Explore Navy Federal auto finance options, including car loans, refinancing, and leasing, with competitive rates and flexible terms, ideal for military personnel and veterans seeking affordable vehicle financing solutions.

The world of auto finance can be overwhelming, with numerous options and complex terminology that can leave even the most informed consumers feeling uncertain. However, for members of the Navy Federal Credit Union, the process of financing a new or used vehicle can be significantly simplified. As one of the largest and most reputable credit unions in the world, Navy Federal offers a range of auto finance options that cater to the diverse needs of its members. In this article, we will delve into the details of Navy Federal's auto finance options, exploring the benefits, features, and requirements of each, to help you make an informed decision when it comes to financing your next vehicle.

Navy Federal's commitment to providing exceptional service and competitive rates has earned it a reputation as a trusted financial partner for military personnel, veterans, and their families. With a wide range of auto finance options available, members can choose the plan that best suits their budget, lifestyle, and financial goals. From new and used car loans to refinancing and lease buyouts, Navy Federal's auto finance options are designed to provide flexibility, convenience, and value. Whether you're a first-time car buyer or a seasoned veteran of the auto finance process, Navy Federal's expert team is dedicated to guiding you every step of the way, ensuring that you secure the best possible deal on your vehicle.

The importance of choosing the right auto finance option cannot be overstated. With the average cost of a new vehicle exceeding $30,000, and used cars often requiring significant upfront payments, the financial implications of a poorly chosen finance plan can be severe. By understanding the different auto finance options available through Navy Federal, members can avoid common pitfalls, such as high interest rates, excessive fees, and unrealistic repayment terms. Instead, they can enjoy the benefits of competitive rates, flexible repayment plans, and personalized service, all of which can help to reduce stress, save money, and ensure a smooth, hassle-free car-buying experience.

Navy Federal Auto Loan Options

Navy Federal's auto loan options are designed to provide members with the flexibility and convenience they need to finance their dream vehicle. With competitive rates, flexible repayment terms, and personalized service, members can choose from a range of plans that cater to their unique needs and financial goals. Some of the key features of Navy Federal's auto loan options include:

- Competitive interest rates: Navy Federal offers some of the most competitive interest rates in the industry, helping members save money on their auto loan.

- Flexible repayment terms: Members can choose from a range of repayment terms, including 36, 48, 60, and 72 months, to ensure that their monthly payments fit comfortably within their budget.

- No prepayment penalties: Navy Federal does not charge prepayment penalties, allowing members to pay off their loan early without incurring additional fees.

- Personalized service: Navy Federal's expert team is dedicated to providing personalized service, guiding members through the auto finance process and ensuring that they secure the best possible deal on their vehicle.

Types of Auto Loans

Navy Federal offers a range of auto loan options, including: * New car loans: Designed for members who are purchasing a new vehicle, these loans offer competitive interest rates and flexible repayment terms. * Used car loans: For members who are purchasing a used vehicle, these loans provide competitive interest rates and flexible repayment terms, with loan amounts available up to $50,000. * Refinance loans: Members who are currently financing a vehicle through another lender can refinance their loan through Navy Federal, potentially saving money on interest rates and fees. * Lease buyout loans: For members who are nearing the end of their lease and wish to purchase their vehicle, these loans provide a convenient and affordable way to do so.Navy Federal Auto Loan Benefits

Navy Federal's auto loan options offer a range of benefits that can help members save money, reduce stress, and enjoy a smooth, hassle-free car-buying experience. Some of the key benefits of Navy Federal's auto loan options include:

- Competitive interest rates: Navy Federal's competitive interest rates can help members save money on their auto loan, reducing the overall cost of financing their vehicle.

- Flexible repayment terms: Members can choose from a range of repayment terms, ensuring that their monthly payments fit comfortably within their budget.

- Personalized service: Navy Federal's expert team is dedicated to providing personalized service, guiding members through the auto finance process and ensuring that they secure the best possible deal on their vehicle.

- No prepayment penalties: Navy Federal does not charge prepayment penalties, allowing members to pay off their loan early without incurring additional fees.

