Discover Navy Federal Business Account Options, including business loans, credit cards, and checking accounts, tailored for entrepreneurs and small businesses, offering flexible financing solutions and cash management tools.

As a business owner, managing finances is a crucial aspect of ensuring the success and growth of your company. With numerous banking options available, it can be overwhelming to choose the right one that meets your business needs. Navy Federal Credit Union is a popular choice among business owners, offering a range of account options tailored to different business types and sizes. In this article, we will delve into the various Navy Federal business account options, their features, and benefits, to help you make an informed decision.

Navy Federal Credit Union is a not-for-profit, member-owned financial cooperative that serves members of the military, veterans, and their families. With over 10 million members, it is one of the largest credit unions in the world. Navy Federal offers a wide range of financial products and services, including business accounts, loans, credit cards, and investment services. Their business account options are designed to provide members with convenient, flexible, and cost-effective ways to manage their business finances.

For small business owners, Navy Federal offers the Business Checking account, which provides a low-cost, straightforward way to manage daily business transactions. This account comes with a range of features, including online banking, mobile banking, and bill pay. Members can also take advantage of Navy Federal's network of over 300 branches and 30,000 ATMs worldwide. The Business Checking account has no monthly maintenance fee, and members can earn dividends on their balances.

Navy Federal Business Account Types

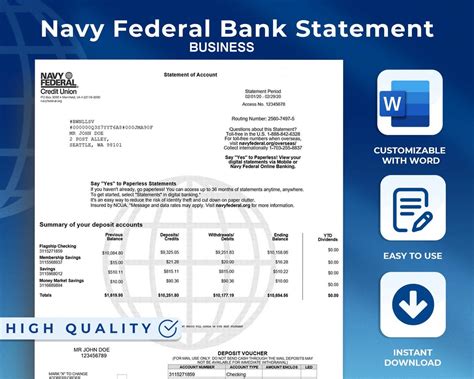

Navy Federal offers several business account types, each designed to meet the unique needs of different businesses. These include the Business Checking account, Business Savings account, and Business Money Market Savings account. The Business Checking account is ideal for small businesses with low to moderate transaction volumes, while the Business Savings account is suitable for businesses that want to earn interest on their savings. The Business Money Market Savings account is designed for businesses with larger balances, offering higher interest rates and limited check-writing privileges.

Business Checking Account Features

The Business Checking account from Navy Federal comes with a range of features that make it an attractive option for small business owners. These include: * No monthly maintenance fee * Unlimited transactions * Online banking and mobile banking * Bill pay and e-statements * Debit card and checks * Access to over 300 branches and 30,000 ATMs worldwide * Dividend earnings on balancesNavy Federal Business Savings Account

The Business Savings account from Navy Federal is a great way for businesses to earn interest on their savings while maintaining easy access to their funds. This account comes with a range of features, including:

- Competitive interest rates

- Low minimum balance requirement

- Unlimited deposits and withdrawals

- Online banking and mobile banking

- Access to over 300 branches and 30,000 ATMs worldwide

- Dividend earnings on balances

Business Money Market Savings Account Benefits

The Business Money Market Savings account from Navy Federal is designed for businesses with larger balances, offering higher interest rates and limited check-writing privileges. The benefits of this account include: * Higher interest rates than traditional savings accounts * Limited check-writing privileges * Debit card and checks * Online banking and mobile banking * Access to over 300 branches and 30,000 ATMs worldwide * Dividend earnings on balancesNavy Federal Business Loan Options

In addition to business account options, Navy Federal also offers a range of business loan options to help members finance their business ventures. These include:

- Business loans: Navy Federal offers business loans with competitive interest rates and flexible repayment terms.

- Lines of credit: Members can access a line of credit to cover unexpected expenses or finance business growth.

- Commercial mortgages: Navy Federal offers commercial mortgages to help members purchase or refinance commercial property.

Business Credit Card Benefits

Navy Federal also offers business credit cards, which provide members with a convenient way to manage business expenses and earn rewards. The benefits of the Navy Federal business credit card include: * Competitive interest rates * Rewards program * No foreign transaction fees * Travel insurance and assistance * Online account managementNavy Federal Business Account Fees

While Navy Federal business accounts come with a range of features and benefits, there are some fees to be aware of. These include:

- Monthly maintenance fees: Some business accounts come with monthly maintenance fees, which can be waived by maintaining a minimum balance.

- Overdraft fees: Members may be charged an overdraft fee if they exceed their account balance.

- ATM fees: Members may be charged an ATM fee if they use an out-of-network ATM.

How to Open a Navy Federal Business Account

To open a Navy Federal business account, members can follow these steps: * Meet the eligibility requirements: Members must be part of the military, a veteran, or a family member of a military member or veteran. * Gather required documents: Members will need to provide business documentation, such as a business license and tax ID number. * Apply online or in-person: Members can apply for a business account online or in-person at a Navy Federal branch. * Fund the account: Members will need to fund the account with an initial deposit.Navy Federal Business Account Customer Service

Navy Federal is committed to providing excellent customer service to its members. The credit union offers a range of support options, including:

- Phone support: Members can contact Navy Federal's customer service team by phone.

- Online support: Members can access online support through the Navy Federal website.

- Branch support: Members can visit a Navy Federal branch for in-person support.

Navy Federal Business Account Security

Navy Federal takes the security of its members' accounts seriously. The credit union uses a range of security measures to protect accounts, including: * Encryption: Navy Federal uses encryption to protect online transactions. * Firewalls: The credit union uses firewalls to prevent unauthorized access to its systems. * Monitoring: Navy Federal monitors accounts for suspicious activity.Navy Federal Business Account Reviews

Navy Federal business accounts have received positive reviews from members. The credit union has a rating of 4.5 out of 5 stars on the Better Business Bureau website, with members praising the credit union's excellent customer service and competitive rates.

Conclusion and Final Thoughts

In conclusion, Navy Federal business account options offer a range of features and benefits that can help business owners manage their finances effectively. With competitive rates, low fees, and excellent customer service, Navy Federal is a great choice for businesses of all sizes. Whether you're a small business owner or a large corporation, Navy Federal has a business account option that can meet your needs.Navy Federal Business Account Image Gallery

We invite you to share your thoughts and experiences with Navy Federal business accounts in the comments below. If you found this article helpful, please share it with your friends and family who may be interested in learning more about Navy Federal business account options. Additionally, if you have any questions or need further clarification on any of the points discussed, please don't hesitate to ask.