As a member of Navy Federal Credit Union, having access to a wide network of ATMs is crucial for managing your finances on the go. With thousands of ATMs available across the United States and abroad, Navy Federal provides its members with the convenience and flexibility they need to conduct their banking transactions. In this article, we will delve into the world of Navy Federal ATMs, exploring five valuable tips that will help you make the most out of this service.

Using Navy Federal ATMs can save you money on fees, provide you with easy access to your accounts, and offer a secure way to manage your finances. Whether you are a frequent traveler or someone who prefers the convenience of banking from your local ATM, understanding how to use Navy Federal ATMs effectively is essential. From avoiding fees to ensuring the security of your transactions, we will cover it all. So, let's dive into the first tip and explore the benefits and features of Navy Federal ATMs.

Understanding Navy Federal ATM Fees

One of the most significant advantages of using Navy Federal ATMs is the potential to save on fees. As a member, you have access to a vast network of fee-free ATMs, including those operated by Navy Federal itself, as well as participating networks like CO-OP. Understanding how ATM fees work and how to avoid them can save you a significant amount of money over time. For instance, out-of-network ATM fees can range from $2 to $5 per transaction, depending on the ATM operator and your account type. By sticking to in-network ATMs or using the Navy Federal ATM locator tool to find fee-free ATMs near you, you can avoid these unnecessary charges.

Locating Navy Federal ATMs

Finding a Navy Federal ATM is easier than you think. The credit union offers a convenient ATM locator tool on its website and mobile app, allowing you to search for ATMs by location, zip code, or even by using your device's GPS. This tool not only helps you find the nearest Navy Federal ATM but also provides you with directions on how to get there. Additionally, you can filter your search by selecting specific services, such as deposit-taking ATMs or those with audio assistance for visually impaired members. By having easy access to this information, you can plan your banking activities more efficiently, whether you are at home, in the office, or traveling.

Security Measures for Navy Federal ATMs

Security is a top priority when it comes to banking, and Navy Federal ATMs are equipped with various measures to protect your transactions. From PIN encryption to secure network connections, every aspect of the ATM experience is designed to safeguard your financial information. Additionally, Navy Federal employs robust monitoring systems to detect and prevent fraudulent activities, ensuring that your accounts remain secure. It's also important for members to play their part in maintaining security, such as covering the keypad when entering their PIN and being cautious of their surroundings when using an ATM.

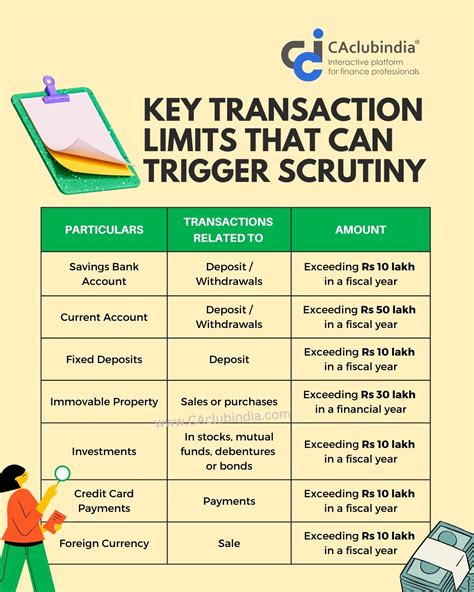

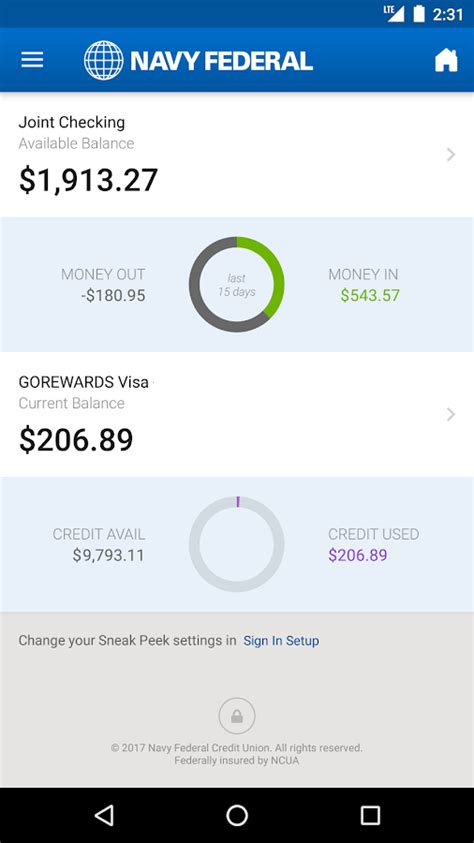

Transaction Limits and Types

Understanding the transaction limits and types available at Navy Federal ATMs is crucial for managing your finances effectively. Whether you need to withdraw cash, deposit funds, or check your account balance, Navy Federal ATMs offer a range of services designed to meet your banking needs. Each account type has its specific transaction limits, which can vary from $500 to $3,000 per day for withdrawals, depending on the account and your membership status. It's essential to familiarize yourself with these limits to avoid any inconvenience or additional fees. Moreover, some ATMs may offer advanced services like depositing checks or transferring funds between accounts, making them a one-stop solution for your banking requirements.

Benefits of Using Navy Federal ATMs

The benefits of using Navy Federal ATMs are numerous, ranging from convenience and cost savings to enhanced security and accessibility. By utilizing the ATM network effectively, members can enjoy a more streamlined banking experience, with the ability to perform a variety of transactions at any time and from virtually any location. This flexibility is particularly beneficial for those with busy schedules or who live far from a branch. Additionally, the wide reach of the Navy Federal ATM network means that whether you are serving abroad, traveling for leisure, or simply need to bank outside of regular business hours, you have the tools and resources necessary to manage your finances with ease.

Additional Tips for Maximizing Navy Federal ATM Benefits

To get the most out of Navy Federal ATMs, consider the following additional tips:

- Always check your account balances regularly to ensure you have sufficient funds for your transactions.

- Keep your ATM card and PIN secure to prevent unauthorized access to your accounts.

- Take advantage of the Navy Federal mobile app to locate ATMs, check balances, and perform other banking tasks on the go.

- Be aware of your daily transaction limits to avoid declined transactions or unnecessary fees.

- Use the ATM locator tool to find ATMs that offer deposit services if you need to make a deposit.

Navy Federal ATM Image Gallery

In conclusion, leveraging the full potential of Navy Federal ATMs can significantly enhance your banking experience, offering convenience, security, and cost savings. By understanding the benefits, transaction limits, and security measures of these ATMs, you can better manage your finances and make the most out of your Navy Federal membership. Whether you are a long-time member or just joining, taking the time to learn about and utilize the ATM network effectively can lead to a more streamlined and efficient banking experience. We invite you to share your experiences with Navy Federal ATMs, ask questions, or provide tips of your own in the comments below. Your insights can help others navigate the world of Navy Federal banking and make informed decisions about their financial management.