How to Apply for a Navy Federal Auto Loan

Applying for a Navy Federal auto loan is a straightforward process that can be completed online, by phone, or in person at a Navy Federal branch. To apply, members will need to provide some basic information, including: * Personal and financial information * Vehicle information, including the make, model, and year of the vehicle * Employment and income information * Credit information, including credit score and historyNavy Federal Auto Loan Rates

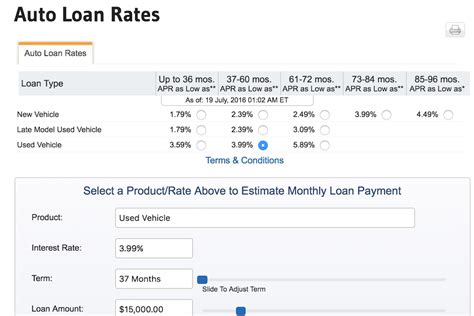

Navy Federal's auto loan rates are competitive and designed to help members save money on their auto loan. Rates vary depending on the type of loan, the loan amount, and the member's credit score and history. Some of the current rates offered by Navy Federal include:

- New car loans: 2.99% - 18.00% APR

- Used car loans: 3.49% - 18.00% APR

- Refinance loans: 3.99% - 18.00% APR

- Lease buyout loans: 4.49% - 18.00% APR

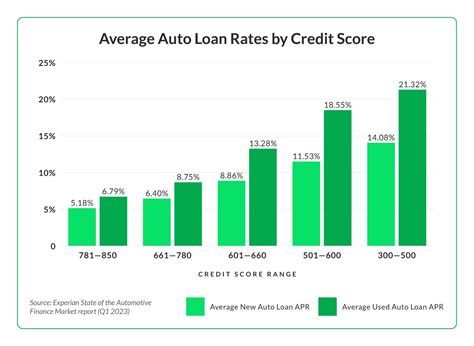

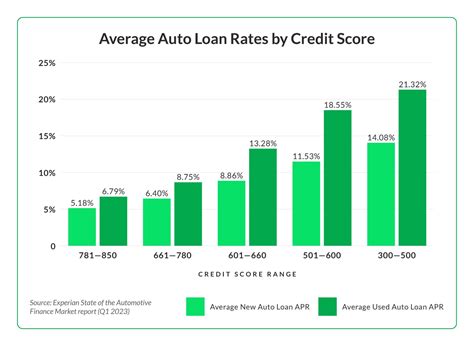

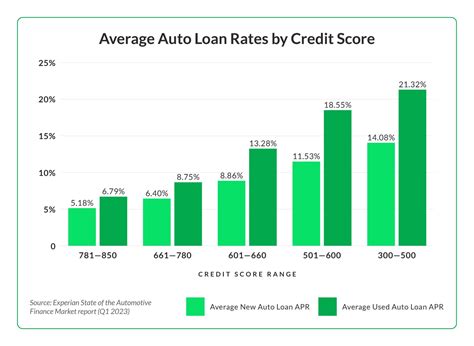

Factors That Affect Auto Loan Rates

A range of factors can affect the interest rate offered on a Navy Federal auto loan, including: * Credit score and history: Members with excellent credit scores and histories may qualify for lower interest rates. * Loan amount: Larger loan amounts may be subject to higher interest rates. * Loan term: Longer loan terms may be subject to higher interest rates. * Vehicle type: The type of vehicle being financed can affect the interest rate, with some vehicles qualifying for lower rates than others.Navy Federal Auto Loan Calculator

Navy Federal's auto loan calculator is a convenient tool that allows members to estimate their monthly payments and determine how much they can afford to borrow. The calculator takes into account a range of factors, including the loan amount, interest rate, and loan term, to provide an accurate estimate of the monthly payment. By using the calculator, members can:

- Determine how much they can afford to borrow

- Estimate their monthly payments

- Compare different loan options and interest rates

- Make informed decisions about their auto loan

How to Use the Auto Loan Calculator

Using the auto loan calculator is straightforward and requires only a few pieces of information, including: * Loan amount: The amount being borrowed to finance the vehicle. * Interest rate: The interest rate offered on the loan. * Loan term: The length of the loan, in months. * Down payment: The amount paid upfront, if applicable.Navy Federal Auto Loan FAQs

Navy Federal's auto loan FAQs provide answers to some of the most common questions about the auto loan process, including:

- What are the current interest rates offered by Navy Federal?

- How do I apply for a Navy Federal auto loan?

- What are the repayment terms for a Navy Federal auto loan?

- Can I refinance my current auto loan through Navy Federal?

Additional Resources

For members who require additional information or assistance, Navy Federal offers a range of resources, including: * Online tutorials and guides * Phone and email support * In-person support at Navy Federal branches * Access to financial advisors and expertsNavy Federal Auto Loan Image Gallery

In conclusion, Navy Federal's auto finance options offer a range of benefits and features that can help members save money, reduce stress, and enjoy a smooth, hassle-free car-buying experience. By understanding the different auto finance options available, members can make informed decisions about their auto loan and secure the best possible deal on their vehicle. Whether you're a first-time car buyer or a seasoned veteran of the auto finance process, Navy Federal's expert team is dedicated to guiding you every step of the way. We invite you to share your thoughts and experiences with Navy Federal's auto finance options in the comments below, and to explore the many resources available to help you navigate the world of auto finance.