Discover Navy Federal pay dates, including active duty, reserve, and retirement pay schedules, with related information on direct deposit, pay charts, and benefits to help plan finances effectively.

The importance of knowing pay dates cannot be overstated, especially for individuals who rely on a regular income to manage their finances effectively. For members of the Navy Federal Credit Union, staying informed about pay dates is crucial for planning and budgeting. Navy Federal Credit Union is one of the largest credit unions in the world, serving military personnel, veterans, and their families. It offers a wide range of financial services, including banking, loans, and credit cards. Understanding the pay schedule is essential for managing one's financial obligations, savings, and investments.

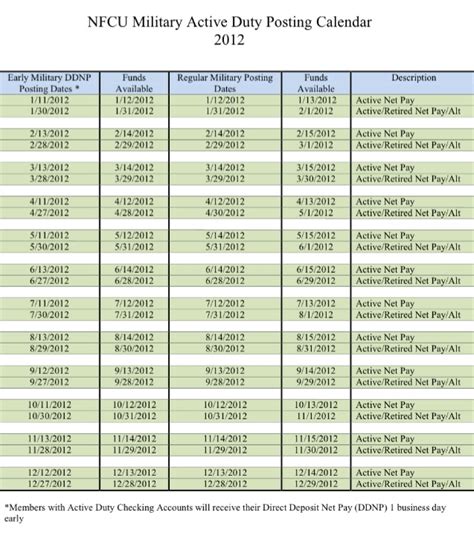

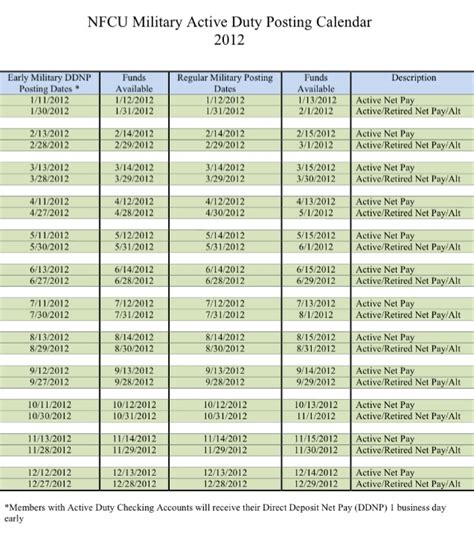

Navy Federal pay dates are typically aligned with the pay schedules of the military and government agencies. The pay dates can vary depending on the specific pay period and the type of pay an individual receives. Generally, active-duty military personnel, retirees, and annuitants can expect to receive their pay on the 1st and 15th of each month. However, there are instances where pay dates may be adjusted due to holidays or other factors. It's essential for individuals to stay informed about any changes to the pay schedule to avoid any financial disruptions.

The significance of knowing Navy Federal pay dates extends beyond just personal financial management. It also plays a critical role in the overall financial stability of the credit union. By providing its members with a reliable and predictable pay schedule, Navy Federal Credit Union helps to promote financial discipline and responsibility. This, in turn, contributes to the credit union's overall mission of serving the financial needs of its members. As the credit union continues to grow and expand its services, the importance of maintaining a transparent and consistent pay schedule will only continue to increase.

Navy Federal Pay Schedule

The Navy Federal pay schedule is designed to provide members with a clear and predictable pay cycle. The pay schedule is typically as follows:

- Pay date: 1st of the month

- Pay date: 15th of the month It's worth noting that these pay dates may be adjusted if they fall on a weekend or federal holiday. In such cases, the pay date will be moved to the preceding business day. For example, if the 1st of the month falls on a Sunday, the pay date will be the preceding Friday.

Understanding Pay Cycles

The pay cycle refers to the period between pay dates. For Navy Federal members, the pay cycle is typically 14 days. This means that from the 1st of the month to the 15th, and from the 15th to the 1st of the following month, members can expect to receive their pay on the designated pay dates. Understanding the pay cycle is essential for managing finances effectively, as it allows individuals to plan and budget accordingly.Factors Affecting Pay Dates

Several factors can affect Navy Federal pay dates, including holidays, weekends, and changes to the pay schedule. It's essential for members to stay informed about any changes to the pay schedule to avoid any financial disruptions. Some of the factors that can affect pay dates include:

- Holidays: If a pay date falls on a federal holiday, the pay date will be moved to the preceding business day.

- Weekends: If a pay date falls on a weekend, the pay date will be moved to the preceding Friday.

- Changes to the pay schedule: The credit union may adjust the pay schedule due to various reasons, such as system updates or changes in government policies.

