Intro

As a member of Navy Federal Credit Union, you may have come across the need to create a statement template for your financial transactions. A well-structured statement template can help you keep track of your expenses, income, and savings, making it easier to manage your finances. In this article, we will provide you with 5 tips for creating a Navy Federal Bank statement template that suits your needs.

Managing your finances effectively is crucial for achieving financial stability and security. A Navy Federal Bank statement template can help you do just that. By creating a template that is tailored to your financial needs, you can ensure that you are keeping track of all your transactions, including deposits, withdrawals, and transfers.

Moreover, having a clear and organized statement template can help you identify areas where you can cut back on unnecessary expenses, make informed investment decisions, and plan for your financial future. In this article, we will explore the importance of having a Navy Federal Bank statement template and provide you with tips on how to create one that works for you.

Tip 1: Determine Your Financial Goals

Before creating your Navy Federal Bank statement template, it's essential to determine your financial goals. What do you want to achieve with your template? Are you trying to track your expenses, create a budget, or save for a specific goal? Knowing what you want to achieve will help you create a template that is tailored to your needs.

Consider the following questions:

- What are your short-term financial goals? (e.g., saving for a vacation, paying off debt)

- What are your long-term financial goals? (e.g., retirement, buying a house)

- What are your financial priorities? (e.g., saving, investing, paying off debt)

By answering these questions, you can create a template that is focused on helping you achieve your financial goals.

Tip 2: Choose a Template Format

There are various template formats available, including Excel spreadsheets, Google Sheets, and PDF templates. Choose a format that is easy to use and accessible to you. Consider the following factors when selecting a template format:

- Ease of use: Choose a format that is easy to navigate and use, even if you're not tech-savvy.

- Customization: Select a format that allows you to customize the template to suit your needs.

- Accessibility: Choose a format that can be accessed from anywhere, such as Google Sheets or Excel Online.

Some popular template formats include:

- Microsoft Excel: A popular spreadsheet software that offers a range of templates and customization options.

- Google Sheets: A free online spreadsheet software that allows real-time collaboration and automatic saving.

- PDF templates: A static template format that can be filled out manually or electronically.

Tip 3: Set Up Your Template Structure

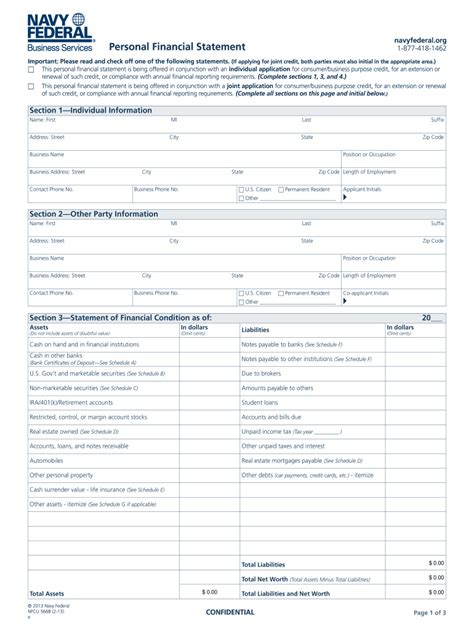

Once you've chosen a template format, it's time to set up your template structure. This includes creating columns, rows, and sections that will help you organize your financial data. Consider the following elements when setting up your template structure:

- Date column: Create a column to track the date of each transaction.

- Description column: Create a column to describe each transaction, such as "groceries" or "rent."

- Amount column: Create a column to track the amount of each transaction.

- Category column: Create a column to categorize each transaction, such as "income" or "expenses."

You can also create sections for:

- Income: Track your income from various sources, such as your salary or investments.

- Expenses: Track your expenses, such as rent, utilities, and groceries.

- Savings: Track your savings, such as your emergency fund or retirement savings.

Tip 4: Automate Your Template

To make your template more efficient, consider automating it. This can be done by linking your template to your Navy Federal Bank account or using formulas to calculate totals and balances. Some ways to automate your template include:

- Linking your template to your Navy Federal Bank account: This will allow you to import your transaction data directly into your template.

