Discover 5 ways Navy Federal auto refinance can help with car loan refinancing, lowering interest rates, and monthly payments, offering flexible terms and competitive rates for a smarter financial move.

Navy Federal Credit Union is a well-established financial institution that offers a wide range of financial services, including auto refinance options. Refinancing your car loan can be a great way to save money on your monthly payments, pay off your loan faster, or even get a lower interest rate. In this article, we will explore the benefits of Navy Federal auto refinance and provide you with a comprehensive guide on how to refinance your car loan with Navy Federal.

Refinancing your car loan can be a bit overwhelming, especially if you're not familiar with the process. However, with the right guidance, you can navigate the process with ease and enjoy the benefits of refinancing your car loan. Navy Federal Credit Union is a great option to consider, as they offer competitive interest rates, flexible repayment terms, and excellent customer service. Whether you're looking to lower your monthly payments, pay off your loan faster, or get a lower interest rate, Navy Federal auto refinance can help you achieve your financial goals.

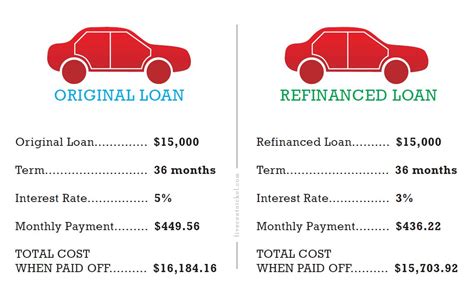

One of the main benefits of refinancing your car loan with Navy Federal is the potential to save money on your monthly payments. By refinancing your loan, you may be able to lower your interest rate, which can result in lower monthly payments. This can be especially beneficial if you're struggling to make your monthly payments or if you want to free up more money in your budget for other expenses. Additionally, refinancing your car loan with Navy Federal can also help you pay off your loan faster, which can save you money on interest over the life of the loan.

Benefits of Navy Federal Auto Refinance

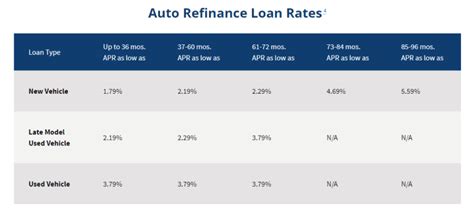

Navy Federal auto refinance offers several benefits, including competitive interest rates, flexible repayment terms, and excellent customer service. With Navy Federal, you can refinance your car loan and enjoy lower monthly payments, pay off your loan faster, or even get a lower interest rate. Additionally, Navy Federal offers a range of repayment terms, from 36 to 84 months, which can help you find a repayment plan that fits your budget and financial goals.

Some of the key benefits of Navy Federal auto refinance include:

- Competitive interest rates: Navy Federal offers competitive interest rates on auto refinance loans, which can help you save money on your monthly payments.

- Flexible repayment terms: Navy Federal offers a range of repayment terms, from 36 to 84 months, which can help you find a repayment plan that fits your budget and financial goals.

- Excellent customer service: Navy Federal is known for its excellent customer service, which can help you navigate the refinancing process with ease.

- Lower monthly payments: By refinancing your car loan with Navy Federal, you may be able to lower your monthly payments, which can free up more money in your budget for other expenses.

- Pay off your loan faster: Refinancing your car loan with Navy Federal can also help you pay off your loan faster, which can save you money on interest over the life of the loan.

How to Refinance Your Car Loan with Navy Federal

Refinancing your car loan with Navy Federal is a relatively straightforward process. Here are the steps you can follow:

- Check your eligibility: Before you apply for a Navy Federal auto refinance loan, you'll need to check your eligibility. You can do this by visiting the Navy Federal website or by contacting their customer service team.

- Gather your documents: Once you've checked your eligibility, you'll need to gather your documents. This may include your current loan documents, proof of income, and proof of insurance.

- Apply for a loan: With your documents in hand, you can apply for a Navy Federal auto refinance loan. You can do this online, by phone, or in person at a Navy Federal branch.

- Review and sign your loan documents: Once your loan is approved, you'll need to review and sign your loan documents. This will outline the terms of your loan, including your interest rate, repayment term, and monthly payments.

- Make your payments: Once you've signed your loan documents, you can start making your payments. You can do this online, by phone, or by mail.

5 Ways Navy Federal Auto Refinance Can Help You

Navy Federal auto refinance can help you in a variety of ways. Here are five ways that refinancing your car loan with Navy Federal can benefit you:

- Lower monthly payments: By refinancing your car loan with Navy Federal, you may be able to lower your monthly payments. This can free up more money in your budget for other expenses.

- Pay off your loan faster: Refinancing your car loan with Navy Federal can also help you pay off your loan faster. This can save you money on interest over the life of the loan.

- Get a lower interest rate: Navy Federal offers competitive interest rates on auto refinance loans, which can help you save money on your monthly payments.

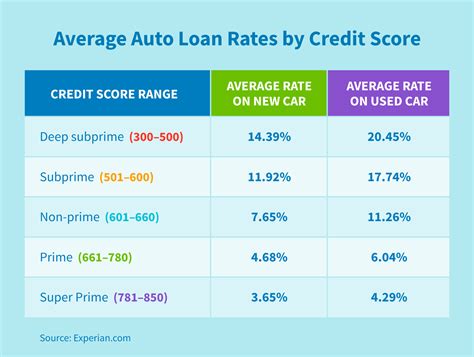

- Improve your credit score: By making your payments on time, you can improve your credit score. This can help you qualify for better loan terms in the future.

- Simplify your finances: Refinancing your car loan with Navy Federal can also help you simplify your finances. By consolidating your debt into a single loan, you can make your payments more manageable and reduce your financial stress.

Common Mistakes to Avoid When Refinancing Your Car Loan

When refinancing your car loan, there are several common mistakes to avoid. Here are a few:

- Not checking your credit score: Before you apply for a Navy Federal auto refinance loan, you should check your credit score. This can help you determine whether you qualify for a loan and what interest rate you may be eligible for.

- Not shopping around: It's a good idea to shop around and compare rates from different lenders before you apply for a Navy Federal auto refinance loan.

- Not reading the fine print: Before you sign your loan documents, make sure you read the fine print. This can help you understand the terms of your loan and avoid any surprises down the road.

- Not making your payments on time: Once you've refinanced your car loan, it's essential to make your payments on time. This can help you avoid late fees and negative marks on your credit report.

Gallery of Navy Federal Auto Refinance Images

Navy Federal Auto Refinance Image Gallery

In conclusion, refinancing your car loan with Navy Federal can be a great way to save money on your monthly payments, pay off your loan faster, or even get a lower interest rate. By following the steps outlined in this article and avoiding common mistakes, you can navigate the refinancing process with ease and enjoy the benefits of refinancing your car loan. Whether you're looking to lower your monthly payments, pay off your loan faster, or get a lower interest rate, Navy Federal auto refinance can help you achieve your financial goals. We invite you to share your thoughts and experiences with Navy Federal auto refinance in the comments below. Additionally, if you found this article helpful, please share it with your friends and family who may be considering refinancing their car loan.