Discover 5 essential Navy Federal insurance tips, including coverage options, membership benefits, and claims processing, to make informed decisions about auto, home, and life insurance policies.

Insurance is a vital aspect of personal finance, providing a safety net against unforeseen events that could otherwise lead to financial ruin. For members of the military and their families, navigating the complex world of insurance can be particularly challenging. This is where Navy Federal Credit Union comes into play, offering a range of insurance products tailored to the unique needs of its members. In this article, we will delve into five Navy Federal insurance tips that can help you make the most of your insurance coverage.

The importance of having the right insurance cannot be overstated. It provides peace of mind, knowing that you and your loved ones are protected against life's uncertainties. Whether it's health insurance, life insurance, or insurance for your home and vehicles, each type plays a crucial role in safeguarding your financial well-being. Navy Federal, with its member-centric approach, offers insurance solutions that are both comprehensive and affordable. By understanding how to leverage these insurance products effectively, you can enhance your financial security and focus on what matters most.

For those who serve in the military, insurance needs can be quite different from those of the general population. The nature of military service, with its inherent risks and uncertainties, necessitates specialized insurance coverage. Navy Federal recognizes these unique needs and has designed its insurance offerings accordingly. From TRICARE supplements to auto insurance that accounts for deployment, Navy Federal's insurance products are crafted with the military lifestyle in mind. By choosing insurance options that are tailored to your specific situation, you can ensure that you have the right level of protection at all times.

Understanding Navy Federal Insurance Options

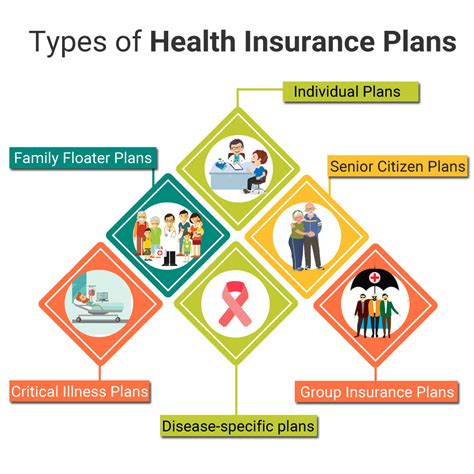

Navy Federal offers a wide array of insurance products, each designed to address different aspects of your financial security. Understanding these options is the first step towards making informed decisions about your insurance coverage. This includes health insurance, life insurance, disability insurance, home insurance, and auto insurance, among others. Each of these insurance types serves a distinct purpose, from ensuring that you can afford medical care when you need it, to providing for your family's financial future in the event of your passing.

Benefit of Customized Insurance Plans

Customized insurance plans are a hallmark of Navy Federal's approach to insurance. By tailoring your insurance coverage to your specific needs and circumstances, you can avoid paying for coverage you don't need while ensuring that you have adequate protection where it matters most. For example, if you're a military member with a family, you may need a life insurance policy that provides a sufficient death benefit to cover your family's living expenses, pay off debts, and fund your children's education. Navy Federal's insurance experts can help you navigate these considerations and create a personalized insurance plan.Maximizing Insurance Benefits

To maximize your insurance benefits, it's essential to understand the terms and conditions of your policies thoroughly. This includes knowing what is covered, what is excluded, and the limits of your coverage. Additionally, being aware of any discounts you may be eligible for can help reduce your insurance premiums. Navy Federal often offers discounts for bundling policies, having a good driving record, or achieving certain educational milestones. By taking advantage of these discounts and ensuring that your coverage levels are appropriate for your needs, you can get the most value out of your insurance dollars.

Importance of Regular Policy Reviews

Regular reviews of your insurance policies are crucial to ensure that your coverage remains aligned with your changing needs. As your life circumstances evolve—whether through marriage, the birth of children, a change in employment, or retirement—your insurance needs will likely change as well. Navy Federal insurance experts can help you conduct these reviews and make adjustments to your policies as necessary. This might involve increasing your coverage, adding new policies, or even reducing coverage in areas where it's no longer needed. By periodically assessing your insurance portfolio, you can maintain optimal protection and avoid unnecessary expenses.Navigating the Claims Process

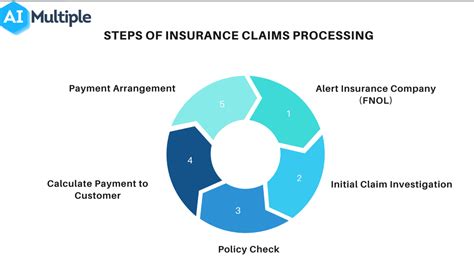

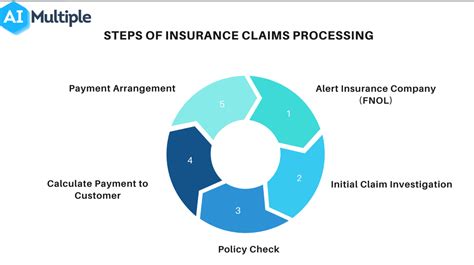

Understanding how to navigate the claims process is a critical aspect of insurance literacy. When you need to file a claim, it can be a stressful and overwhelming experience, especially if you're dealing with the aftermath of an accident, illness, or other traumatic event. Navy Federal is committed to making this process as smooth and efficient as possible. By knowing what documentation you need to provide, how to submit your claim, and what to expect in terms of communication and follow-up, you can reduce anxiety and ensure that you receive the benefits you're entitled to in a timely manner.

Role of Technology in Insurance Management

Technology plays a significant role in the management of your insurance policies. Navy Federal utilizes digital platforms to make it easier for members to access their policy information, pay premiums, and even file claims. This not only enhances convenience but also reduces the risk of errors and speeds up the processing time for claims and other requests. By leveraging these technological tools, you can stay on top of your insurance coverage and make adjustments as needed, all from the convenience of your computer or mobile device.Financial Planning with Insurance

Insurance is a key component of any comprehensive financial plan. It serves as a protection mechanism, ensuring that your financial goals and aspirations are not derailed by unexpected events. When integrating insurance into your financial planning, it's essential to consider your overall financial situation, including your income, expenses, debts, and savings. Navy Federal's financial advisors can help you assess your insurance needs within the context of your broader financial picture, recommending products and strategies that support your long-term financial health and stability.

Building an Emergency Fund

An emergency fund is a crucial financial safety net that can help you cover unexpected expenses without going into debt. While insurance can provide financial protection against many risks, it's not a substitute for having cash reserves. Navy Federal encourages its members to build an emergency fund that can cover at least three to six months of living expenses. By combining a robust emergency fund with the right insurance coverage, you can create a powerful financial fortress that protects you against life's uncertainties and positions you for long-term financial success.Conclusion and Next Steps

In conclusion, navigating the world of insurance as a Navy Federal member requires a combination of understanding your unique needs, leveraging the right insurance products, and maintaining a proactive approach to financial planning. By following the tips outlined in this article and staying engaged with your insurance coverage, you can enhance your financial security and well-being. Whether you're just starting to build your insurance portfolio or looking to optimize your existing coverage, Navy Federal's expertise and member-centric approach make it an invaluable resource in your financial journey.

Navy Federal Insurance Image Gallery

We invite you to share your thoughts and experiences with Navy Federal insurance in the comments below. Whether you have questions about getting started with insurance, optimizing your current coverage, or navigating the claims process, our community is here to support you. Share this article with friends and family who may benefit from these insights, and don't hesitate to reach out to Navy Federal directly for personalized advice and guidance. Together, let's build a stronger, more secure financial future for all.