- Using formulas to calculate totals and balances: This will save you time and reduce errors.

Some popular automation tools include:

- Zapier: A tool that allows you to link different apps and services, such as your Navy Federal Bank account and Google Sheets.

- IFTTT (If This Then That): A tool that allows you to create custom recipes based on specific triggers and actions.

Tip 5: Review and Update Your Template Regularly

Finally, it's essential to review and update your template regularly. This will ensure that your template remains accurate and relevant to your financial needs. Consider the following:

- Review your template monthly: Take some time each month to review your template and ensure that it's accurate and up-to-date.

- Update your template as needed: If your financial goals or needs change, update your template accordingly.

Some things to review and update include:

- Transaction data: Ensure that your transaction data is accurate and up-to-date.

- Budget categories: Review your budget categories and update them as needed.

- Financial goals: Review your financial goals and update your template to reflect any changes.

By following these 5 tips, you can create a Navy Federal Bank statement template that helps you manage your finances effectively and achieve your financial goals.

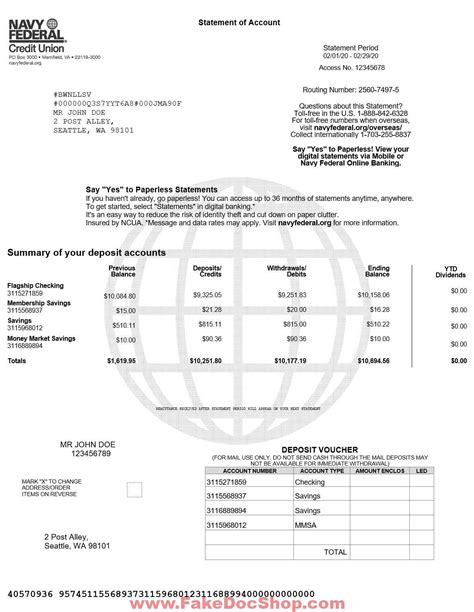

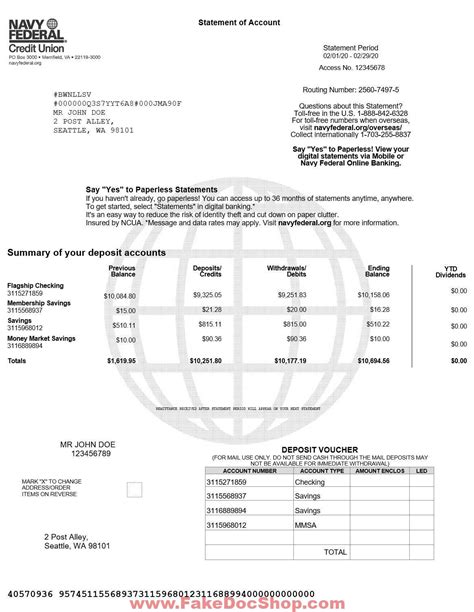

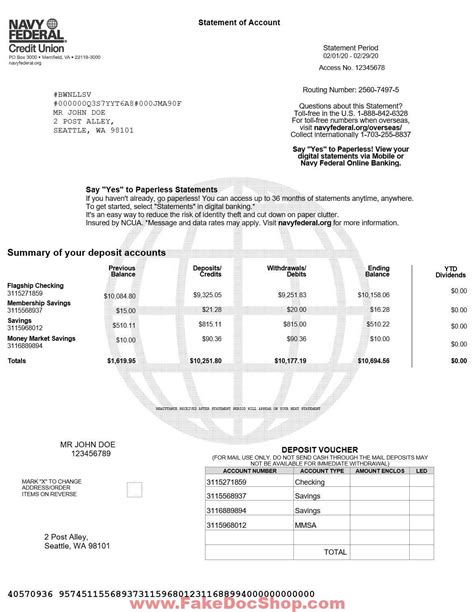

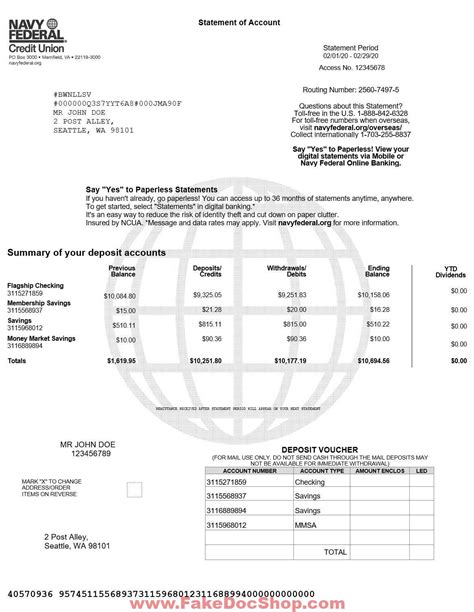

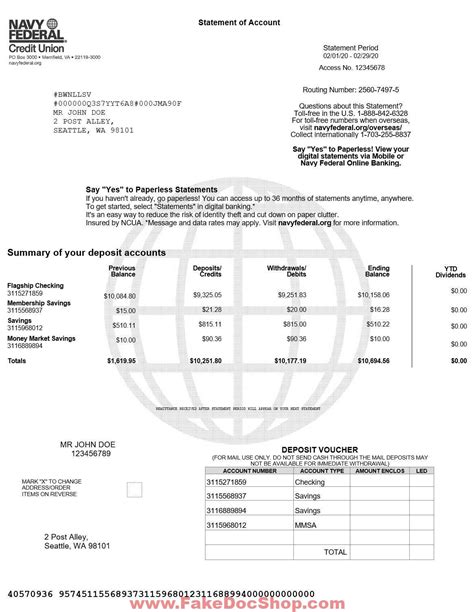

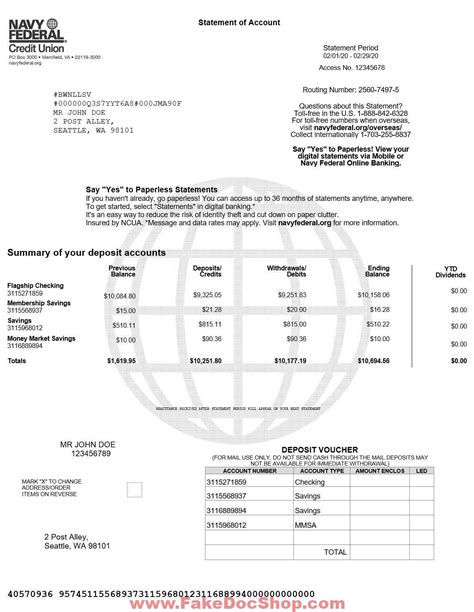

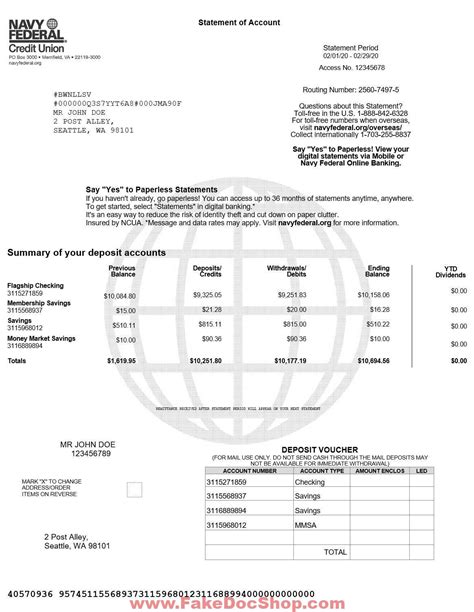

Gallery of Navy Federal Bank Statement Templates

Navy Federal Bank Statement Template Gallery

We hope this article has provided you with valuable tips and insights on how to create a Navy Federal Bank statement template that suits your needs. Remember to review and update your template regularly to ensure that it remains accurate and relevant to your financial goals.