a new mortgage.