Staying Informed

To stay informed about Navy Federal pay dates, members can: - Check the credit union's website for updates on pay dates and any changes to the pay schedule. - Sign up for email notifications to receive alerts about pay dates and any changes to the pay schedule. - Contact the credit union's customer service department for assistance with pay-related inquiries.Managing Finances Effectively

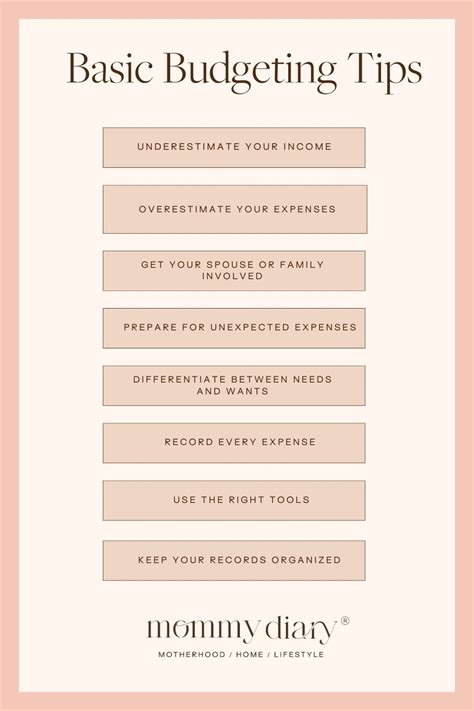

Managing finances effectively is crucial for achieving financial stability and security. By understanding the Navy Federal pay schedule and staying informed about any changes to the pay schedule, members can plan and budget accordingly. Some tips for managing finances effectively include:

- Creating a budget: Develop a budget that takes into account income, expenses, and savings.

- Prioritizing expenses: Prioritize essential expenses, such as rent, utilities, and groceries, over discretionary expenses.

- Building an emergency fund: Save for unexpected expenses, such as car repairs or medical bills.

Avoiding Financial Pitfalls

To avoid financial pitfalls, members should: - Avoid overspending: Avoid spending more than what is earned, as this can lead to debt and financial instability. - Avoid late payments: Make payments on time to avoid late fees and negative credit reporting. - Monitor credit reports: Monitor credit reports regularly to ensure accuracy and detect any signs of identity theft.Navy Federal Credit Union Services

Navy Federal Credit Union offers a wide range of financial services, including:

- Banking: Checking and savings accounts, certificates, and IRAs.

- Loans: Personal loans, auto loans, mortgages, and credit cards.

- Investments: Brokerage services, retirement accounts, and investment advice.

- Insurance: Auto, home, and life insurance.

Benefits of Membership

The benefits of membership with Navy Federal Credit Union include: - Competitive rates: Competitive rates on loans and deposits. - Low fees: Low or no fees on banking services. - Personalized service: Personalized service from experienced financial professionals. - Financial education: Financial education and resources to help members achieve financial stability and security.Financial Planning and Budgeting

Financial planning and budgeting are essential for achieving financial stability and security. By creating a budget and prioritizing expenses, members can manage their finances effectively and achieve their financial goals. Some tips for financial planning and budgeting include:

- Assessing financial goals: Identify short-term and long-term financial goals.

- Tracking expenses: Track expenses to understand where money is being spent.

- Creating a budget: Develop a budget that takes into account income, expenses, and savings.

Retirement Planning

Retirement planning is an essential aspect of financial planning. By starting to save for retirement early, members can ensure a comfortable retirement and achieve financial stability and security. Some tips for retirement planning include: - Starting early: Start saving for retirement as early as possible. - Contributing regularly: Contribute regularly to a retirement account. - Diversifying investments: Diversify investments to minimize risk and maximize returns.Investment Options

Navy Federal Credit Union offers a wide range of investment options, including:

- Brokerage services: Brokerage services for stocks, bonds, and mutual funds.

- Retirement accounts: Retirement accounts, such as IRAs and 401(k)s.

- Investment advice: Investment advice from experienced financial professionals.

Risk Management

Risk management is an essential aspect of investing. By understanding the risks associated with investing, members can make informed investment decisions and minimize losses. Some tips for risk management include: - Diversifying investments: Diversify investments to minimize risk and maximize returns. - Understanding risk tolerance: Understand personal risk tolerance and adjust investments accordingly. - Monitoring investments: Monitor investments regularly to ensure they are aligned with financial goals.Navy Federal Pay Dates Image Gallery

In conclusion, understanding Navy Federal pay dates is essential for managing finances effectively and achieving financial stability and security. By staying informed about pay dates and any changes to the pay schedule, members can plan and budget accordingly. Navy Federal Credit Union offers a wide range of financial services, including banking, loans, investments, and insurance. By taking advantage of these services and following tips for financial planning and budgeting, members can achieve their financial goals and secure their financial future. We invite you to share your thoughts and experiences with Navy Federal pay dates and financial management in the comments below. Additionally, feel free to share this article with others who may benefit from this information, and don't hesitate to reach out if you have any further questions or concerns.